DAX rebounds after lower open; DE40 Up 0.1%, defense sector improves sentiments on German market as media reports around Russia - Ukraine summit in Istanbul suggest low probability of 30-day ceasefire. According to MoscowTimes sources, Russian president Putin will not attempt the summit personally, nor Trump despite Zelenskyy arrival. Futures on Wall Street slightly decline.

-

Following a weaker open, the DAX has returned to gains, with the DE40 index rising by 0.1%. The German market is being buoyed by strength in the defense sector.

-

Shares of Thyssenkrupp are down more than 12% after releasing earnings, as both sales and market conditions in the steel segment disappointed investors.

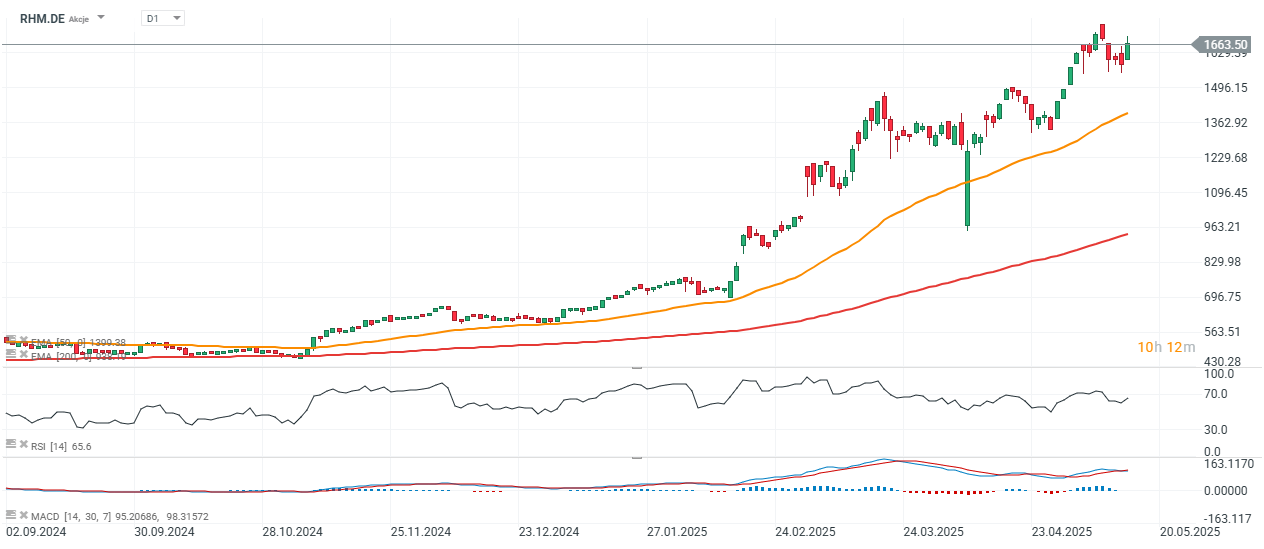

- Germany's defense stocks are in demand amid renewed Russia-Ukraine tensions. Rheinmetall is up nearly 5%, while RENK Group and Hensoldt are also gaining ground.

- Meanwhile, economic data showed that Eurozone GDP missed expectations on a monthly basis (0.3% vs 0.4% forecast), but industrial production came in stronger than anticipated both month-over-month (2.6% vs 2.0%) and year-over-year (3.6% vs 2.5%).

DE40 (Daily Chart)

DAX futures swiftly rebounded following recent sell-offs and are currently holding near historical highs.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appSource: xStation5

Buy-side Volume Regaining Strength

Over the last few hours, buying volume has regained momentum. The key resistance level now stands near 23,650 points.

Source: xStation5

Market Volatility in Europe – BMW Drops, Rheinmetall Gains on Geopolitical Tensions![]()

Source: xStation5

Steel and Automotive Drag Down Thyssenkrupp

Thyssenkrupp shares had rallied strongly in recent months, largely driven by investor optimism over a potential spin-off of its Marine Systems division, which services the German Navy (Kriegsmarine). However, the company’s latest results disappointed due to weak steel demand and a slowdown in the automotive industry.

- Despite these setbacks, the industrial conglomerate maintained its full-year forecast for fiscal 2024/25. When announcing its half-year results, the company said it still expects adjusted EBIT to come in between €600 million and €1 billion.

- In contrast, adjusted operating profit in Q2 came in at just €19 million—a 90% drop from the same period a year ago. This result was significantly impacted by a €23 million loss in the steel division. CEO Miguel Lopez expressed hope for better market conditions in the second half of the year.

- The company attributed the poor performance in Steel Europe to lower revenues and planned shutdowns related to restructuring efforts. Meanwhile, work continues on building a facility for "green" steel production.

- Thanks to the sale of its subsidiary Thyssenkrupp Industries India, the group reported a net profit of €167 million in Q2. For the full year, Thyssenkrupp continues to target net earnings between €100 million and €500 million.

Preparations to spin off the marine division are in full swing, and a sale of a minority stake could be completed before year-end. However, the unchanged guidance disappointed the market, prompting profit-taking after the strong rally in Thyssenkrupp shares earlier this year.

Thyssenkrupp Shares (Daily Chart)

On the daily chart, shares of the German steelmaker and naval supplier are undergoing a significant correction from recent local highs near €11. A major support test could occur around the EMA200, close to €6.50 per share.

Source: xStation5

Source: xStation5

Source: xStation5