- Most markets closed for holidays

- US sanctions European officials

- Meta under Italian scrutiny

- Sanofi purchases US vaccine developer

- Most markets closed for holidays

- US sanctions European officials

- Meta under Italian scrutiny

- Sanofi purchases US vaccine developer

Volatility and trading on European exchanges are noticeably reduced due to the closure of many of them during the Christmas holidays. Trading will not take place on exchanges in Germany, Italy, Switzerland, Poland, the Czech Republic, Scandinavia, and the Baltic countries. Trading hours are shortened to 12:30 in the UK, 14:00 in Spain, and 14:05 in France. Among contracts, FRA40 is recording gains, rising by 0.3% today.

Despite the lack of significant readings on the continent and reduced investor activity, there will still be price-forming factors that may be discounted after the holiday period ends.

The USA has announced visa sanctions on five European commissioners involved in legislation related to digital services in the EU. Despite multiple indications of monopolistic practices and illegal data processing by American tech companies, President Donald Trump's administration maintains that the penalties are political and opinion-forming. This event is a radical escalation of tensions between Europe and the USA, which will undoubtedly be reflected in market valuations over time.

At the same time, the dispute between the Italian regulator (AGCM) and Meta is intensifying. Italy has decided to order the suspension of certain contractual provisions with WhatsApp, which the regulator claims abuse the market leader position and harm customers.

Macroeconomic Data:

- In the USA, data on unemployment benefit claims will be published, with a reading significantly divergent from market expectations potentially affecting, among other things, the strength of the Euro against the Dollar. Approximately 224,000 new claims are expected.

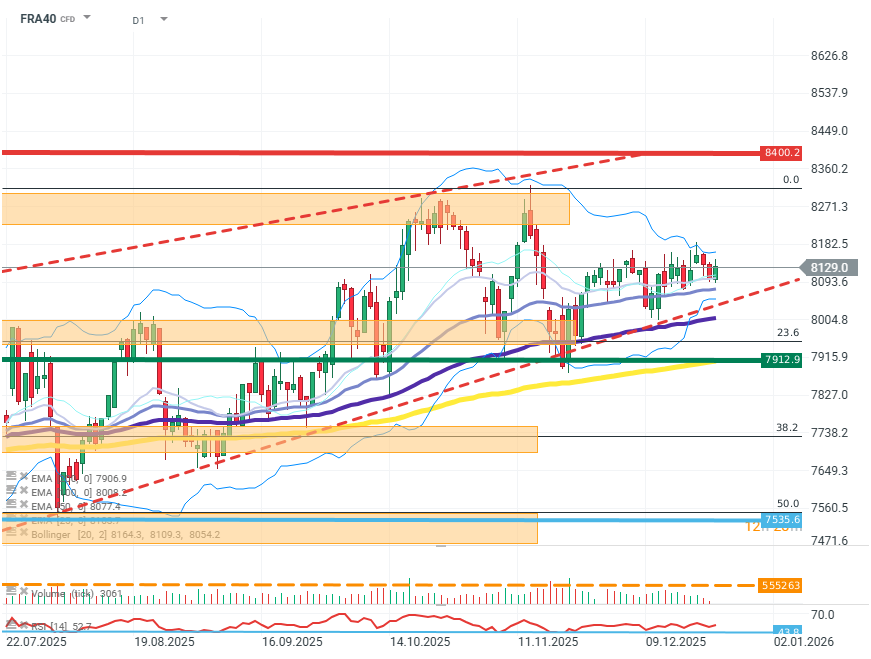

FRA40 (D1)

Source: xStation5

The price remains in a long-term upward channel, but momentum is noticeably declining. Buyers have once again failed to overcome local peaks at the level of 8320, and the price is increasingly oscillating in the lower boundary of the upward trend channel. For the supply side, the first target is a breakout below the channel towards FIBO 23.6, which could provide room for further declines.

Company News:

- Sanofi (SAN.FR) - The French pharmaceutical giant announced the acquisition of California-based company Dynavax for $2.2 billion in cash. At the same time, the company is under pressure from regulatory delays on the FDA side, which is postponing the decision regarding one of the new drugs for multiple sclerosis.

- Supermarket Income REIT (SUPR.UK) - Purchased three supermarkets in the UK for 97.6 million pounds.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

EU Suspends Landmark Trade Deal. Gold is up 2%

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?