- European Indices soared on BoE emergency rate cut

- Adidas shares plunged

- Dax gained 1.72%

European indices opened significantly higher today, after the Bank of England followed footsteps of other major central banks and decided for an emergency rate cut to offset the economic impact of the coronavirus outbreak. Later today, the UK Chancellor will be presenting the annual budget. Initially the DAX 30 soared 1.78%; the FTSE 100 gained 1.9%; the CAC 40 rose 2.4%; the IBEX 35 advanced 2% and the FTSE MIB went up 2.5% .

Germany is still concerned as the coronavirus continues to spread across the country

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appTotal number of confirmed coronavirus cases in Germany quickly increased to 1565. In connection with the worsening situation, press conference has been scheduled for Chancellor Merkel today. Supposedly the head of the German government is afraid that 60-70% of Germans could be infected with the new coronavirus. During the conference chancellor will be accompanied by a health minister Jens Spahn.

German Dax (DE30) -the last two corrections (marked with red rectangles) were identical, which means that we are still in the downtrend, but on the other hand, the key support at 10350 has been maintained. Only breaking below this level can lead to a direct downward impulse. At the moment 11000 pts is the key resistance level. The next resistance level is located at 11350pts while support level can be found at 10350 pts. Source: xStation5

DAX members at 09:14 am GMT. Source: Bloomberg

DAX members at 09:14 am GMT. Source: Bloomberg

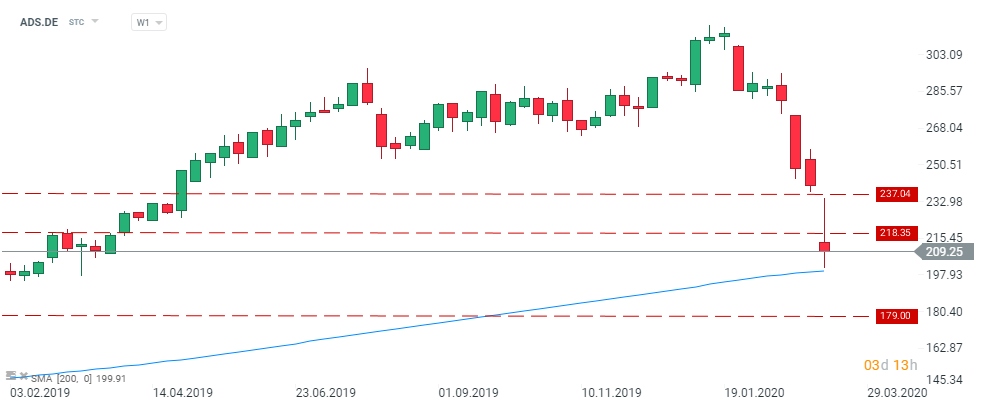

Adidas (ADS.DE) shares plunged 5.70% as company announced that sales in China were 80% below 2019 levels from January 25 to end of the last month. Company expects that sales in China for the Q1 will decline from 800 million euro to 1 billion euro due to the spread of coronavirus. Demand for Adidas products is also falling in Japan and South Korea.

Adidas (ADS.DE) broke through key support level at 218.35 and is heading towards next support zone at 179.00. Local resistance is located at 237.04. Source:xStation5

Adidas (ADS.DE) broke through key support level at 218.35 and is heading towards next support zone at 179.00. Local resistance is located at 237.04. Source:xStation5

Analyst actions:

- Hamburger Hafen (HHFA GR) raised to “buy” at Mai First. Price target set at 22 euro

- Software Ag (SOW GR) raised to “overweight” at Morgan Stanley. Price target set at 30 euro