-

European indices trade higher

-

DE30 continues to struggle in the 16,000 pts area

-

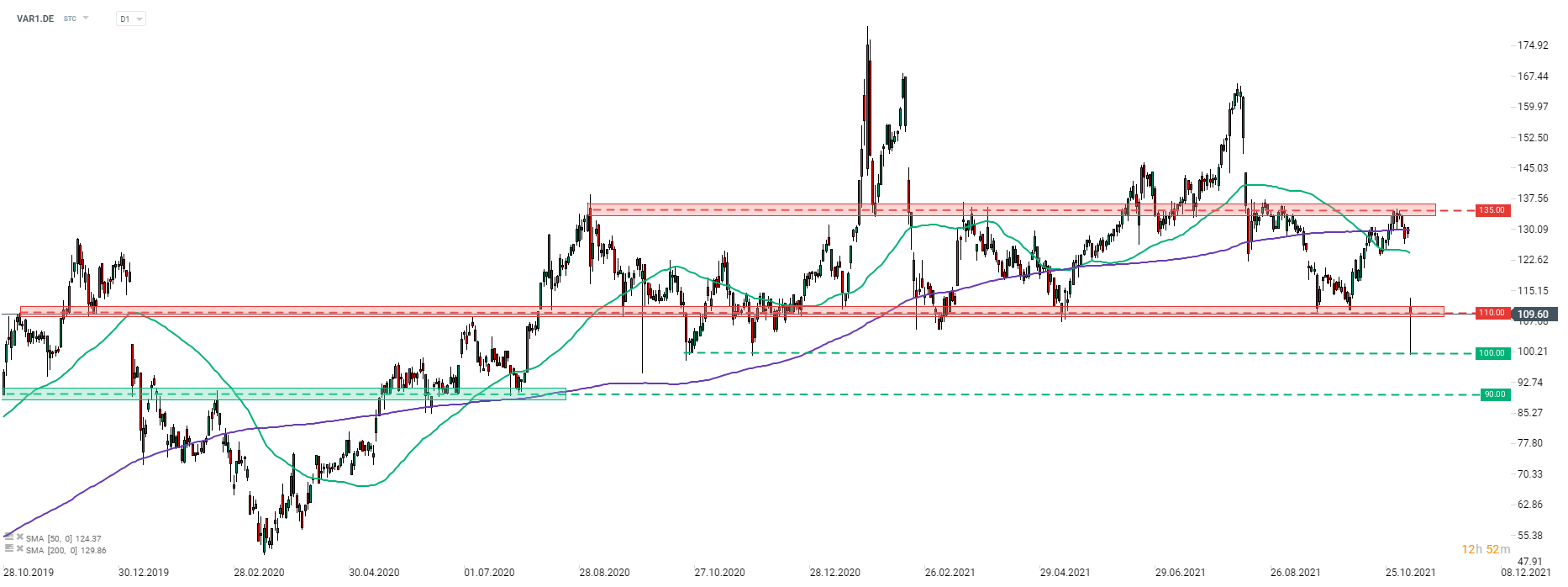

Varta plunges after guidance cut

European stock markets are trading higher during the final session of the week. However, scale of gains is minor and does not exceed 0.5% in most cases. Indices from UK, the Netherlands and Switzerland are top performers while Spanish and Polish equities lag the most.

German industrial production data for September was released today at 7:00 am GMT. It showed another disappointing quarter of the German industry. Production dropped 1.1% MoM while the market expected an increase of 0.9% MoM. Note that this drop comes after a 3.5% MoM drop in August. Out of 9 monthly German industrial data releases this week only 2 showed month-over-month increases (March and July).

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

DE30 continues to trade in the 16,000 pts area. The index struggles to launch another big move in either direction. Note that the German index is also trading near the upper limit of a steep upward channel, suggesting that some correction may be looming. In such a scenario, the first technical support to watch can be found in the 15,800 pts area and is marked with the lower limit of local market geometry. DE30 may experience elevated volatility at 12:30 pm GMT, when the US NFP report is released.

Company News

Varta (VAR1.DE) drops more than 15% today and is the worst performing MDAX member. Shares of the company pull back following a guidance cut. Varta said that it now expects full-year revenue to reach €900 million, down from previous forecast of around €940 million. To make things worse, Varta said that its Q3 earnings will be around 7.5% below market's revenue expectations and above 6.8% below adjusted EBITDA expectations. Company will publish a quarterly earnings report for the quarter ended in September 2021 on November 11, 2021.

Deutsche Telekom (DTE.DE) and Australian asset manager IFM Investors agreed to launch a €1.8 billion joint venture that will focus on building fiber optic connections in rural regions of Germany.

Airbus (AIR.DE) announced that it has delivered just 36 jets in October 2021, down from 40 deliveries in September. Airbus received 22 new orders in October and 30 cancellations. As a result, year-to-date cancellations increased to 167 - much more than 115 recorded in full-2020. Airbus would need to deliver around 140 jets in the final 2 months of 2021 in order to hit a full-year target of 600 deliveries.

Analysts' actions

-

Varta (VAR1.DE) downgraded to "sell" at DZ Bank. Price target set at €90.00

Varta (VAR1.DE) plunged following a full-year sales guidance cut. Stock trades around 15% lower on the day. However, at one point of today's session stock was trading over 20% lower and was testing the €100 area - the lowest levels in almost a year. Shares bounced off the daily lows and are attempting to climb back above the mid-term price zone at €110.00. Source: xStation5

Varta (VAR1.DE) plunged following a full-year sales guidance cut. Stock trades around 15% lower on the day. However, at one point of today's session stock was trading over 20% lower and was testing the €100 area - the lowest levels in almost a year. Shares bounced off the daily lows and are attempting to climb back above the mid-term price zone at €110.00. Source: xStation5