- What makes Greenland worth attention?

- What justifies the unprecedented rhetoric of the USA?

- Is Greenland a reason for worsening relationships, or just a pretence?

- Who can gain or lose from the emerging trends?

- What is the worst-case scenario?

- What makes Greenland worth attention?

- What justifies the unprecedented rhetoric of the USA?

- Is Greenland a reason for worsening relationships, or just a pretence?

- Who can gain or lose from the emerging trends?

- What is the worst-case scenario?

Recently, investors, analysts, commentators, and the public have been watching with consternation the unusually aggressive rhetoric of the US president's administration towards European allies. At the centre of the dispute is Greenland, a frozen island with a population of about 55,000 people. This is not the first time, either for the USA or for Donald Trump, that they have demanded control over Greenland. However, never before has the USA been so determined to take control of the island, while Europe remains determined and refuses any territorial changes. Could the Atlantic Ocean witness escalation, and what is it about Greenland that justifies further deterioration of relations between the USA and Europe?

Greenland - not just ice and snow?

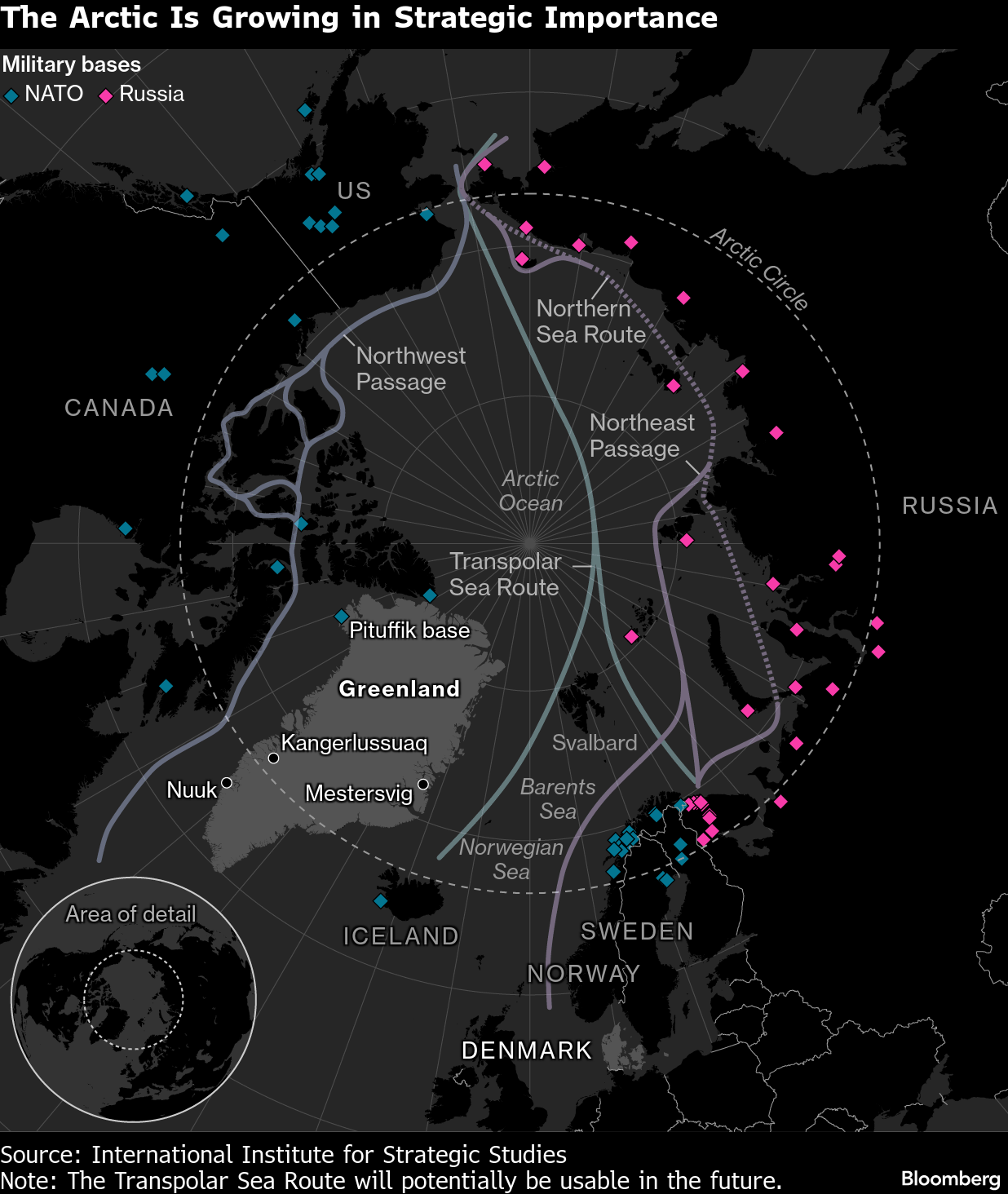

The USA cites its security and the fact that control over the island is indispensable for American national security. The problem lies in the fact that the USA already has a military base in Pituffik. Additionally, the USA currently benefits from cooperation with NATO countries in monitoring the Atlantic and the Arctic Circle. In a world of satellites, over-the-horizon radars, and advanced sonar systems, expanding infrastructure in Greenland is not only unnecessary but downright absurd. Equally, absurd are suggestions of Greenland being "taken over" by Russia or China.

Source: Bloomberg Finance

There is also the issue of potential Arctic shipping/trade routes, but here too, analysts' suspicions and politicians' declarations face internal contradictions. Who would sail these future routes? The USA pursues an isolationist policy and is engaged in a trade war with its largest partners, namely the EU and China. Europe is fully satisfied with routes through the Atlantic, the Suez Canal, and the Panama Canal, while Russia is undergoing an economic catastrophe that has erased it from the world's economic map. Is it about something else?

The rare earth metals crisis hit developed markets like an avalanche moving at a turtle's pace. All participants and decision-makers waited to acknowledge the problem until China threatened to use existing dependencies as a tool of pressure.

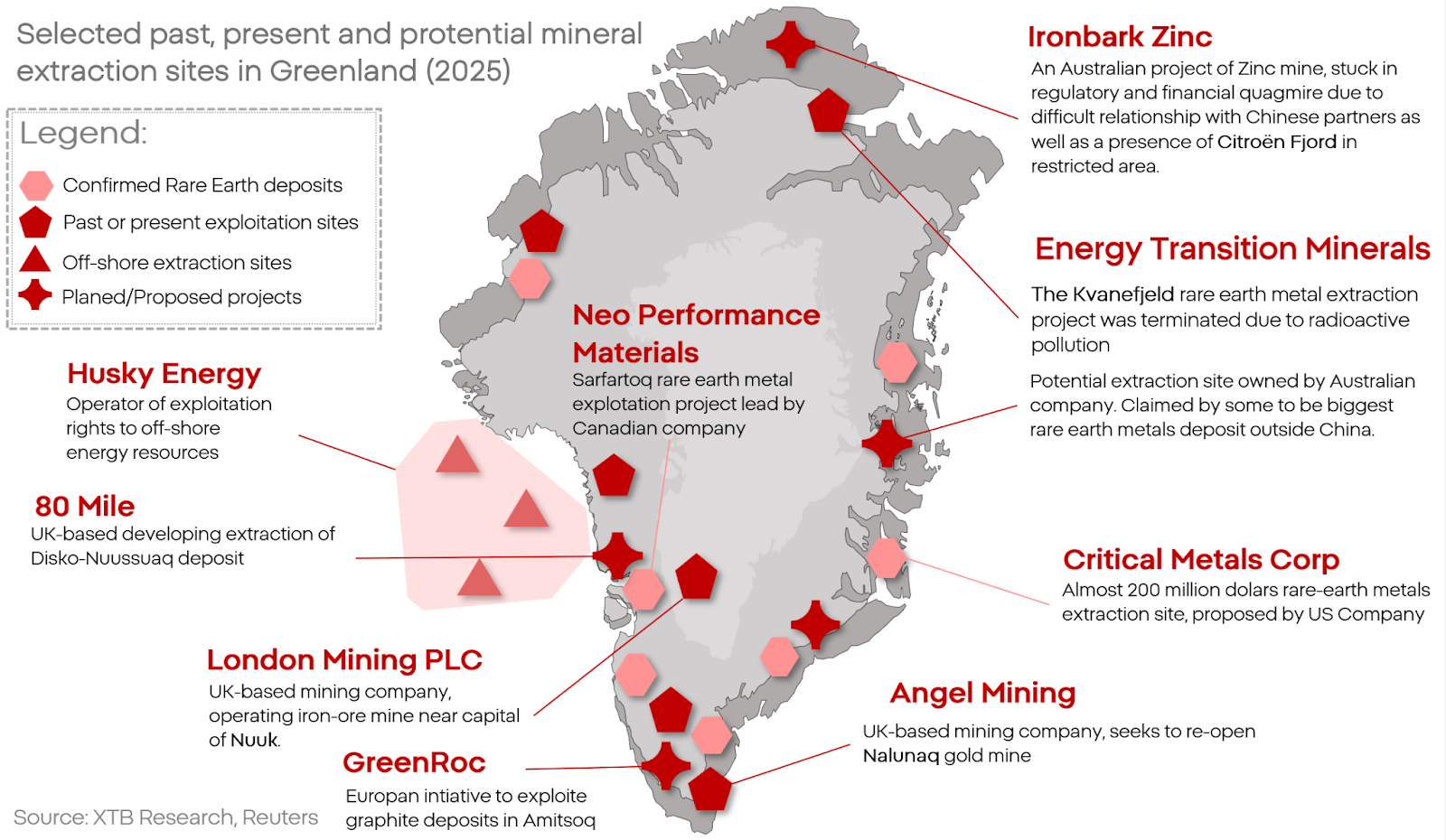

In this light, many point to the seemingly obvious fact of the presence of huge deposits of countless minerals (including so-called rare earth metals) on the island. However, this observation is not very careful. Greenland has vast deposits of many more or less strategic resources. However, the USA is a large country, possessing much larger deposits on its own territory. Even those located in the Rocky Mountains, the Mojave Desert, Alaska, or the northern taiga are much more accessible than any deposits in Greenland. Greenland is located in the Arctic Circle, with 80% of its surface covered by ice sheet. These deposits are so difficult to access that even gold or diamond mining there is uneconomical. This does not take into account the fact that the USA does not have facilities to refine such resources.

Others point out that it's not about extraction, but rather control over them. Preventing China, which, among other, acquired a 12% stake in the Kvanefjeld mine in Greenland in 2021. However, this explanation is also misleading. Not only has the operation of the Kvanefjeld mine been halted due to radioactive contamination, but most mining projects in the region are in their infancy, and China already controls about 80% of the rare earth metals market. Would cutting off their unexploited deposits in Greenland change anything? Nothing indicates it.

Even the most conservative attempts to exploit resources in the region require enormous financing and technology, which the USA lacks.

Who has such technology, and who simultaneously lacks alternative geological deposits? Europe does not have these resources, and specialists inextracting them include the UK and Scandinavian countries, including Denmark, which is the current owner of Greenland. It is worth mentioning that the island contains 37 of the 50 key minerals according to the European "CRMA."

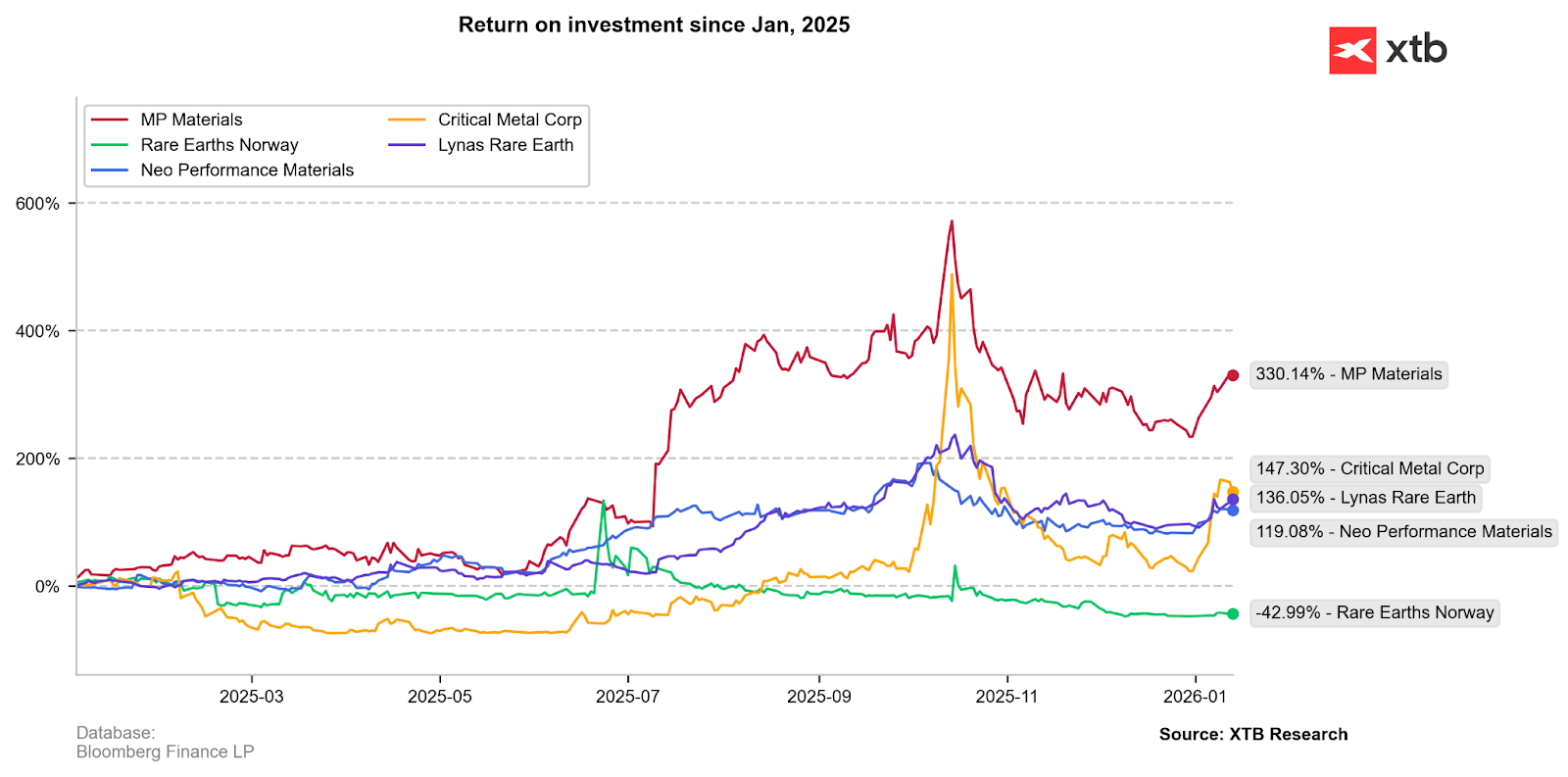

Rare earth metals companies have had a very good period. Is this the beginning of growth or its end?

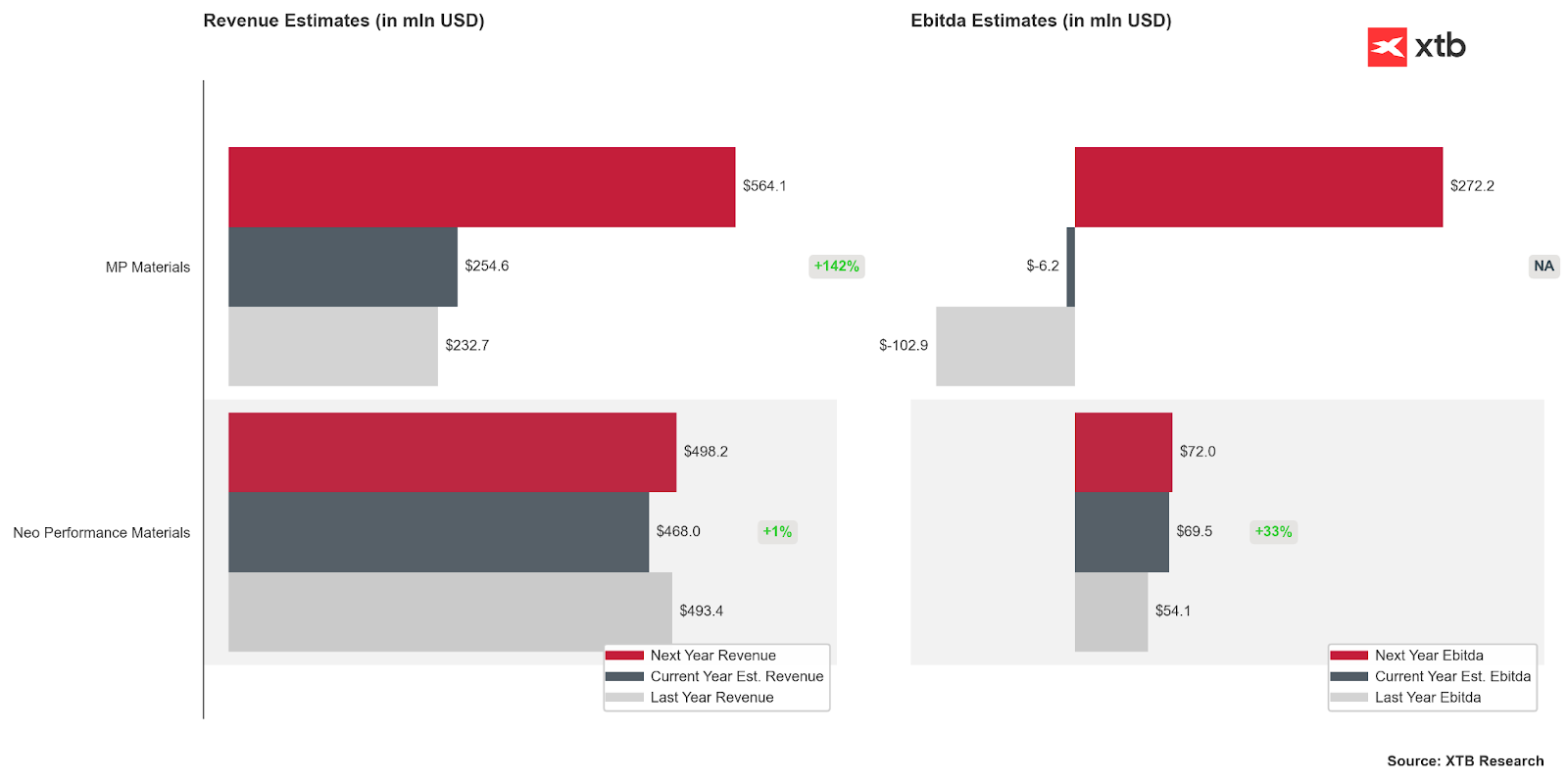

American rare earth metals companies are growing faster, and expectations for them are the highest. Will generous subsidies and investments be enough to catch up?

The flame of conflict and the shadow of dependency

Donald Trump is a man who led six companies to bankruptcy. There is no reason to suspect him of understanding what constitutes the strength of an organization or where its value lies. Today, that company is no longer casinos or hotels, but the USA and NATO. Many commentators are convinced that even the most unbalanced and incompetent presidential administration in the USA will not overturn the pillar of American position, which is NATO. This certainty is not shared by, among others, John Bolton, multiple national security advisor in the White House.

The current US administration does not see Europe as an ally and partner. It sees it as an opponent, if not an enemy. This is not a guess or conclusion, but a clearly defined "new security policy" of the USA from 2025.

To get to the point, Europe has a range of strategic and structural advantages over the USA, and the "scarecrow" in the form of the Russian army, which allowed the USA to implement its policy from a position of strength, burned on the steppes of Ukraine. The American economy is doing increasingly poorly, and antagonized allies are increasingly asking whether the USA's place in the global balance of power is justified.

The USA wants to encircle Europe - strategically and economically, Greenland is the starting point for this plan. Trump and his supporters want to conduct their foreign policy assuming that Europe is "weak" - whatever that may mean. They cannot do this when structural and strategic dependencies are still, in some cases, extremely in favor of Europe.

The elephant in the room that more and more people are noticing over time is ASML. Without ASML machines, there is no Nvidia, no Intel, and no TSMC. ASML's lithography machines are the most complex system humanity has built so far. Both the USA and China are years, if not decades, behind the capabilities of the European company. This system is also extremely resistant to attempts at technology theft.

The SWIFT system. Although the USA is still considered the financial center of the world, the SWIFT system is a European system.

However, this is not the end of Europe's financial advantage. Europe's debt is smaller than that of the USA (in terms of GDP). Additionally, Europe holds a significant majority of its own debt, which is not the case for the United States. Moreover, about 20% of all US debt is currently held by Europeans.

Europe is also a powerhouse in a range of niche chemical and precision industry products. Products that most people will never hear about but without which assembly lines and workshops worldwide could come to a halt overnight.

In the USA, the topic of alleged US military superiority as the ultimate argument is also gaining traction. This advantage is real, but it is much smaller than public perception or US decision-makers suggest. The USA's advantage is mainly quantitative and only in selected types of forces. Technologically, both sides are similar in capabilities, but in terms of training, Europeans lead the way. Exercises like "Mission Command," "Red Flag," "Joint Warrior" are just loud examples. The last 30 years have been a series of humiliations and defeats for the USA in most simulated confrontations with European forces. Americans are still not sober after their success in Venezuela. They seem to forget that fighting irregular forces of a collapsed economic dictatorship from South America is not the same as fighting the best soldiers on earth in their natural environment. Denmark remembers this, which in the face of open threats responded that "they will shoot first and ask questions later."

What does this mean for markets and companies?

US policy now resembles not a map but a roulette table. It can change completely from day to day. However, a threat and risk have emerged, without precedent. Regardless of further developments, it is worth looking at what the current situation may mean for the market.

First and foremost, it can be expected that Europe, in light of unprecedented threats, may take an even more "total" path of expanding its armed forces and defence industry. It may quickly turn out that current record valuations for companies like Rheinmetall or Hensoldt still have room for upward movement.

Weakness of the dollar. The position of the dollar as a reserve currency is increasingly loudly questioned in the face of the emergence of new "centers of gravity" in world politics and economy. However, this is the smallest problem for the American currency. Donald Trump openly announced that the next Fed chairman should implement his policy rather than focus on protecting the currency's value or the stability of the financial system. Additionally, an increasingly confrontational course towards the few remaining US allies, in the face of galloping debt and deficit, will exert pressure on the attractiveness of both American bonds and, consequently, the dollar itself.

In the face of growing rivalry between the USA and Europe, primarily but not only in the economic dimension, it can be expected that Europe will try to strengthen companies and sectors where it has a structural advantage or can gain it at a moderate cost. Mature companies that may become beneficiaries of reliefs, new agreements, subsidies, or other types of promotion include: ASML, Siemens, Novo Nordisk, BASF, AstraZeneca, Roche Holding, SAP, Ericsson, or Bosch. Where Europe has the potential for complete independence, and over time, to take market share from the USA and China, are semiconductors and batteries. European stock exchanges already have a range of companies ready for further development like VARTA AG.

However, European car manufacturers, who are increasingly struggling with production and sales of mentioned cars, may join this trend. Both Volkswagen Group, BMW, and Daimler already have active teams engaged in designing and producing advanced batteries and power systems.

DAXEX.DE (D1)

DXSE.DE (D1)

Source: xStation5

European industrial and medical companies, after several quarters of sharp corrections, are increasingly confidently maintaining growth channels.

Who might lose first? Here it is worth recalling the "Freedom fries" case. In 2001, the United States invaded Afghanistan, and in 2002 took control in Iraq. This was met with vocal criticism from many political centers, and one of the most important and loudest was France.

The public in the USA was so outraged by the attempt to question its "war on terror" that a grassroots initiative was launched to change the name of "French fries" to "freedom fries." What does this anecdote mean in the context of contemporary rivalry? One of the standout manifestations of European culture and craftsmanship in the USA is the so-called "luxury brands" like LVMH, Hermès, or Kering. It is not a difficult scenario to imagine that in the context of growing tensions and increasingly sharp rhetoric, the USA may decide on restrictions and/or boycotts of these companies' products.

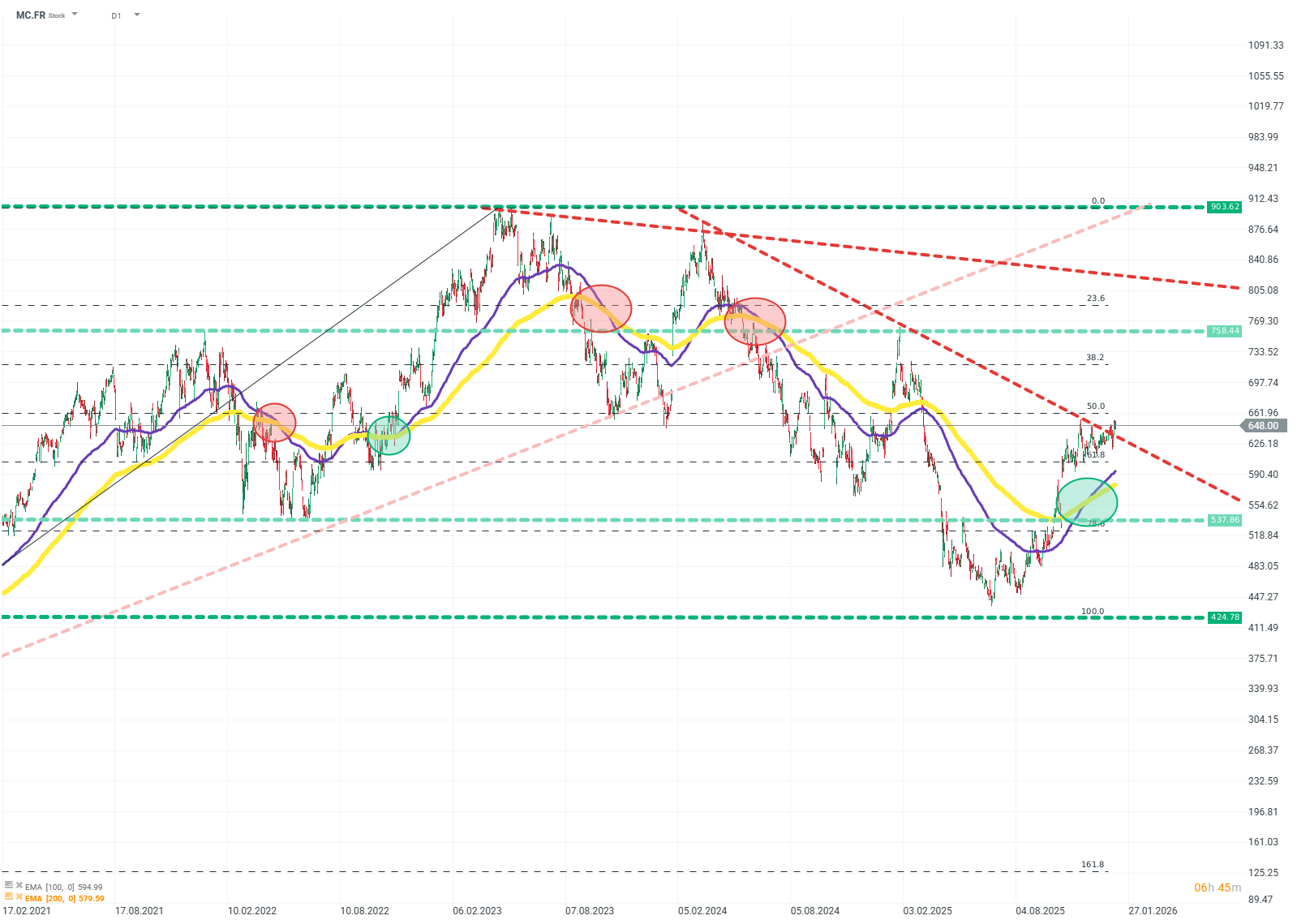

MC.FR (D1)

Source: xStation5

Luxury companies are also returning to growth trends; can they maintain it?

Is there anything to fear?

A more or less direct confrontation between the USA and Europe would be a disaster for the market and the world. What are the real indications that, let's not be afraid to use the word, threats - from the USA are more than just a negotiation tactic?

US base in Greenland - In 2023, the name of the military base was changed from "Thule" to "Pituffik," a word from the language of Greenlandic Inuit, who make up about 80% of the population. The base changed its name after 70 years. Simultaneously, in 2024, command over it was transferred to the so-called "Space Force," an entirely new branch of the armed forces created by Trump during his first term, which provided an opportunity to staff its commander with a series of "loyalists." Is all this a coincidence?

The USA is also openly engaging in subversive activities, trying to influence the sentiments of the island's population, organizing separatist movements, or even offering social transfers to the island's population in exchange for changing affiliation.

Polar escalation activities are not only on the US side. Denmark, like most European countries, has raised its defense spending to levels unseen for decades, if not the highest in history. What is puzzling is that despite regular, illegal intrusions by Russian ships and drones into Danish waters and space, it has spent over $6 billion on expanding and modernizing Arctic forces.

Other members of the European part of NATO are also not passive. France, Germany, and the UK are currently negotiating increasing the number of units stationed on the island or are in the process of transferring troops to the island.

The desire to annex Greenland has been present in American politics since the 1880s. Donald Trump is a politician increasingly unpopular in the USA and overwhelmingly disliked outside the USA. It is possible that certain elements of the American establishment may try to use the Republican president, who is currently serving his second term, and his imperial ambitions, as well as the "MAGA" movement's aversion to Europe and NATO, to attempt to take control of the island and/or try to regain a dominant position over Europe, which the USA has lost. This is an unlikely scenario, but at the beginning of this year, it ceased to be a fantastic scenario - and it became a risk that needs to be priced.

Kamil Szczepański

Junior Capital Markets Analyst at XTB

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets