EchoStar (SATS.US), a leading provider of technology and connectivity solutions, has seen its stock soar over 38% today following the announcement of its merger completion with DISH Network Corporation. This merger has significantly enhanced EchoStar's strategic, financial, and operational flexibility, positioning it as a global leader in both terrestrial and non-terrestrial wireless connectivity.

The merger integrates DISH Network's satellite technology, streaming services, and 5G network with EchoStar's satellite communications, optimizing the combined company's strategic and financing capabilities. EchoStar has acquired a range of wireless spectrum licenses through a newly formed subsidiary, EchoStar Wireless Holding L.L.C., enhancing its resource allocation for strategic goals. This move, along with the designation of various subsidiaries as "Unrestricted Subsidiaries" and the transfer of a $4.7 billion receivable to EchoStar Intercompany Receivable L.L.C., aims to bolster EchoStar's position as a premier provider of terrestrial mobile, satellite connectivity, and content services.

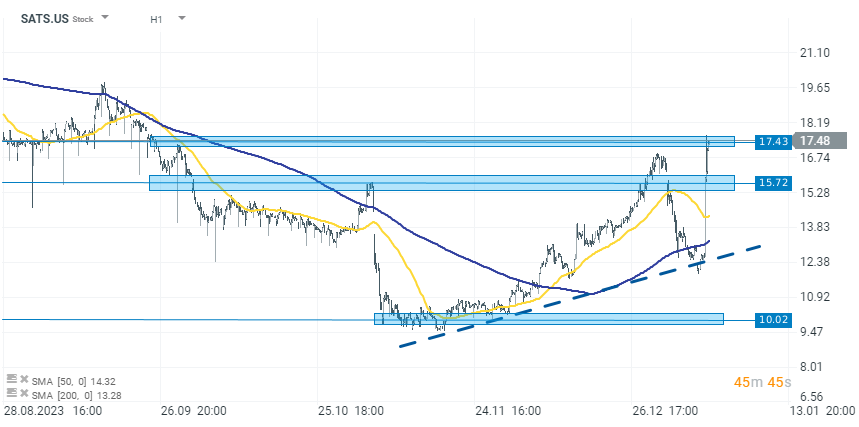

Source: xStation 5

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?