-

European equities plunge on US politics and European lockdowns

-

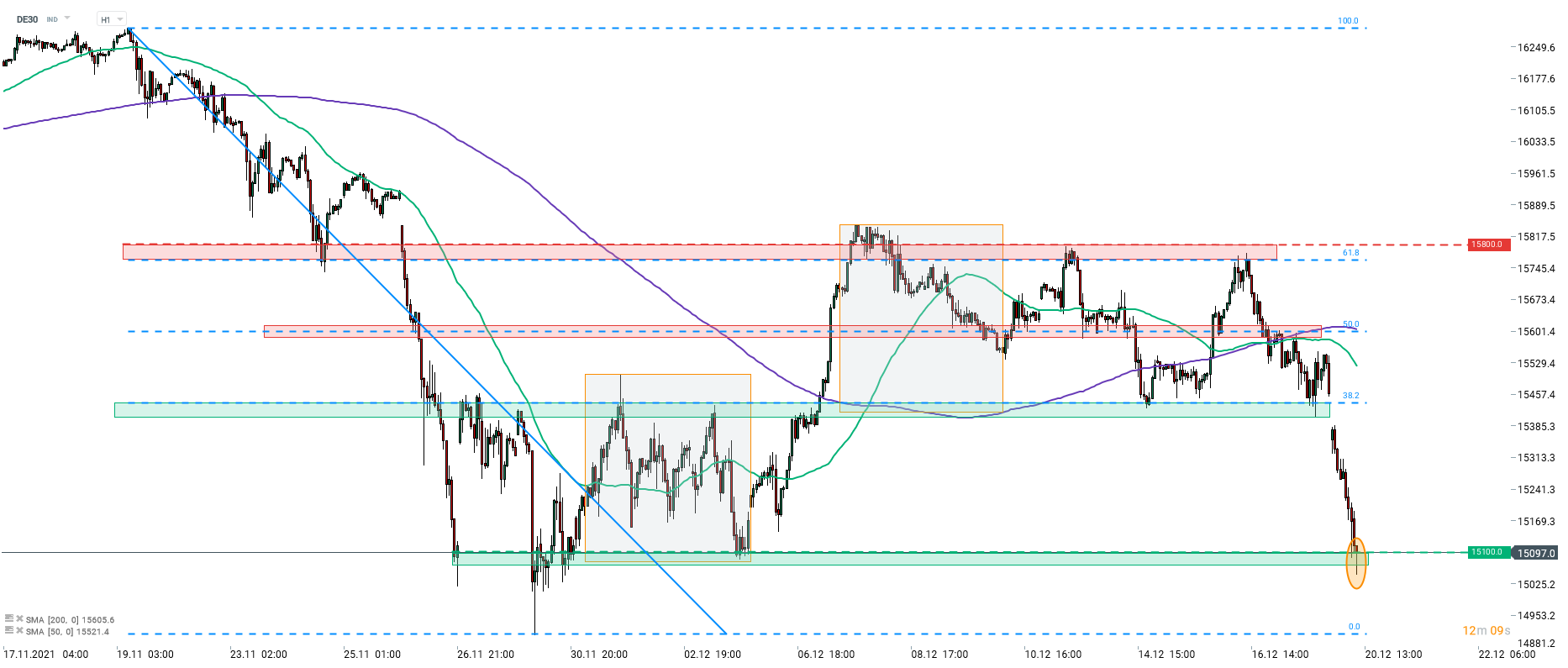

DE30 tests 15,100 pts area

-

Deutsche Telekom may sell radio tower business in Q1 2022

European stock markets are taking a hit on Monday after the Netherlands announced nationwide Christmas lockdown and as passage of the US infrastructure bill gets delayed into 2022. Blue chips indices from the Old Continent are trading over 1% lower today with German, French, Spanish and Italian indices dropping more than 2%.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 launched a new week's trading with a bearish price gap. The German index dipped below the lower limit of the market geometry and recent trading range at the start of today's futures trading and the downward move deepened later on. A range of the downside breakout from a recent 15,430-15,800 pts trading range has been realized as the index reached 15,100 pts area. Downward move lost momentum after reaching this obstacle and it looks like bulls are trying to launch a recovery move. Long, lower wick of the most recent hourly candlestick (orange circle) looks promising. The nearest major resistance zone to watch can be found in the 15,430 pts area.

Company News

Reports saying that Continental (CON.DE) is being pressured by China to stop using parts manufactured in Lithuania are again making rounds in the news. However, this time Reuters also reports that pressure is being felt by other German companies, mainly from the automotive and agricultural businesses. China continues to deny exerting any pressure on international companies. Lithuania and China are in a diplomatic row over Taiwan.

According to the Handelsblatt report, Deutsche Telekom (DTE.DE) may sell its radio tower business as soon as Q1 2022. Deutsche Telekom will allow other telecom companies to submit offers for minority or majority stake in a division that is valued at around €20 billion. According to Handelsblatt, Deutsche Telekom wants the sale to be in progress by the end of the first quarter of 2022.

According to Christian Scherer, Chief Commercial Officer of Airbus (AIR.DE), customers that order single-aisle jets from a popular A320 family have to wait 2 years for a delivery. Company said that the situation is the result of shortages of some of the most important components in the production process.

In spite of reports saying that Deutsche Telekom (DTE.DE) is moving closer to a radio tower business sale, stock is trading lower today. Shares of German telecom company take a dive and are testing an important support zone. The €15.50-15.80 price zone, marked with the lower limit of market geometry, previous price reactions and 38.2% retracement of the post-pandemic recovery, is a key support to watch for now. Source: xStation5

In spite of reports saying that Deutsche Telekom (DTE.DE) is moving closer to a radio tower business sale, stock is trading lower today. Shares of German telecom company take a dive and are testing an important support zone. The €15.50-15.80 price zone, marked with the lower limit of market geometry, previous price reactions and 38.2% retracement of the post-pandemic recovery, is a key support to watch for now. Source: xStation5