-

European markets trade higher

-

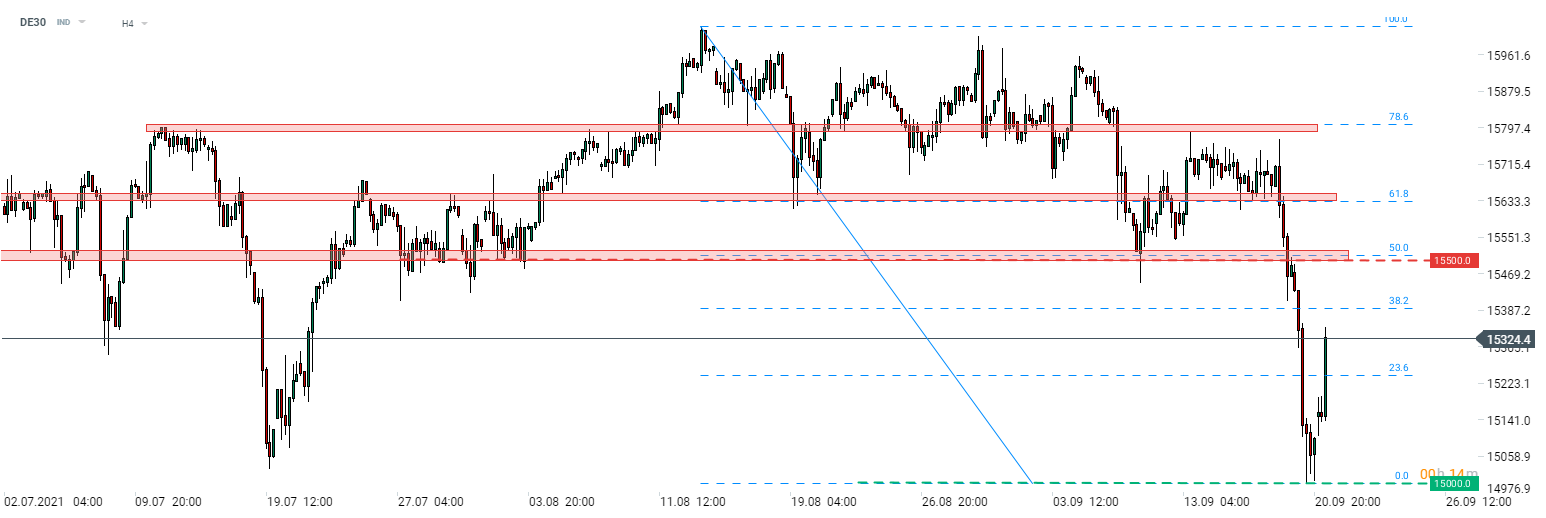

DE30 jumps 300 points off Monday's low

-

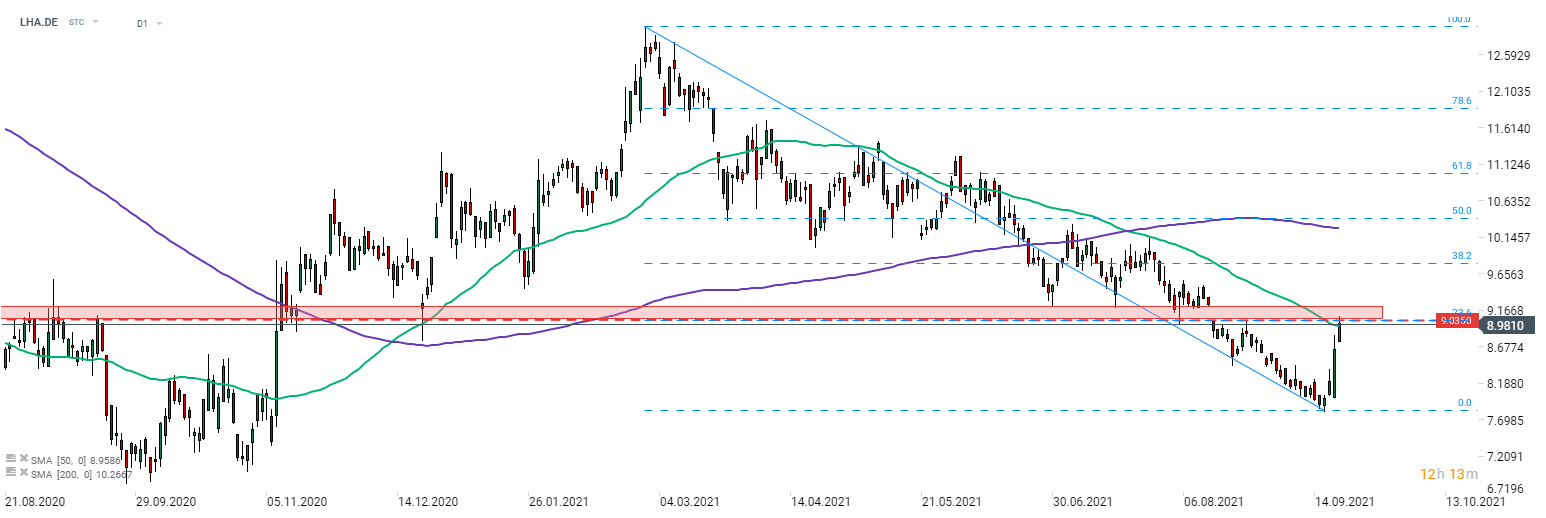

Lufthansa rallies on US border reopening and plans to pay back state aid

Situation on the global stock markets calmed on Thursday with major blue chips indices launching a recovery move. Major indices from Europe trade 1-1.5% higher today with German DAX (DE30) and Dutch AEX (NED25) being outperformers. Economic calendar for the day ahead lacks key releases so traders should expect sentiment to play a major role. One thing that was easy to forget amid Evergrande turmoil is that FOMC will set rates tomorrow at 7:00 pm BST and market may start to position for the event.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30, as well as other European indices, halted sell-off overnight and began to recover today. The German index has managed to recover over 300 points so far. Nevertheless, it is still less than a half of the Friday-Monday drop combined. Retracements of the downward move measured off the all-time highs offer us some hints on what levels to watch as most of the line up really well with previous price reactions. Having said that, the first major resistance zone to watch can be found ranging above the 15,500 pts handle and is marked with the 50% retracement. The next resistance in line can be found at 61.8% retracement at around 15,630 pts.

Company News

Volkswagen (VOW1.DE) has officially filed a proposal to the French market regulator for a takeover of the Europcar Mobility Group. Volkswagen, along with UK fund Attestor and Dutch mobility company Pon proposed to take over Europcar for €2.5 billion. If the regulator gives green light for the takeover, Volkswagen will receive 66% of Europcar shares, Attestor will receive 27% and Pon will get the remaining 7%. Takeover was already approved by Europcar's board.

Lufthansa (LHA.DE) is one of the best performing German stocks today, gaining around 4%. German carrier gains after it was announced that the United States will reopen borders for visitors from Europe. Apart from that, Lufthansa also announced that it will raise around €2.1 billion via equity offering and use proceeds to repay part of the state-aid it has received during Covid-19 pandemic.

Analysts' actions

-

Porsche Automobil Holding (PAH3.DE) rated "buy" at DZ Bank. Price target set at €110

-

Norma Group (NOEJ.DE) downgraded to "hold" at Stifel. Price target set at €37

In spite of a broad market sell-off yesterday, Lufthansa managed to move higher as the US lifted some travel restrictions. Move is being continued today, supported by news of plans to repay some of the state aid. Stocks is currently testing a major resistance in the €9.035 area, marked with the previous price reactions, downward trendline, 50-session moving average and the 23.6% retracement of a recent downward move. Source: xStation5

In spite of a broad market sell-off yesterday, Lufthansa managed to move higher as the US lifted some travel restrictions. Move is being continued today, supported by news of plans to repay some of the state aid. Stocks is currently testing a major resistance in the €9.035 area, marked with the previous price reactions, downward trendline, 50-session moving average and the 23.6% retracement of a recent downward move. Source: xStation5