-

European markets erase early drops

-

DE30 tries to climb back above 15,800 pts

-

RWE has enough liquidity to survive extreme power prices

Indices in Europe launched today's session lower following a downbeat trading in Asian earlier in the day. However, moods started to improve following launched of the trading session on the Old Continent and now majority of European indices trade higher on the day. While gains in Western Europe are rather small, equity indices from the eastern part of the continent outperform. Russian RTS index (RUS50) surges over 3% following yesterday's plunge.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 failed to break above the all-time highs at the beginning of 2022 and a downward move was launched. Taking a look at the index at D1 interval, we can see that DE30 dropped below the short-term support at 15,820 pts yesterday. Downward movement was continued today during the Asian session but declines were halted slightly ahead of the 200-session moving average (orange circle) and recovery move was launched. Should the index climb back above the 15,820 pts support zone today, a strong bullish candlestick pattern would surface on the daily interval.

Company News

Volkswagen (VOW1.DE) reached an agreement with German Bosch to set up a JV this year that will support battery cell factories in order to make Europe self-sufficient in the field. JV will help manufacturers in Europe scale up their production by delivering production systems.

Markus Krebber, CEO of RWE (RWE.DE), said that his company has enough liquidity to survive extreme power price spikes. Comments came two weeks after RWE's competitor, Uniper, said that it needs €10 billion in additional credit lines due to the exceptional situation on the power market.

Share price of Leoni (LEO.DE) is taking a hit today. Company announced on Tuesday in the evening that the German Federal Cartel Office carried out searches in the company's premises as part of the ongoing investigation into the cable manufacturing sector.

Analysts' actions

-

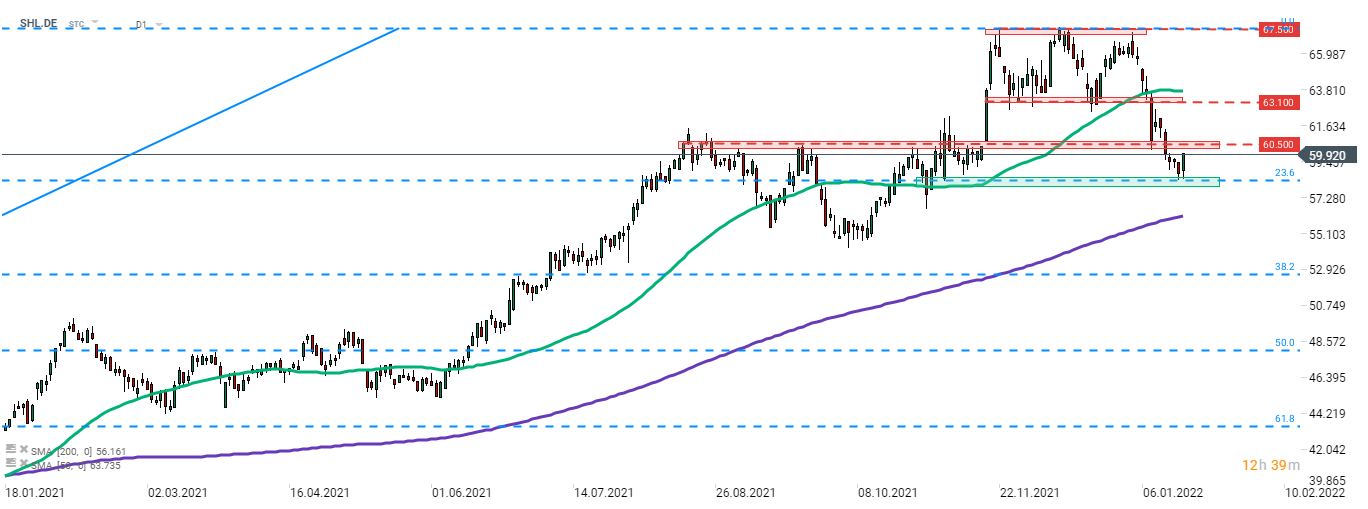

Siemens Healthineers (SHL.DE) upgraded to "buy" at Societe Generale. Price target set at €75.00

-

Commerzbank (CBK.DE) upgraded to "buy" at Deutsche Bank. Price target set at €10.00

Siemens Healthineers (SHL.DE) attempts to halt recent declines following a bullish recommendation from Societe Generale. Stock bounces off the 23.6% retracement of the post-pandemic recovery move today and looks towards a test of the €60.50 resistance zone. Source: xStation5