After yesterday's session, which ended with declines in the banking sector, Western European markets are recording gains today. Investors are focusing on the Federal Reserve's decision, which will be announced in the evening.

Trading is taking place in a calmer atmosphere, and the main indices in Europe are in positive territory, signaling a partial rebound after previous declines. However, turnover remains limited as the market awaits signals from the USA regarding further monetary policy.

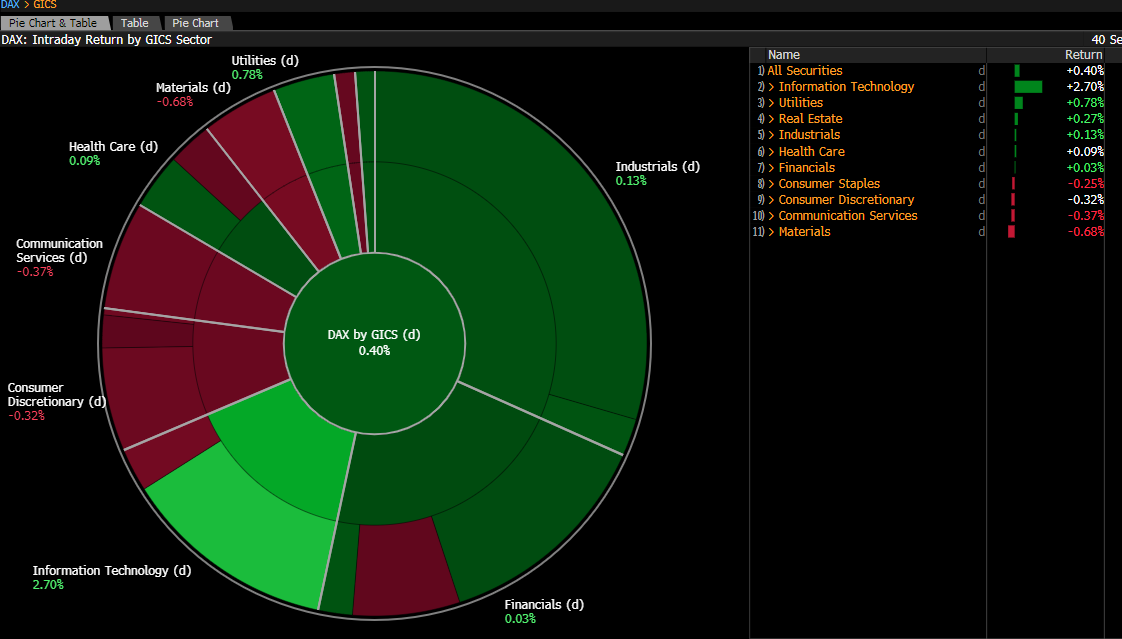

Source: Bloomberg Finance LP

The German index is rising today on the wave of positive sentiment in technology stocks.

Macroeconomic Data:

From a macroeconomic perspective, attention was drawn to the final inflation data, which turned out to be slightly lower than the initial reading. The market may interpret this as a signal that price pressure is gradually decreasing.

Market consensus assumes that the Fed will decide today to lower interest rates by 25 basis points. However, the most significant impact on the future direction of the markets will come from the message contained in the statement and at the press conference, particularly regarding inflation prospects and economic growth.

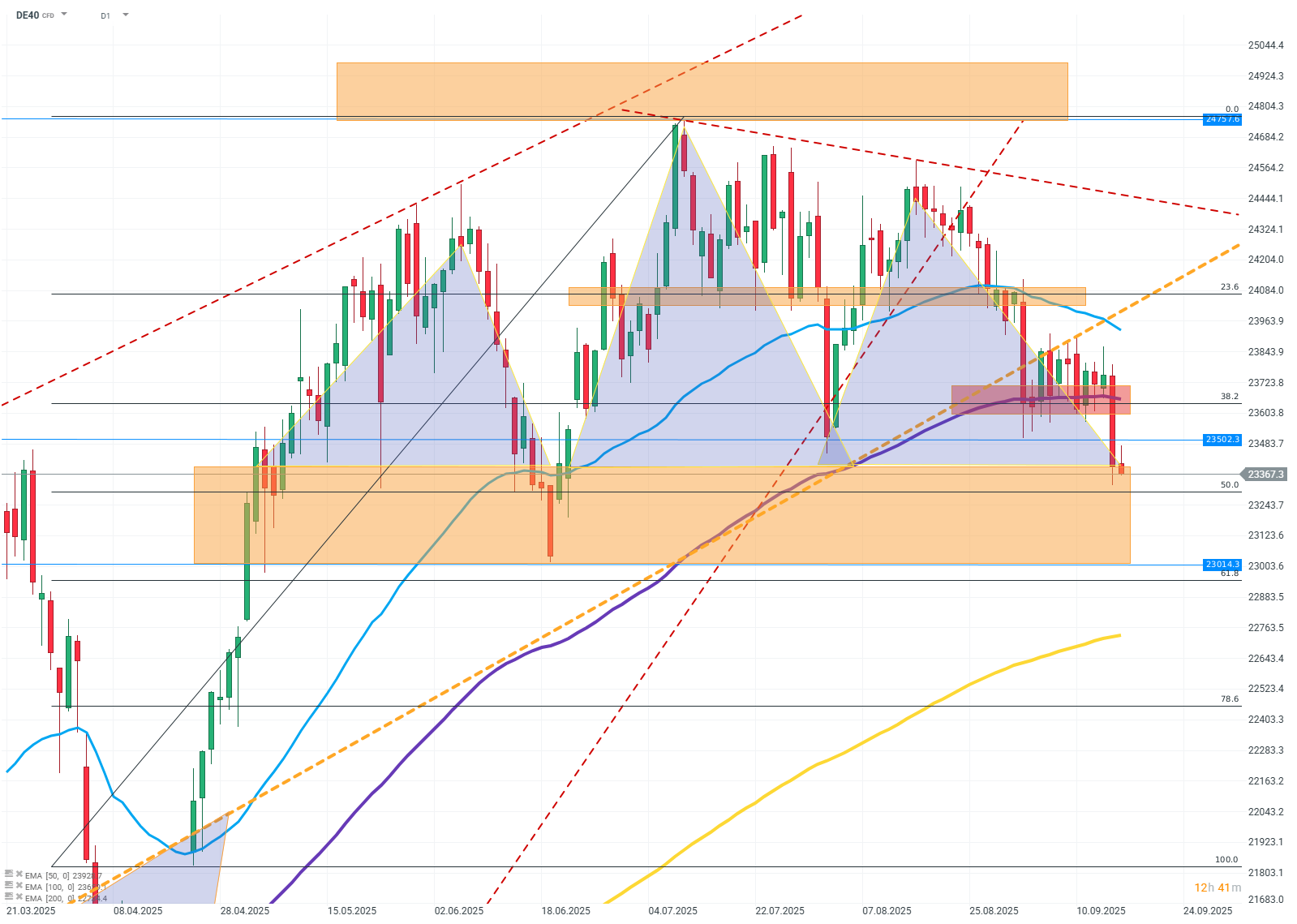

DE40 (D1)

Source: Xstation

The chart clearly outlines a head and shoulders pattern, signaling a potential reversal of the upward trend. The neckline is defined by previous support, which has been breached, reinforcing the negative tone of the technical setup. Additionally, the price has fallen below the EMA100, confirming the selling advantage. The entire setup indicates the risk of deepening the correction, with the market's behavior in the area of subsequent support zones being crucial to halting the downward momentum. If buyers want to regain initiative, a quick return above 23,700 points will be necessary.

Company News:

Centrica (CNA.UK) – The company gained support after JPMorgan raised its recommendation, improving sentiment towards the energy sector in the UK. The stock price rose by over 1% today.

Beiersdorf (BEI.DE) – The consumer goods producer came under selling pressure after yesterday's downgrade by Jefferies, maintaining a negative tone around the company. The stock price fell by about 1.5% at the opening.

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)