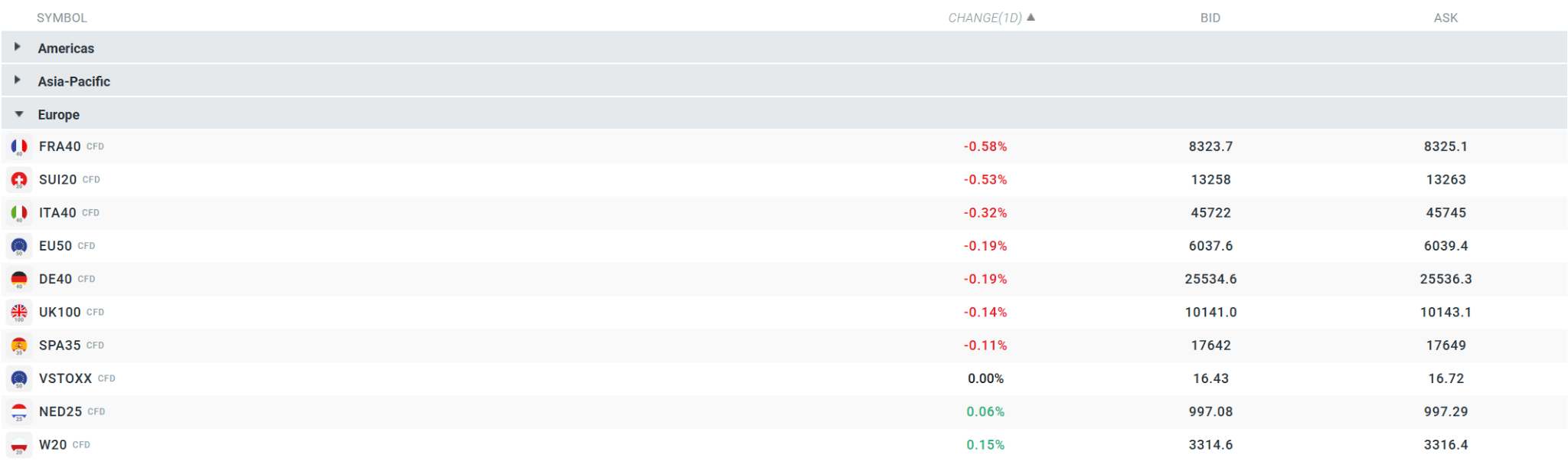

European indices are performing relatively poorly at the start of the second phase of Tuesday's trading session. The German DAX is down 0.19%, while the French FRA40 is down 0.58% and the British FTSE100 is down 0.14%. At the same time, however, US futures are trading flat, raising hopes for a rebound when the US cash session opens. The main topic of today's session is US CPI data, which will be released in less than an hour.

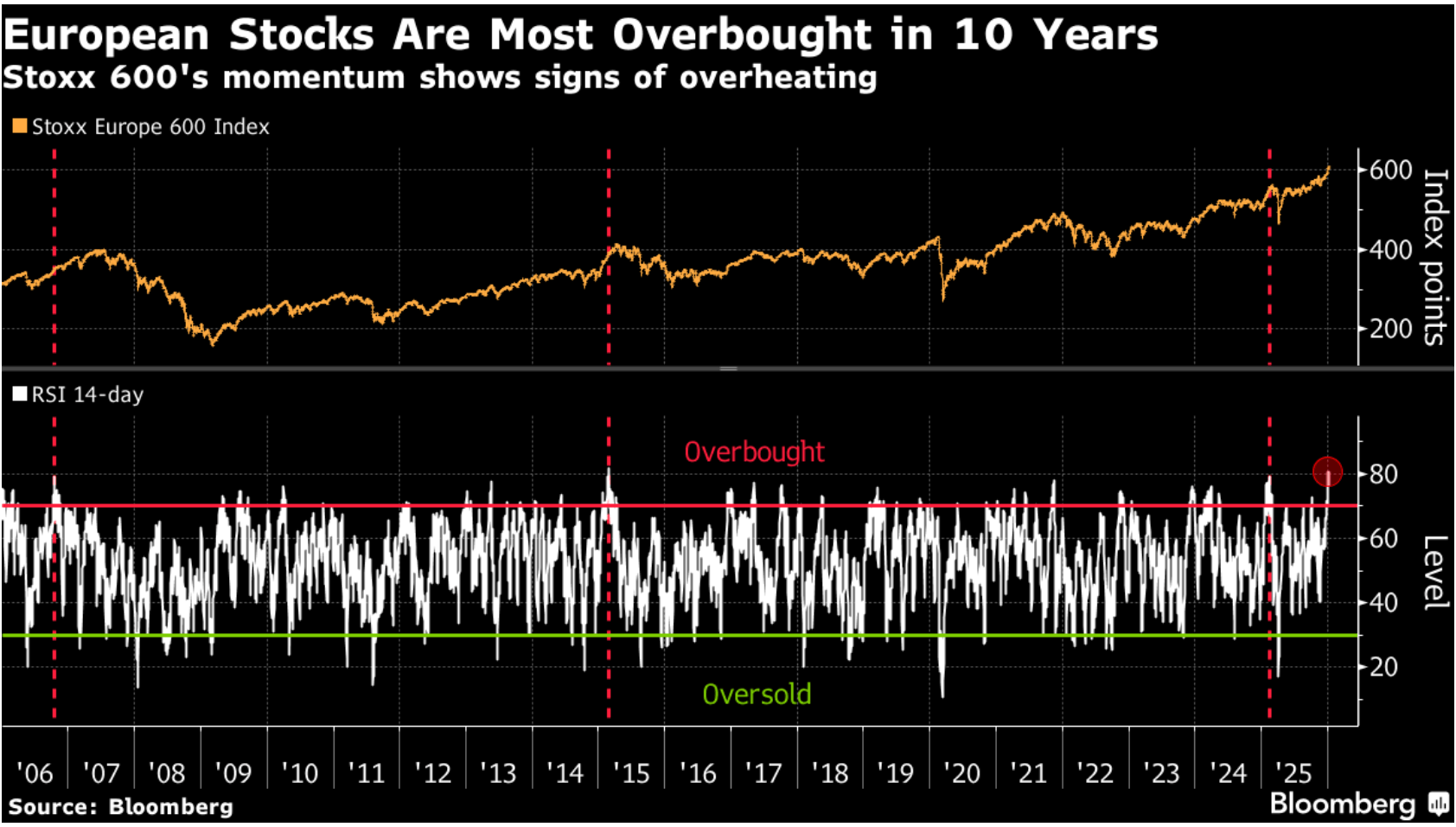

The European equity market, represented by the Stoxx Europe 600, has performed impressively, rising 17 per cent in 2025 and an additional 3.2 per cent in early 2026, outperforming the S&P 500. The index is showing signs of overheating: the 14-day RSI has exceeded 80, which has rarely happened in the last 20 years and suggests a risk of consolidation or an impending peak. Analysts at Oddo BHF and Societe Generale warn against overly rapid growth in valuations, especially in cyclical sectors, given weak economic growth (forecast at 1.2% in 2026) and flat corporate earnings in the previous year. Source: Bloomberg Financial LP

Current quotations for major contracts. Source: xStation

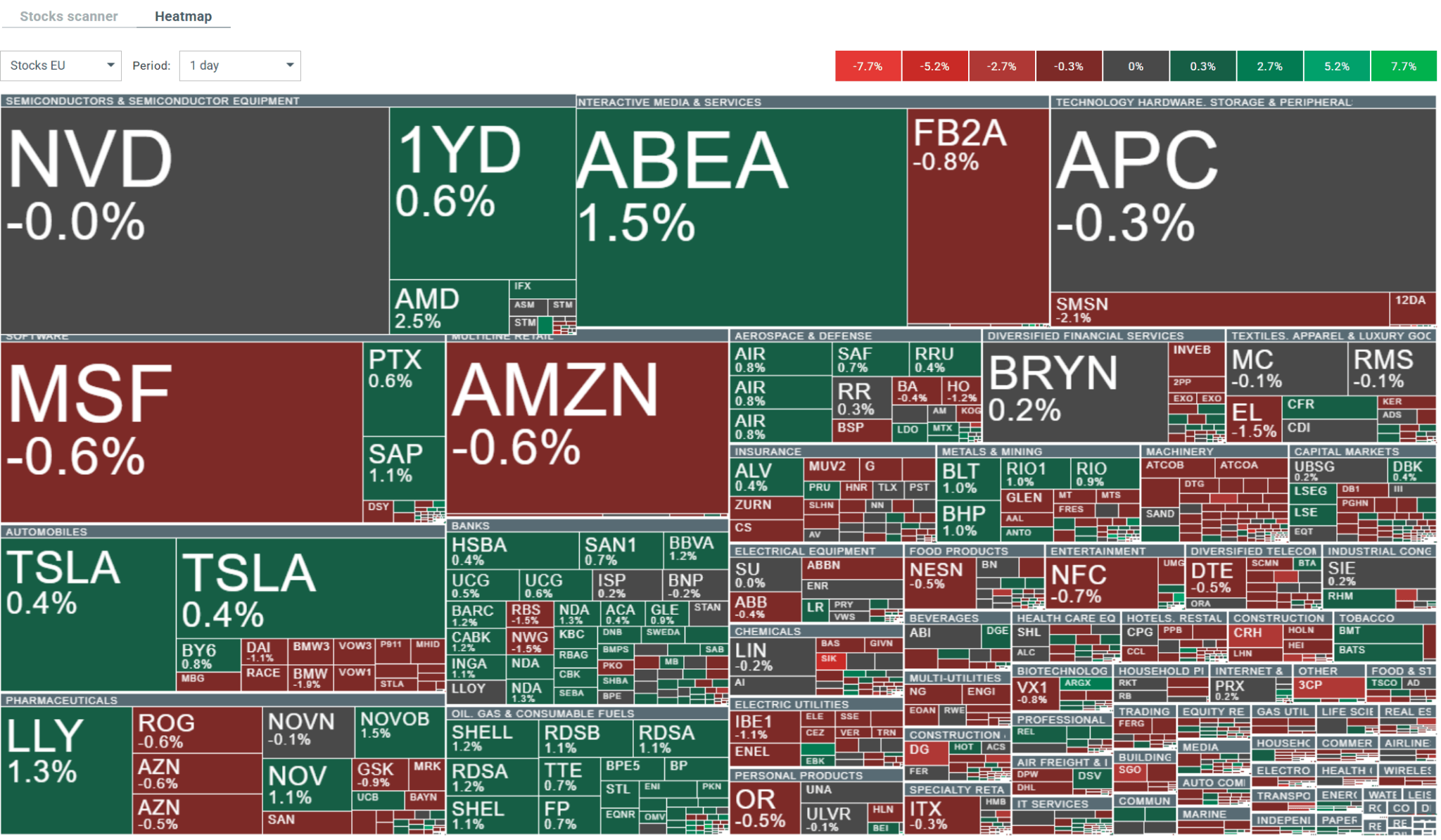

Current volatility observed on the broader European market. Source: xStation

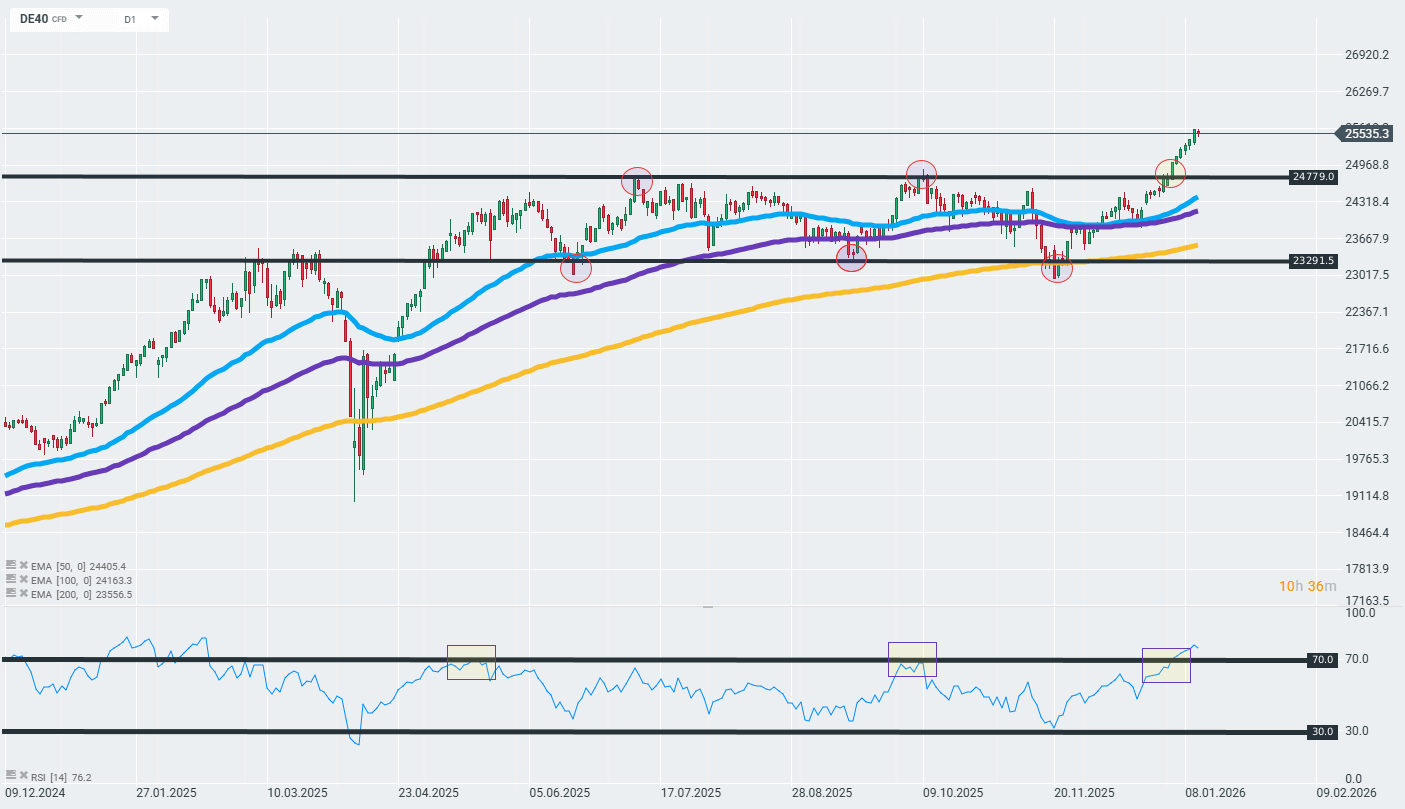

During Tuesday's trading session, the DAX is consolidating yesterday's gains, but continues to break above the previously mentioned barrier of 24,780 points, which was the main resistance level in 2025. What is more, the current bullish momentum, which managed to push the contract above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), is, from a technical perspective, an indication of a short-term upward trend in the instrument. As long as DE40 remains above these support barriers, the current trend is likely to continue. Source: xStation

Key corporate news:

Symrise (SY1.DE) shares rose 4.6% in response to the announcement of a strategic change in the company's portfolio. The German-American company specialising in aromas and flavours has decided to sell its Terpenes unit and invest in the Swedish company Swedencare. The transaction is part of a restructuring trend aimed at focusing on more profitable business segments and improving capital efficiency. The decision to divest from the chemical industry (Terpenes) and invest in the animal care sector (Swedencare) signals a strategic shift towards the animal health and welfare sector, which is seen as more promising. The market responded positively to the announcement, as reflected in the appreciation of the share price.

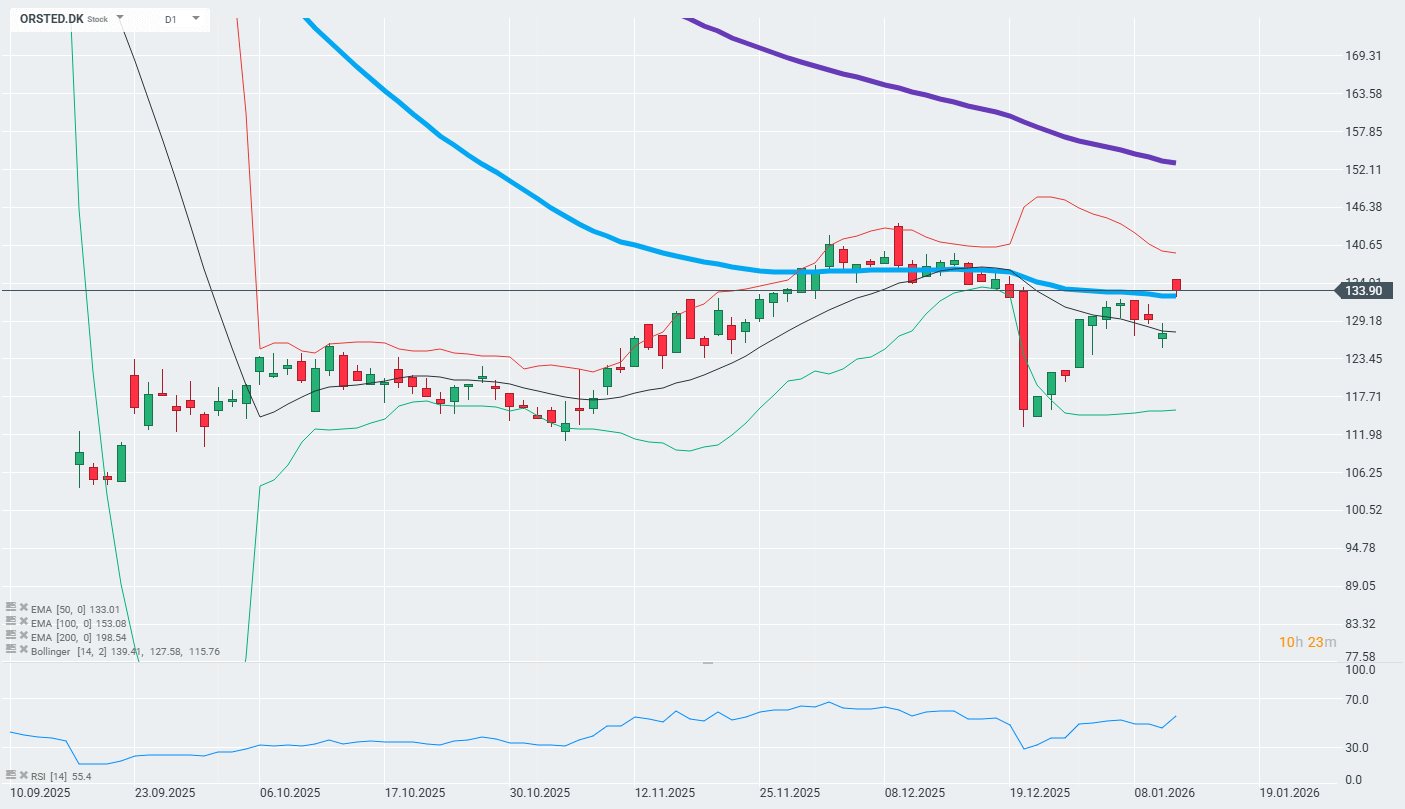

Energy company Orsted (ORSTED.UK) rose 5% after announcing that it had won a court case preventing the Trump administration from resuming a suspended offshore wind farm project in US coastal waters. The court ruling is a significant victory for the renewable energy sector, which has faced the administration's policy of limiting investment in zero-emission sources. As Orsted's share price rises, interest in other clean energy companies is also growing. The court ruling signals that even in the face of political opposition, investments in renewable energy can be protected by legal institutions, which improves the outlook for the entire green energy sector.

The company's shares opened today's session with a significant upward gap. Source: xStation

Activities of investment bank analysts:

UPGRADES:

- Aena upgraded to neutral by BofA.

- Atoss Software upgraded to buy by Jefferies; target price €140.

- Aurubis upgraded to buy by Bankhaus Metzler; target price €161.

- Bittium upgraded to accumulate by Inderes; target price €36.

- HMS Networks upgraded to "buy" by Pareto Securities; target price SEK 480.

- Lufthansa upgraded to "buy" by DBS Bank; target price €10.

- PVA TePla upgraded to "buy" by Jefferies; target price €31.

- Pan African upgraded to "overweight" by Nedbank CIB; target price 149.27 pence.

- Swissquote upgraded to "outperform" by Oddo BHF; target price CHF 555.

- Zalando upgraded to "overweight" by Barclays; target price €35.

DOWNGRADES:

- ASM Intl downgraded to below average by Jefferies; PT €495

- Airtel Africa downgraded to hold by HSBC; PT 400 pence

- BAE downgraded to hold by Deutsche Bank; PT 2140 pence

- BMW downgraded to neutral by UBS; PT €93

- Continental downgraded to hold by Berenberg

- Eiffage downgraded to neutral by BofA.

- Heineken downgraded to "hold" by HSBC; target price €78.

- Leonardo downgraded to "hold" by Deutsche Bank; target price €57.

- SMA Solar downgraded to "hold" by Jefferies.

- Thales downgraded to "hold" by Deutsche Bank; PT €280

- Vinci downgraded to below average by BofA

- Volvo downgraded to hold by Morgan Stanley; PT SEK 323

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China