-

European markets trade mixed

-

DE30 pulls back after failed test of 16,200 pts resistance

-

Vonovia drops on capital increase news

Majority of the European stock market indices trade little changed at the beginning of a new week. Range of moves in most cases does not exceed 0.3% in either direction. However, there are some outliers. Blue chips indices from Spain, Portugal and Austria gain around 0.6% while Russian indices plunge over 2% amid reports that the country is reportedly planning an invasion on Ukraine.

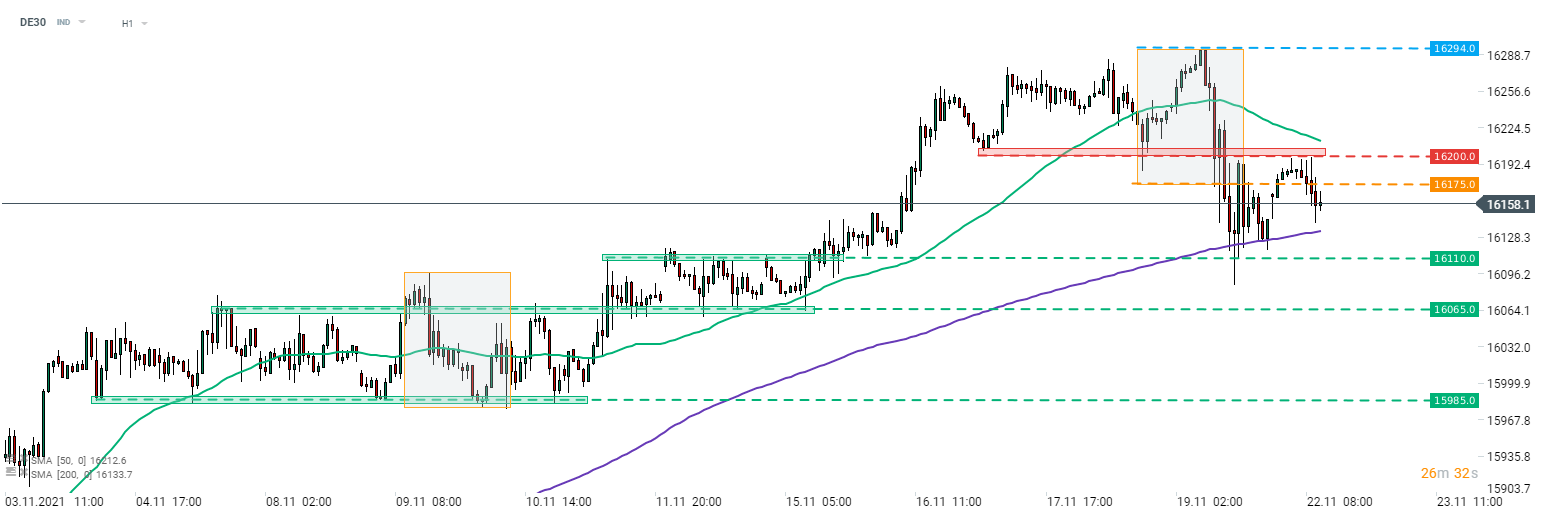

DAX futures (DE30) opened higher after the weekend but the advance was halted at the 16,200 pts resistance zone. The index broke below the lower limit of the market geometry at the end of the previous week, threatening a bigger drop. A key support to watch now is marked with the 200-hour moving average (purple line) that has halted sell-off on Friday. Source: xStation5

DAX futures (DE30) opened higher after the weekend but the advance was halted at the 16,200 pts resistance zone. The index broke below the lower limit of the market geometry at the end of the previous week, threatening a bigger drop. A key support to watch now is marked with the 200-hour moving average (purple line) that has halted sell-off on Friday. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appVonovia (VNA.DE) announced its plans to raise around €8 billion by issuing slightly over 200 million shares to its existing shareholders at €40 per share, an over 20% discount to market price. Existing shareholders will have a right to subscribe for 7 newly-issued shares for every 20 shares they currently own. Proceeds from capital increase will be used to repay part of loans taken for Deutsche Wohnen acquisition.

According to German antitrust authorities, CEZ, Czech utilities company, will acquire Belectric, a PV plant builder, from RWE (RWE.DE). Financial details of the deal were not disclosed yet.

Fraport (FRA.DE) announced that it will sell a majority 51% stake in passenger screening company FraSec Luftsicherheit to Sasse Group. A 26% stake will be acquired on January 1, 2022 while the remaining 25% stake will be acquired on January 1, 2023.

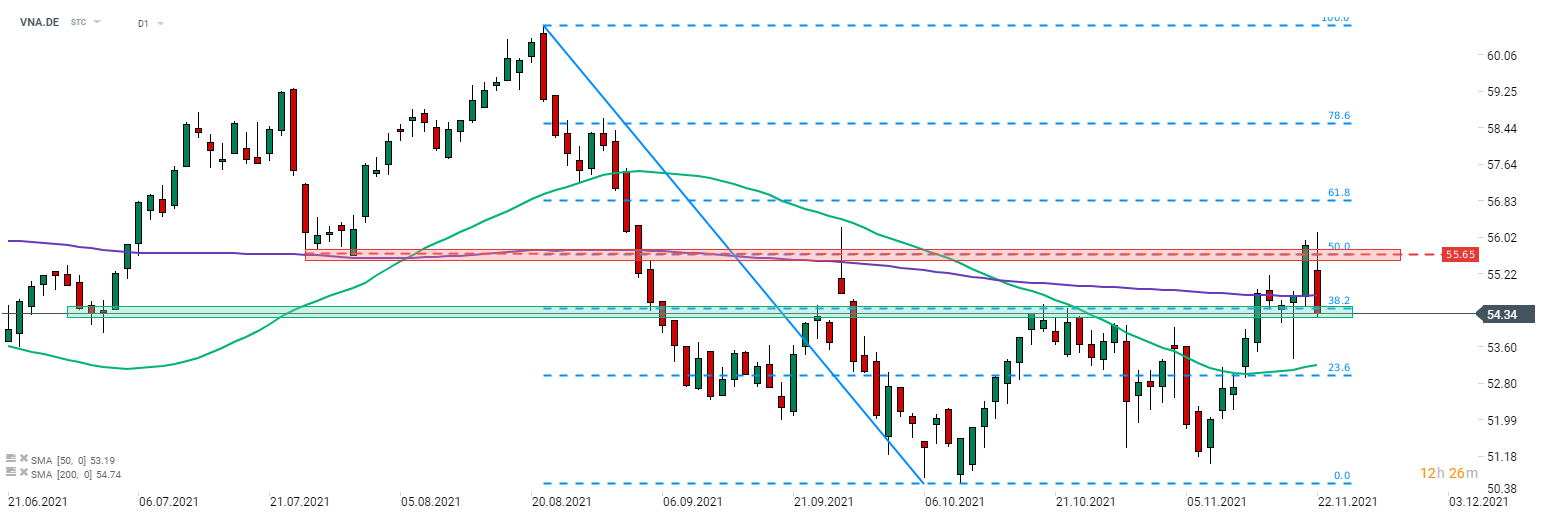

Shares of Vonovia (VNA.DE) are dropping over 2% today, following news of planned capital increase and new share issue. Stock managed to finish Friday's trading slightly above the €55.65 resistance zone, marked by the 50% retracement of recent correction. Stock pulled back from this resistance today and is now testing a support marked with the 38.2% retracement in the €54.50 area. Source: xStation5

Shares of Vonovia (VNA.DE) are dropping over 2% today, following news of planned capital increase and new share issue. Stock managed to finish Friday's trading slightly above the €55.65 resistance zone, marked by the 50% retracement of recent correction. Stock pulled back from this resistance today and is now testing a support marked with the 38.2% retracement in the €54.50 area. Source: xStation5