- Indexes in Europe are recording gains

- Dax gains 0.35% to the level of 17,100 points

- President Lagarde gives an interview about ECB policy

- Rheinmetall, Commerzbank, and Zalando among the leaders on DAX

Markets in Europe are mainly recording a rising session, consolidating around historical highs. The French CAC40 gains 0.35%, the Italian ITA40 gains 0.50%, and the DAX is noted higher by 0.30%. In the first part of the day, we observe a weaker dollar and euro, with the EURUSD pair gaining a modest 0.05% to 1.0730. The yields of American bonds are slightly losing to the level of 4.22%.

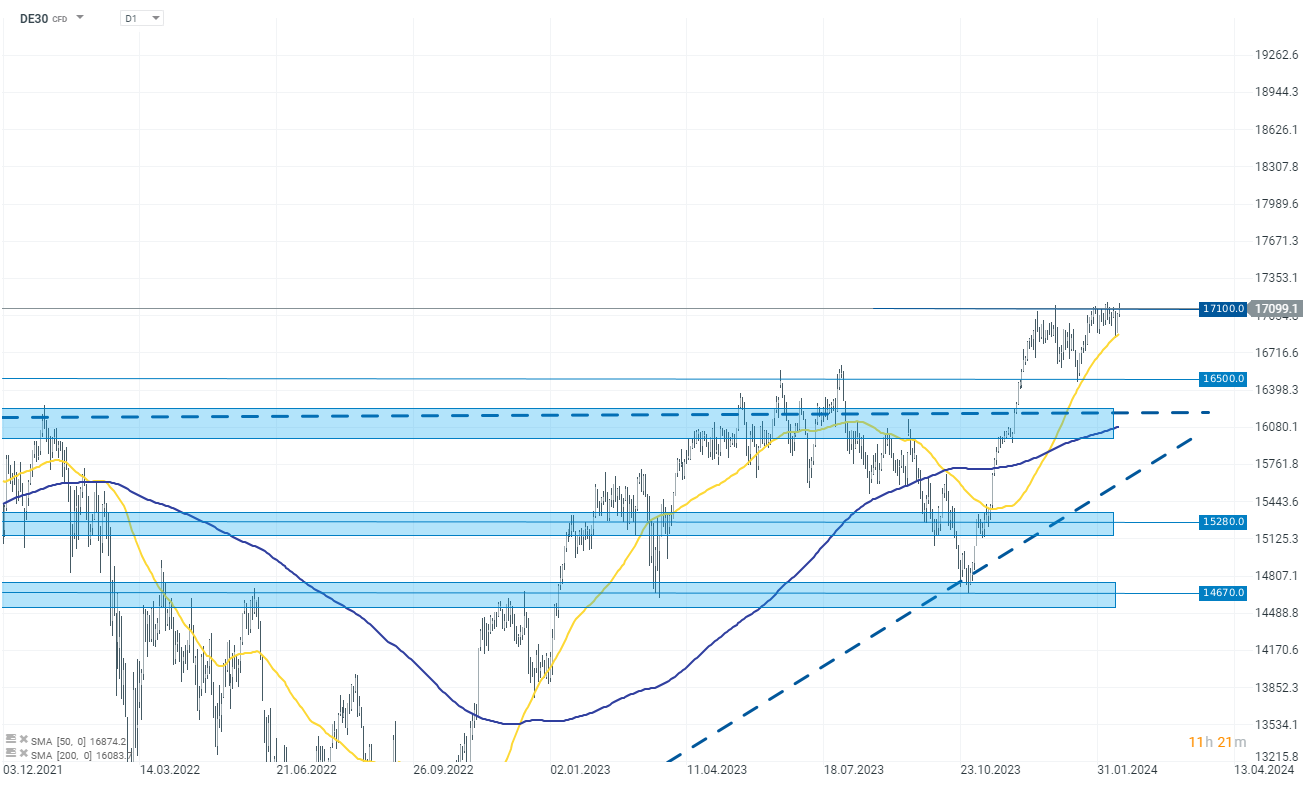

The German DAX index is noted in the vicinity of historical highs at 17,100 points. This is a level that bulls have been unable to overcome since mid-December 2023, and if it is breached, we may experience a larger upward movement. Otherwise, it is necessary to closely monitor support levels at 16,500 and 16,700 points.

Source: xStation 5

Lagarde's Comments

European Central Bank President Christine Lagarde highlighted the weak economic activity in the Eurozone for 2023 and the expectation of continued subdued activity in the near term. In her speech to the European Parliament, she emphasized the ongoing disinflation process, which is expected to reduce inflation over 2024 as the impact of past shocks fades and tight financing conditions persist.

- Lagarde stressed the need to maintain high interest rates for a sufficient duration to ensure inflation returns to the 2% target timely.

- Despite the current disinflationary trend, the ECB requires more data, especially on wages, to confirm this trajectory.

- The market anticipates a reduction in interest rates, but the ECB is cautious, noting strong wage growth driven by tight labor markets and inflation compensation demands.

Company News

Commerzbank (CBK.DE) gains 4.00% in today's session following a substantial rise in profits in the past year. The bank's net profit increased to 2.2 billion euros, up from 1.44 billion the previous year, aligning with analyst expectations. This improvement was largely due to a nearly 30% increase in net interest income, totaling 8.4 billion euros, benefiting from the European Central Bank's shift away from zero and negative interest rates. Commerzbank also announced a dividend increase for 2023 to 0.35 euros per share and continues a share buyback program, maintaining a payout ratio of 50%. The board targets a net result of around 3.4 billion euros by 2027. However, charges from its Polish subsidiary, mBank, particularly related to Swiss franc loans, have impacted its profits.

Source: xStation 5

Renault (RNO.FR), a competitor of Volkswagen, achieved significant business growth and returned to profitability. The company reported a net profit of 2.2 billion euros, a notable recovery from the previous year's loss of 354 million euros due to its withdrawal from the Russian market. Renault's sales increased by 13% to 52.4 billion euros, driven primarily by price increases and higher sales volumes. The operating profit margin improved by 2.4 percentage points to 7.9%. The company plans to raise its dividend from 0.25 euros per share to 1.85 euros.

Source: xStation 5

Morning wrap (15.10.2025)

Daily Summary: Powell pulls markets back up! 📈 EURUSD higher

EURUSD higher after Powell's speech! 💶📈

Salesforce announces partnerships with OpenAI and Anthropic🚨