The EURUSD continues to rise, mainly due to the weakness of the US dollar following the release of inflation data last week. EURUSD has reached the highest levels since before the Ukraine war and is testing very important resistance levels. Today, the market's attention will be focused on the publication of retail sales and industrial production from the US. Expectations point to a pretty solid report:

-

Headline sales for June are expected to pan out at 0.5% m/m against expectations of 0.3% m/m

-

Core sales are expected to evaporate at 0.3% m/m against a previous expectation of 0.1% m/m

-

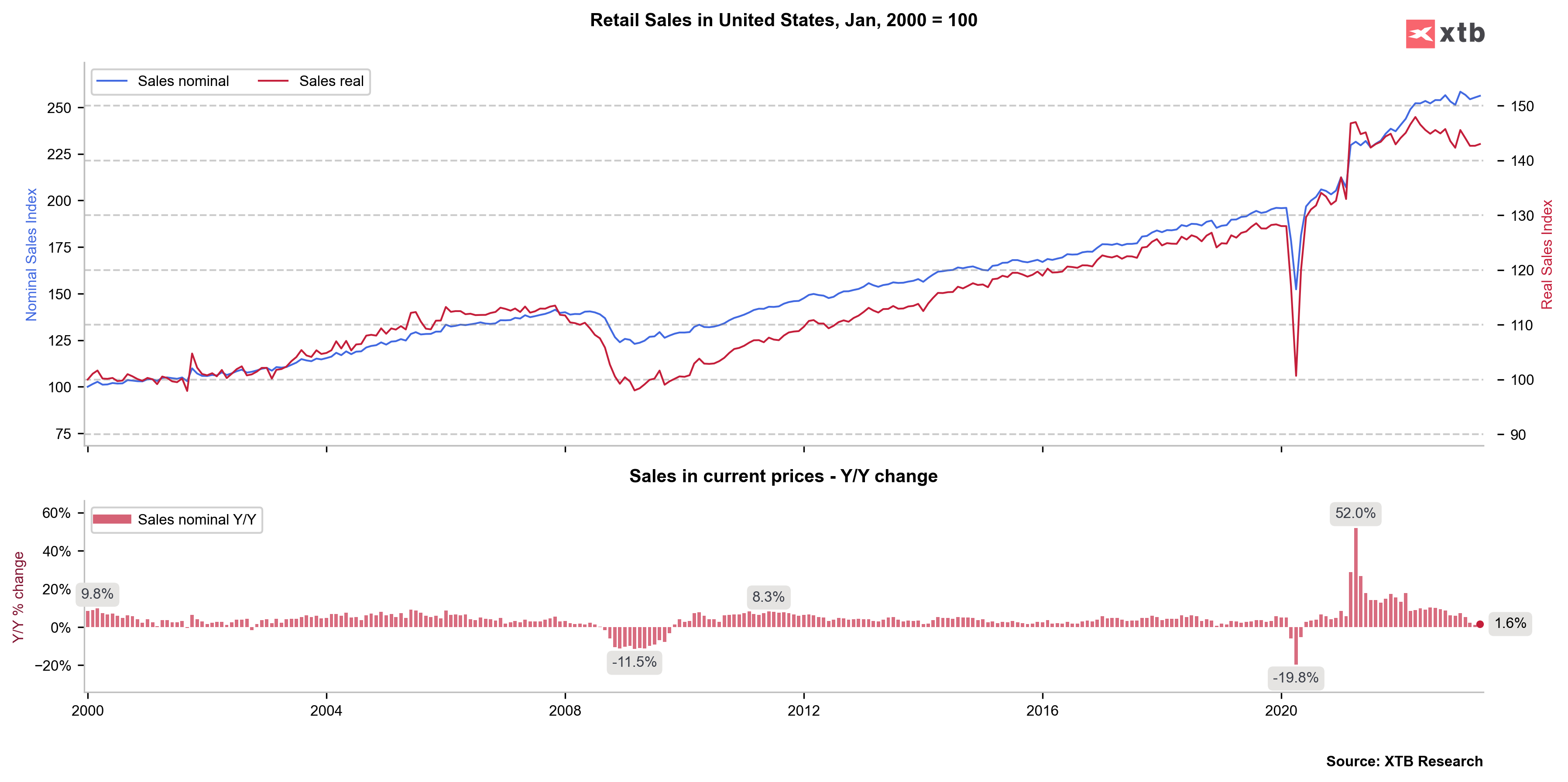

It is worth noting that last time, annualised sales came in at 1.6% y/y and are expected to remain at the same level. Realistically, however, we have significant declines.

-

Consensus indicates that car sales will contribute significantly to retail sales volumes.

-

Moreover, we are also to see rapid sales growth in the restaurant and bar sector. A risk factor for higher retail sales volumes may be the slowing dynamics of fuel sales.

It is clear that real retail sales have been declining for some time. However, with inflation at only 3.0% YoY, the decline in real sales is already modest. However, in nominal terms, we are not seeing large increases either. Source: Bloomberg, XTB

Moreover, the retail sales report will be the last important indication before next week's FOMC meeting (we will no longer hear comments from Fed bankers due to the closed period). At the moment, the money market is pricing that the FED will raise rates by 25 basis points on Wednesday 26 July with a 95% probability.

EURUSD is testing the vicinity of an important resistance at the 61.8 Fibo retracement of the entire large downward wave started in 2021. A break of this level will mean a negation of the entire upward impulse of the dollar from almost the last 2 years. If retail sales surprise even more strongly than the consensus indicates, a correction to the range 1.1180-1.1200, where the upper limit of the upward trend channel is located, will be possible. Source: xStation5

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)