DocuSign (DOCU.US) shares surged more than 16.0% on Friday after the software company recorded solid quarterly results.

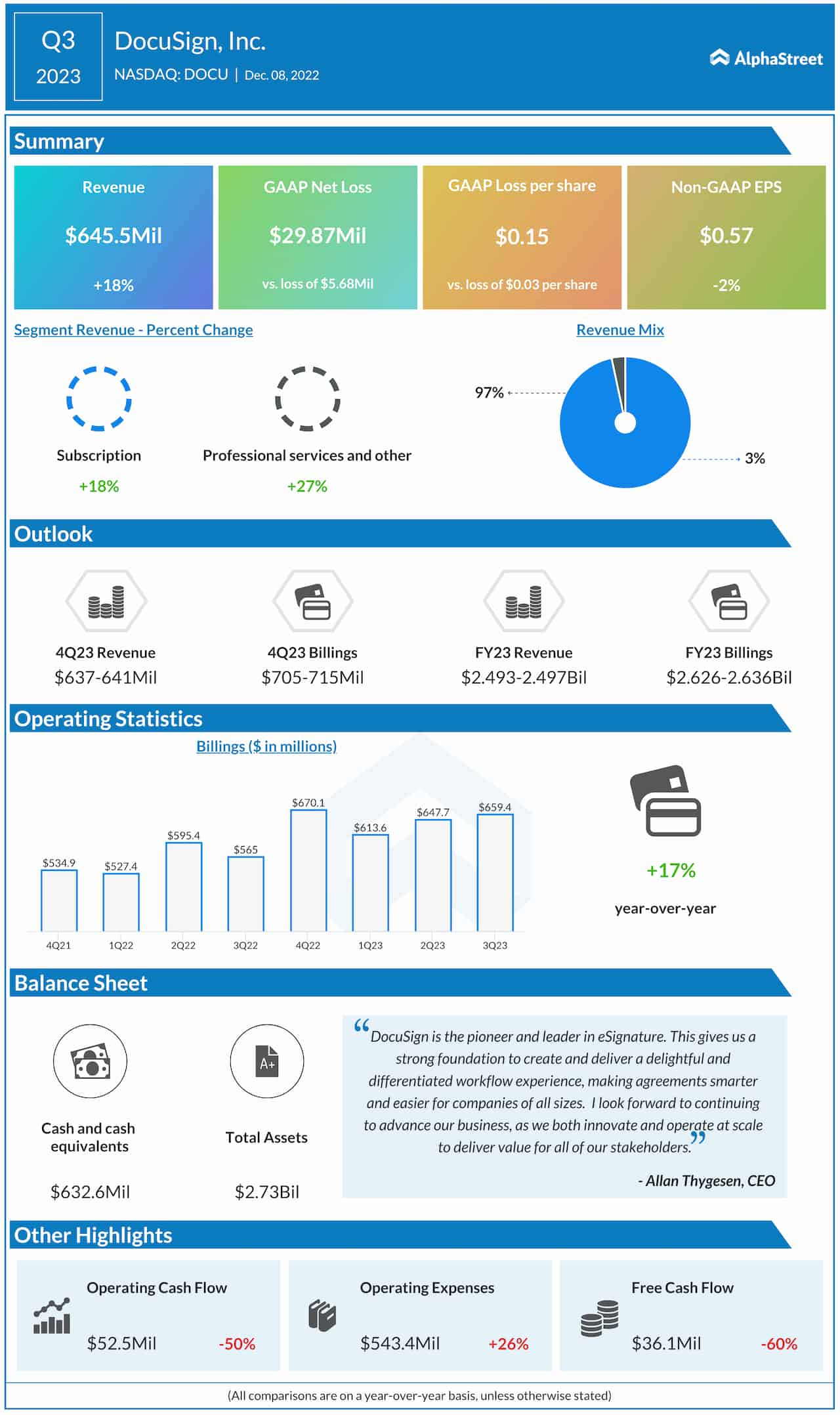

- Company earned 57 cents per share, down 2% YoY, easily topping analysts’ estimates of 42 cents.

- Revenue rose 18.0% YoY to $645.5 million, easily topping market estimates of $627 million.

- Leading provider of digital signature services said that billings — a metric that tracks sales to new customers - rose 17% to $659.4 million on YoY basis.

- For the Q4, DocuSign expects revenue in the region of $637 million to $641 million, at the midpoint of the range, slightly below analysts’ consensus at $640.5 million. Q4 billings are expected to increase in the region from $705 million to $715 million, with non-GAAP gross margin in the 82% to 83% range.

- Jefferies analyst Brent Thill said in a note to clients "(DocuSign) delivered a beat across the board against low expectations aided to some extent by early (contract) renewals," Thill said. "Despite the beat, management's billings growth outlook for fiscal 2024 is appropriately prudent given the tougher macro environment. (DocuSign) remains focused on improving its go-to-market motion, but it will take a few quarters."

Highlights of DocuSign Q3 2022 financial results. Source: Alphastreet

DocuSign (DOCU.US) stock rose sharply following superb quarterly results and broke above long-term downward trendline and 200 SMA (red line). If buyers manage to push the price above local resistance at $51.50, which is marked with previous price reactions, then the upward move may accelerate towards next resistance at $56.70. On the other hand, if sellers manage to regain control and break below the 200 SMA (red line), then retest of recent lows at $39.60 cannot be ruled out. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street