German blue chip index was one of the weakest in April and excluding dividends it was actually slightly negative – in sharp contrast to 5%+ gains on major US indices. However, traders started May on a positive note.

The day started with great news on the economic front. German March retail sales soared unexpectedly by as much as 7.7% m/m and 11% y/y. The consensus for the annual change was just at -0.3%. This shows how strong pent-up (delayed) demand is but also reflects potential inflationary pressures as companies deal with higher input costs.

Manufacturing PMIs for April were finally slightly softer than initially reported in Europe (62.9 vs 63.3 in EMU, 66.2 vs 66.4 in Germany) but still very very hot – the data did not affect markets in a meaningful way.

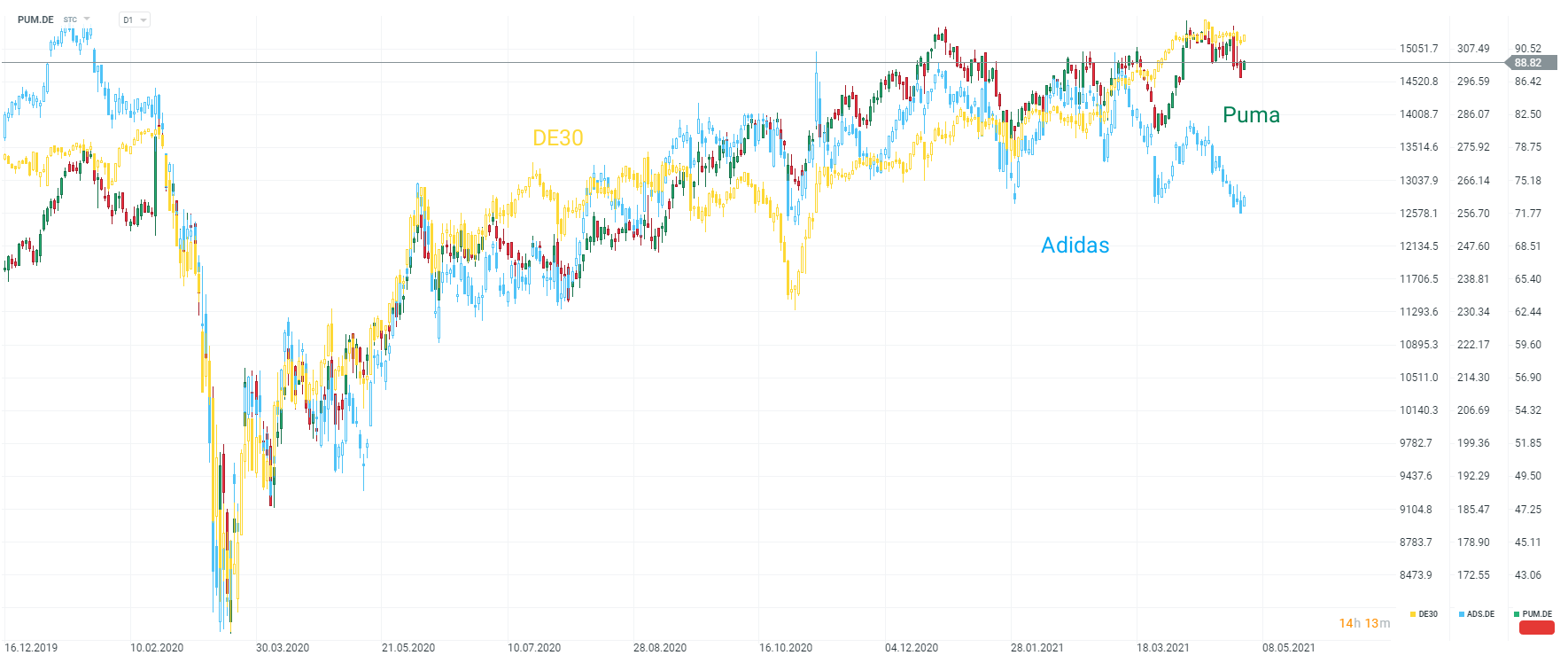

Looking at the chart, Friday’s close near the support zone meant a risk of a breakout lower that could potentially trigger a head and shoulders formation and drag DE30 all the way down to the lower limit of ascending channel. While this scenario still remains a possibility, strong opening makes it more remote and traders may hope for the rally to be continued.

Sneaker stocks gain on strong data

Sneaker stocks gain on strong data

Strong demand helps Adidas (ADS.DE) and Puma (PUM.DE) stocks – both gain close to 2% on Monday morning. Especially Adidas has been struggling – Friday close brought it to lows from early November (DE30 has gained around 4000 points since then!). Puma fared better but prices slid last week – will strong data from Germany help drive these stocks higher?

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

AbbVie near 1-month low after earnings report 📉

CHN.cash under pressure despite positive Trump remarks 🚩