- Broad market decline amid change in sentiment

- Nvidia and Deutsche Telecom build data center together

- Ferrari earnings better than expected

- Philips gains after display of orders and EBITDA

- Broad market decline amid change in sentiment

- Nvidia and Deutsche Telecom build data center together

- Ferrari earnings better than expected

- Philips gains after display of orders and EBITDA

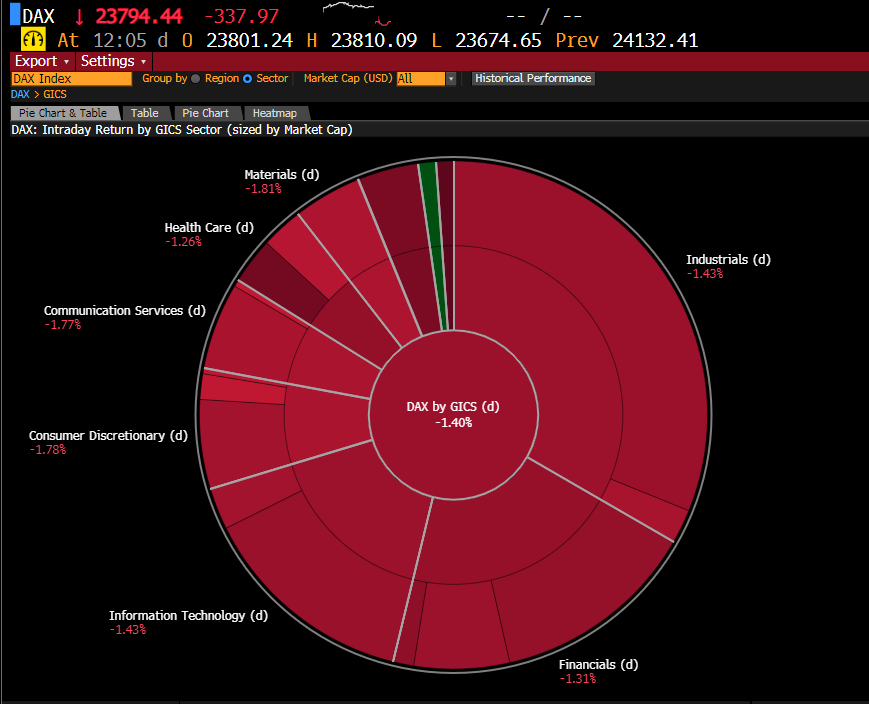

European indices open with significant declines and negative sentiment amid a shift away from risky assets. The potential trigger for temporary profit-taking and correction might have been the negatively received results from Palantir. In Europe, there are no earnings reports or macroeconomic data today that would justify such a deep and broad correction. The leader of declines in Europe around midday is the DAX, whose futures contracts are falling by as much as 1.3%. The CAC40 is also performing poorly. Similar declines are recorded by Spanish and Italian indices. SPA35 and ITA40 contracts are losing almost 1%. The FTSE 1000 and WIG20 are faring better, with declines limited to around 0.8%.

Source: Bloomberg Finance LP

The sell-off in the European market was sudden, relatively deep, and across the entire index, but with volume slightly below average. The biggest declines are noted in telecommunications, retailers, and the materials and mining industry.

Macroeconomic Data:

In Europe, there are no significant macroeconomic publications today, but all markets will be awaiting today's JOLTS readings from the USA, which will provide valuable information about the state of the American labor market.

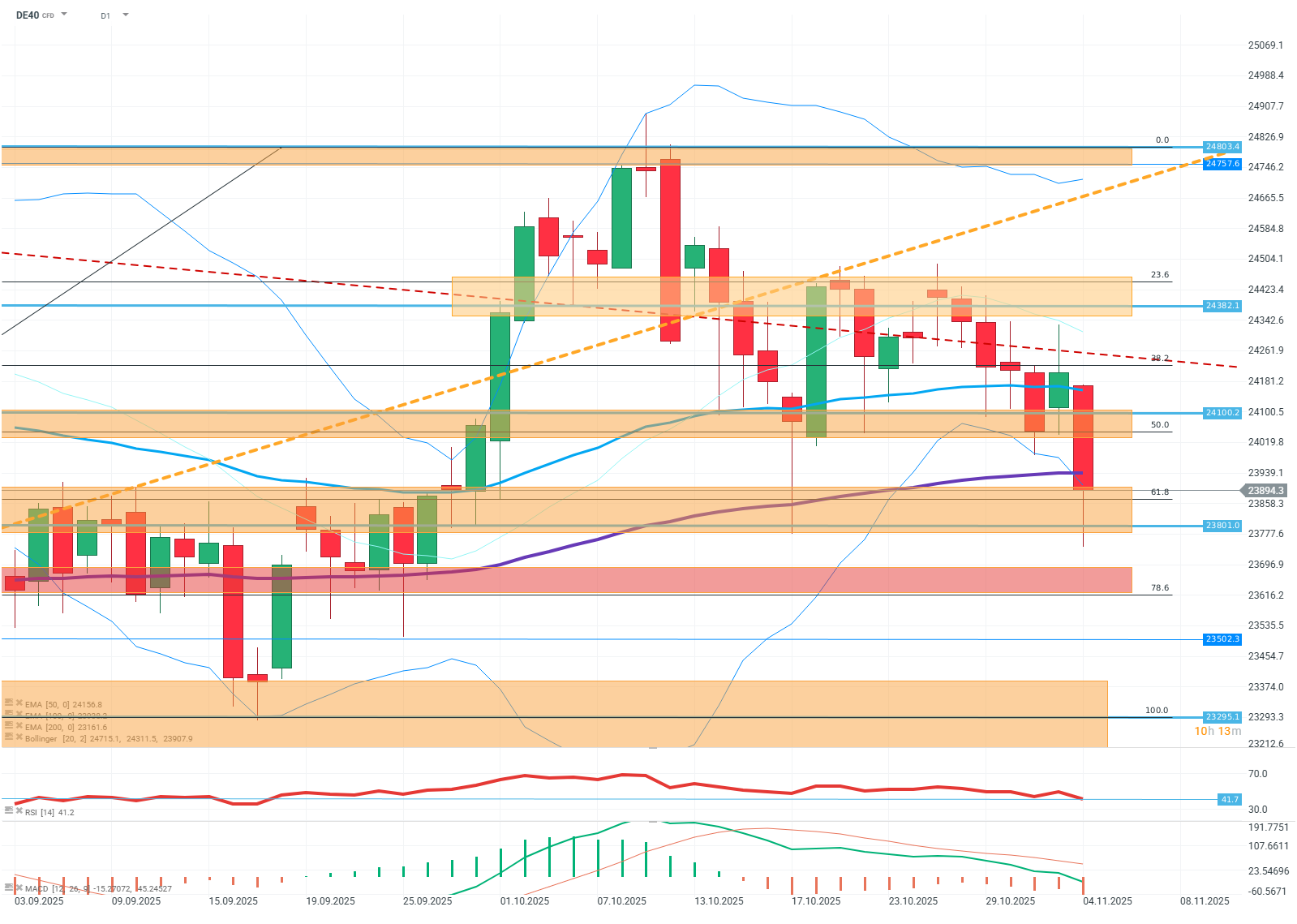

DE40 (D1)

Source: xStation5

The price on the index has fallen below the FIBO 50 level and the EMA25 average, positioning it in the lower half of the six-month consolidation. The declines stopped at the FIBO 61.8 level, where the resistance zone is additionally supported by EMA100. For buyers, it is crucial to maintain above the 23800 level and then move towards 24100. If the FIBO 61.8 level cannot be defended, the next resistance is at 23600 and the FIBO 78.6 level.

Company News:

Philips (PHIA.NL) - The Dutch company primarily engaged in medical equipment published positive results. EBITDA indicators were clearly above market expectations. Noteworthy are also substantial orders from the USA and Canada. The stock price is rising by 2.5%.

Rio Tinto (RIO.UK) - The mining company is falling by almost 3% after submitting a purchase offer to Canadian Teck Resources.

SAF-Holland (SFQ.DE) - The chassis manufacturer is losing over 3% of its valuation after publishing weak sales forecasts.

Ferrari (RACE.IT) - The Italian supercar manufacturer published results boasting, among other things, a 5% increase in EBITDA, which turned out to be above market expectations. Net revenues also increased to 382 million Euros, and diluted EPS reached 2.14 Euros. The stock price is rising by 2.5%.

Telefonica (TEF1.ES) - The Italian telecommunications service provider is losing as much as 11% after publishing forecasts indicating a drastic decline in free cash flows. Morgan Stanley analysts additionally point to significant company debt and weak revenues from Germany.

Deutsche Telekom (DTE.DE) — The German telecommunications service provider announced a collaboration with Nvidia. The companies will build a data center in Germany worth over a billion Euros. The company's shares are losing over 1%.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war