Summary:

- European and US equities rise ahead of Trump-Xi meeting

- Stock of the week: Carrefour

- US banks surge after Fed stress tests

- G20 summit kicked off today

- Bitcoin tries to climb back above the $12k handle

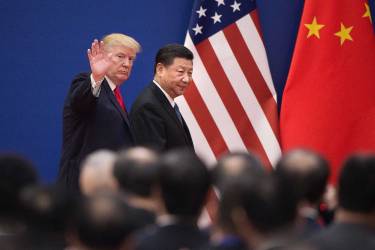

Friday’s trading in Asia has brought some nervousness as equity indices have retreated, gold prices have moved up while the US 10Y bond yield has come back again toward 2%. These is a classic risk-off reaction as investors are gearing up for a pivotal meeting between Xi Jinping and Donald Trump on Saturday during the G20 summit in Osaka, Japan.

Major stock market indices from Wall Street are trading higher on the final trading session of the second quarter. Banks are among the best performing US stocks thanks to passing Fed stress tests and raising payouts. Meanwhile, Wall Street Journal reported that Apple will shift manufacturing of new Mac Pro to China.

Carrefour, the French retailer with broad international presence, announced at the beginning of the week that it will divest major part of its Chinese business. The move may seem strange given that China is the fastest growing grocery market in the world. We take a look at the company in our “Stock of the week”analysis.

This week’s series of US data was moving from weakness to weakness. All the regional Fed indicators were moving sharply down: Dallas, Richmond and Kansas. Consumer confidence deteriorated, data on home sales and durable orders wasn’t particularly strong either and Q1 GDP was revised down (although just marginally) and the week has ended with a contractionary reading of Chicago PMI that has plummeted 15 points since February.

Deutsche Bank was the best performing DAX stock on the final trading session of the week. The troubled German lender got boosted by the Federal Reserve as the US central bank announced results of the annual stress tests. Fed said that all 18 lenders that took part in the tests passed them. This is a huge win for the Deutsche Bank and its CEO, Christian Sewing, as the German lender had a track record or performing poorly or even failing previous tests.