Relief on the markets caused by Fed and US Treasury intervention into SVB collapse and Signature Bank regulatory shutdown was short-lived. European markets went in a freefall mode after a flat opening of the European cash session. Panic was reignited after First Republic Bank shares plunged 60% in the US premarket session, showing the problems are far from over. German DAX is dropping over 3%, breaks below the 15,000 pts mark and reached the lowest level in 2 months! US index futures erased all of the gains made during the Asian session- S&P 500 futures (US500) trade flat compared to Friday's cash close.

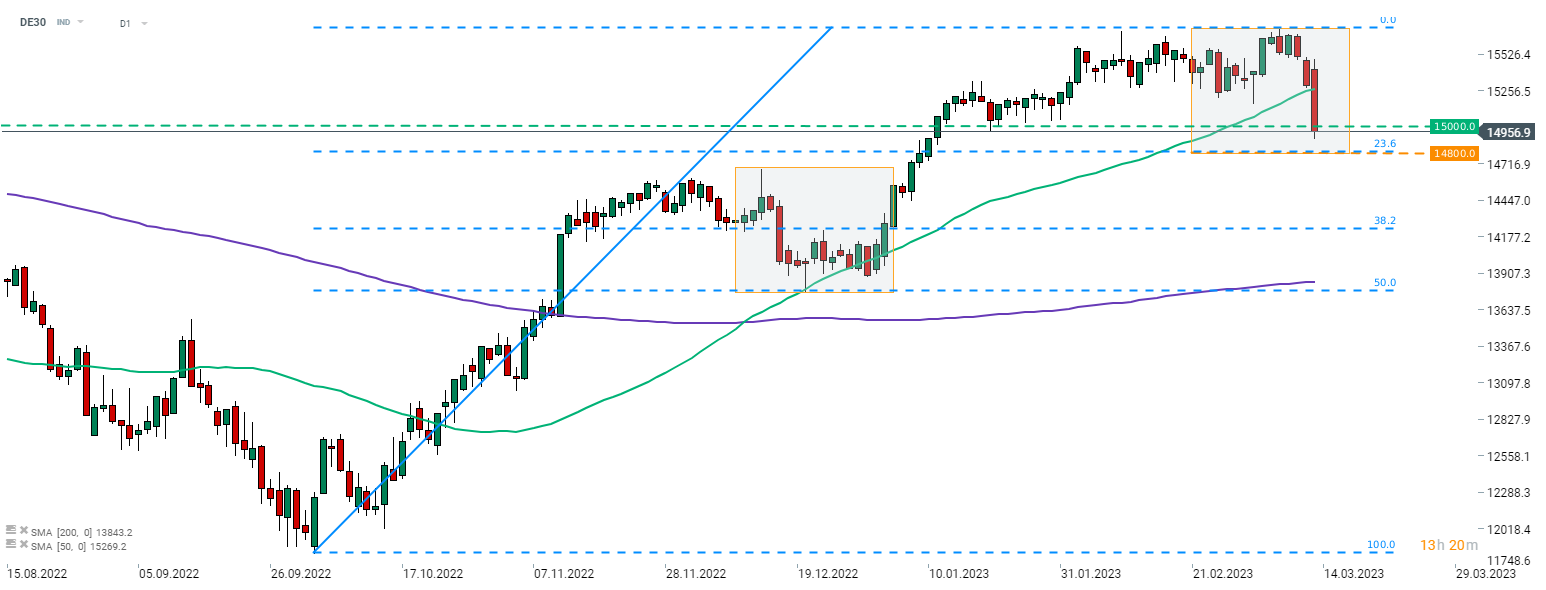

DE30 breaks below 15,000 pts for the first time since mid-January 2023 as concerns over the condition of US banks continue to pressure global markets. Key support to watch can be found in the 14,800 pts area - the lower limit of the Overbalance structure and 23.6% retracement of the upward impulse. Source: xStation5

DE30 breaks below 15,000 pts for the first time since mid-January 2023 as concerns over the condition of US banks continue to pressure global markets. Key support to watch can be found in the 14,800 pts area - the lower limit of the Overbalance structure and 23.6% retracement of the upward impulse. Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)