European session opens with distinctly negative sentiments. Major indices are experiencing broad sell-offs amid investor concerns about growth rates and trade tensions. Among futures contracts, the leaders of declines are W20 and NED25, with sell-offs exceeding 0.6%. FRA40, DE40, and UK100 are losing slightly less, depreciating by 0.4%. ITA40 is the only one rising around noon.

The market is still trying to discount a huge portion of macroeconomic data and the results of the world's largest companies. Market expectations regarding comments from central bankers, the meeting between Xi and Trump, and the results of technology companies may have been exaggerated, and investors are reassessing their hopes today, which is reflected in falling valuations.

Source: Bloomberg Finance Lp

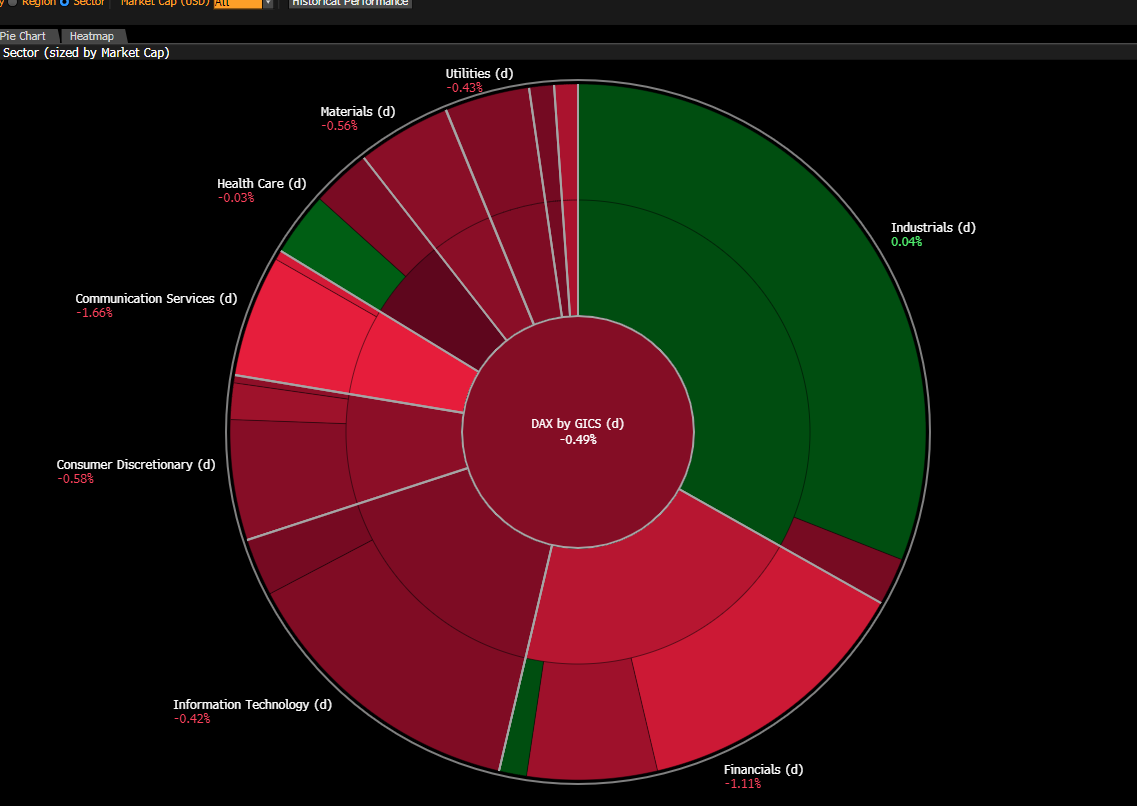

On the German index, we can observe a broad correction, indicating a general deterioration in sentiment. Communication services and banks are losing the most due to negative information from companies and concerns about sector results. The industry is doing better, supported by the still heated defense industry.

DE40 (D1)

Source: xStation5

The chart shows the continuation of the downward correction and the formation of a consolidation channel in the FIBO 23.6-50 range. The price broke the support at the level of 24,300 points and EMA50, indicating short-term weakness of buyers. To prevent an extended downward correction, buyers must maintain the support zone around 24,000. Sellers taking the initiative may bring the price down to around 23,900, where the FIBO 61.8 level and EMA100 are located.

Company news:

Fuchs (FPE.DE) — The German lubricant manufacturer is up over 7% after publishing results that significantly exceeded key investor expectations, and the company's management expressed optimism about future quarters' results. Investment analysts spoke positively about the results, praising the company for good cost management and sales growth in Asia.

Deutsche Telekom (DTE.DE) — The company is losing about 1.5% after a series of credible comments emerged in the public space suggesting that the company would replace equipment and infrastructure provided by Chinese Huawei at the expense of the German taxpayer. This decision is said to be driven by security concerns and fears of espionage from China.

Kongsberg Gruppen (KOG.NO) — The company is up over 4% at the session's opening after publishing good results. The company managed to increase revenues by 12%, and in the defense sector, the company grew by 38% year-on-year. Margins also improved.

Saint-Gobain (SGO.FR) — The centuries-old construction-industrial company disappointed investors. Despite sales growth, turnover in the USA clearly fell, prompting investors to depreciate the company by 3%.

Renk Group (R3NK.DE) — The German company engaged in the production of advanced drive systems, mainly for the defense industry, received recommendations from an investment bank. The stock price is up 2%.

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈