- The USDIDX has gained about 1.65% since the beginning of the week, reaching a two-month high.

- A sustained trend reversal remains uncertain amid emerging expectations for further interest rate cuts in the U.S.

- The USDIDX has gained about 1.65% since the beginning of the week, reaching a two-month high.

- A sustained trend reversal remains uncertain amid emerging expectations for further interest rate cuts in the U.S.

The dollar index is gaining for the fourth consecutive session (USDIDX: +0.6%), rising to its highest level in two months.

The price has broken above the 100-day exponential moving average (EMA100, dark purple), which in March—amid trade-related uncertainty—initiated the strongest downward trend in the world’s leading currency since 2022. Pressure on the USDIDX began to stabilize after the index hit a 3-year low in June, but a sustained trend reversal seems unlikely given the direction of U.S. monetary policy, which could still turn more dovish.

USDIDX broke above EMA100. Source: xStation5

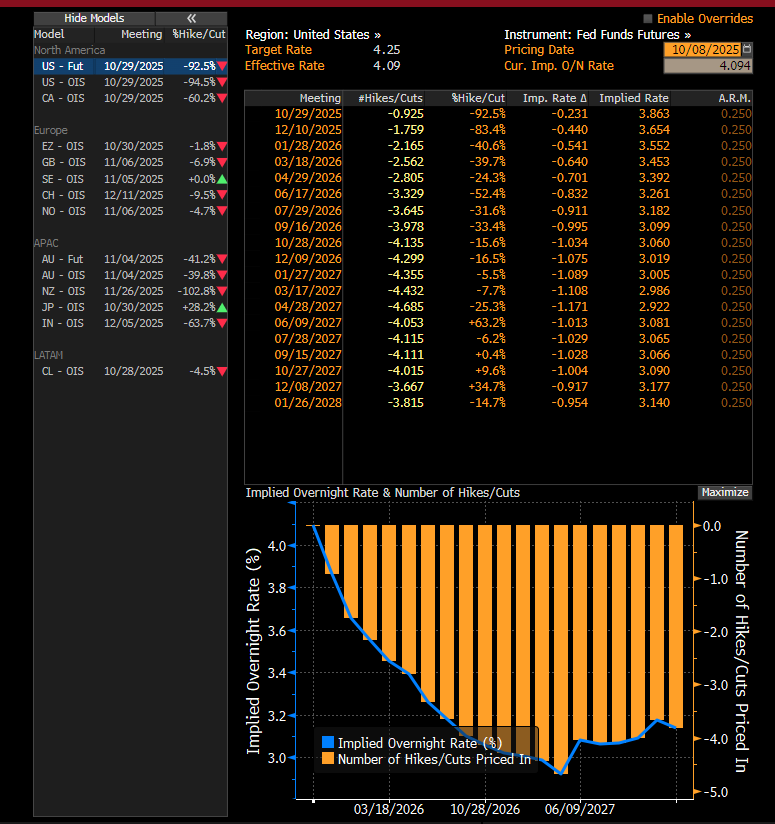

The swap market currently assigns a 75% probability to two interest rate cuts in the U.S. before the end of 2025. The Fed’s tone remains cautious, emphasizing a dual risk (potential increases in both inflation and unemployment), while the end of Jerome Powell’s term is approaching. Even if the Fed has ended the easing pause that began in December 2024, a truly dovish shift has yet to occur.

Pricing of further U.S. interest rate cuts in the futures market. Source: Bloomberg Finance LP

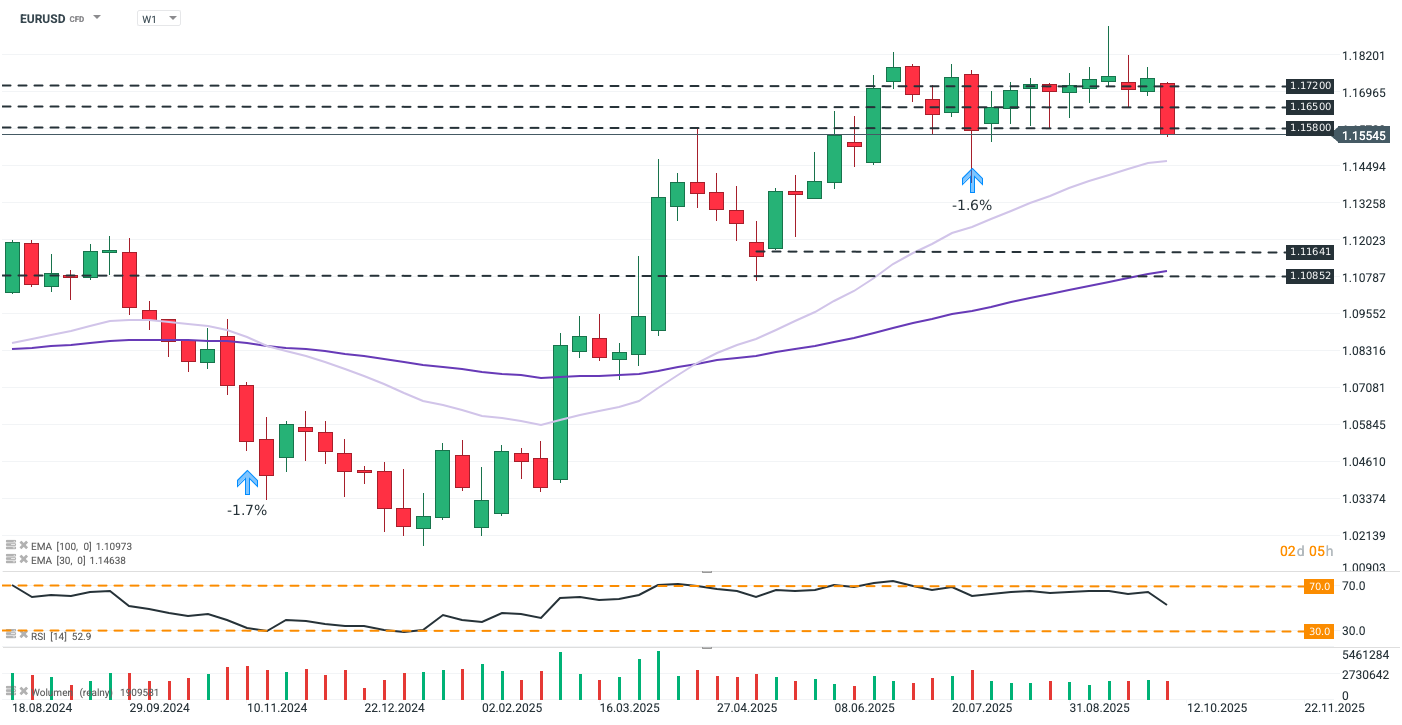

Paradoxically, the dollar is strengthening despite the lack of major economic data releases (for instance, today’s weekly jobless claims were not published). This has shifted investors’ attention toward the “rest of the world,” particularly to politically chaotic France. It’s no surprise, then, that the euro has become one of the biggest losers in the dollar’s new bullish narrative. Over the course of the week, the common currency has weakened by about 1.5% against the USD, marking what could be its largest weekly drop since November 2024.

EURUSD on weekly interval. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉