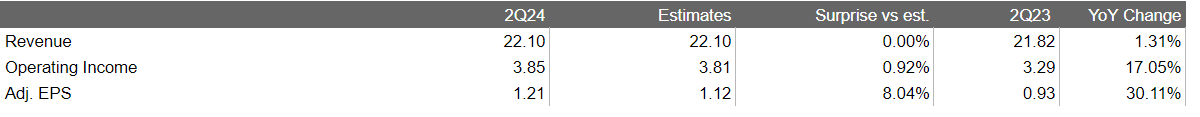

The entertainment industry giant released its 2Q24 results today (the company's fiscal year does not align with the calendar year). The company exceeded expectations in terms of earnings per share (EPS) and also raised its EPS forecast for full-year 2024. However, it disappointed in the Entertainment segment, with the increase in operating profit primarily attributed to the Experiences segment.

Disney results (in bln $, apart from EPS) Source: XTB Research, Bloomberg Finance L.P.

Disney results (in bln $, apart from EPS) Source: XTB Research, Bloomberg Finance L.P.

Revenues in line with expectations, but there's weaknesses in the Entertainment segment.

In the Entertainment segment, the company reported a 5% year-over-year decrease in revenues to $9.8 billion. This was mainly due to a decline in sales in the Content Sales/Licensing and Other segment, which decreased by 40% year-over-year and was 15% lower than market consensus. The year-over-year decline resulted from the lack of major film premieres in this quarter, while the previous year boasted titles such as Ant-Man and the Wasp: Quantumania, as well as the continued success of Avatar: The Way of Water. Direct-to-Consumer revenues, including Disney+ subscriptions, increased by 13% year-over-year to $5.64 billion, primarily due to higher subscription fees.

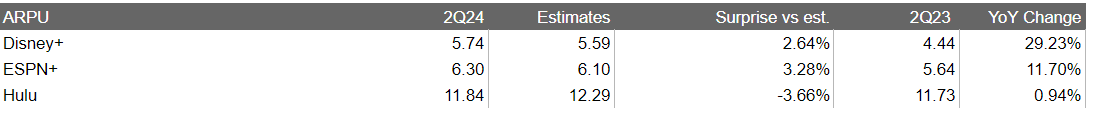

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Regarding Disney+ subscribers, the company reported 153.6 million subscriptions, translating to 4 million new subscribers. This is 15% lower than the market expected. In the streaming revenue context, maintaining high values of newly acquired users is crucial due to limited room for subscription price increases in the highly competitive platform market. Therefore, weaker subscriber growth data can be interpreted as a negative signal.

In terms of sports revenue, the company recorded $4.31 billion, in line with market expectations and 2% higher than the previous year. The theme parks segment surprised with a 10% revenue increase to $8.39 billion (compared to +3% expectations), primarily driven by ticket price increases.

In terms of average revenue per subscriber, the company experienced its strongest growth with Disney+ subscriptions, where the increase was nearly +30% to $5.74. Conversely, a decline was recorded on the Hulu platform.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Upward revisions in forecasts

The company raised its EPS forecasts, anticipating a 25% increase in 2024, which means approximately $4.70. Before the results publication, the company's forecast was $4.60. However, this is still a lower increase than expected, as the market consensus anticipated EPS of $4.71.

Importantly, the company managed to achieve operating profit in the streaming segment, and Disney announces that it is on track to maintain a positive streaming result throughout 2024. The company achieved an operating profit in the Entertainment segment of $0.78 billion (+72% year-over-year), with streaming contributing $47 million in profit (compared to a loss of $587 million the previous year).

Disney forecasts generating $14 billion in operating cash flow in full-year 2024, representing over a 40% year-over-year increase.

The market reacted coolly to the company's results, with Disney losing 8%.

Source: xStation

Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street