- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

ECB Governing Committee has outlined monetary council views regarding the economy during a press conference:

- Chairman reassures that European economy and labor market remains strong despite tribulations

- European companies have increased their investments in IT infrastructure, software and digitalization

- Infrastructural and industrial investments related to defense industry and armed forces are boosting economy but might increase inflation

- "Households keep saving unusually large portions of their income"

- Long term inflation expectations stay around 2%, but outlook is "uncertain"

- Tariffs, geopolitical tensions, trade disruptions remain one of the primary threats to growth and are projected to remain

- Additionally, the importance of expansions and strengthening the Euro Area as well as European financial system was reiterated

- Credit conditions for business have moderately tightened

- Food inflation is easing, but energy inflation persist for longer than expected

- ECB is in "a good place" but that place is not "fixed"

- AI impact on EU job markets is "to be seen"

- Monetary transition is not hindered

- Risks to EU banking system are negligible, and bank profits are stable

- Risks to growth are now more balanced and the range has narrowed (upsides and downsides are now more equal and both are less severe)

It was reassured repeatedly that ECB maintains reactive, data driven policy. By which, investors most likely are meant to not expect further rate cuts not justified by a substantial decline in economic growth. During the question's session, ECB officials avoided direct answers regarding whenever hikes are equally likely as cuts. By that, officials likely wanted to prevent creating disrupting carefully created inflation expectations.

ECB maintains its commitment to stability first and foremost. The Governing Committee has carefully avoided creating unrealistic expectations for growth. While growth and labor market condition remains lackluster, it is good enough for ECB to focus more on addressing numerous local and global risks to European economy and financial system - much more severe than slow growth.

The "Good place" Chairman Lagarde keeps referring to is seemingly a place in which ECB is in the best possible position to address realized risks without depriving itself of opportunities to exploit more favorable conditions for growth.

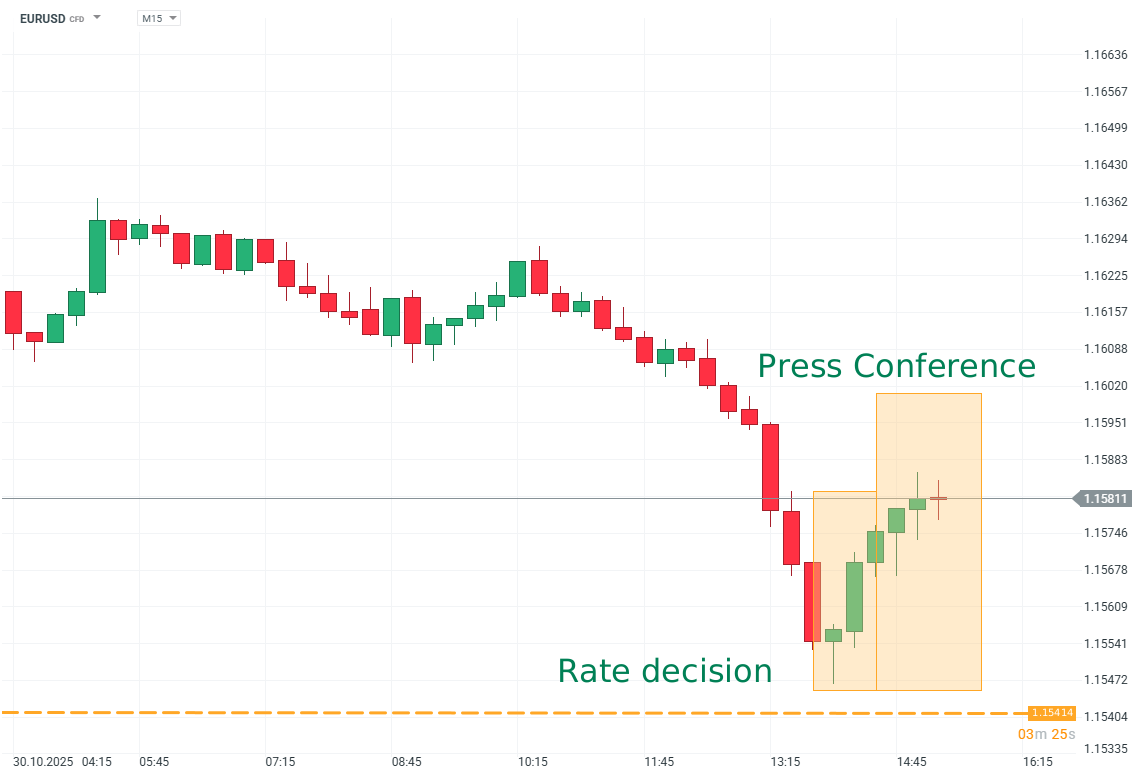

EURUSD (M15)

Source: xStation5

Euro erases some of its earlier declines after rates decision and press conference.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing