Following today's comments from Fed members, specifically dovish remarks from Bowman and Waller, the market has returned to euphoric gains. We are observing a shift away from low-risk assets such as the dollar, which is breaking through successive key levels. Meanwhile, stocks and cryptocurrencies are gaining. The S&P 500 index is very close to this year's highs, Bitcoin has just broken above 38,000 USD, and gold is up 1.35%, reaching 2,040 USD per ounce. The rises are driven by a weakening dollar, and bond yields are also retreating.

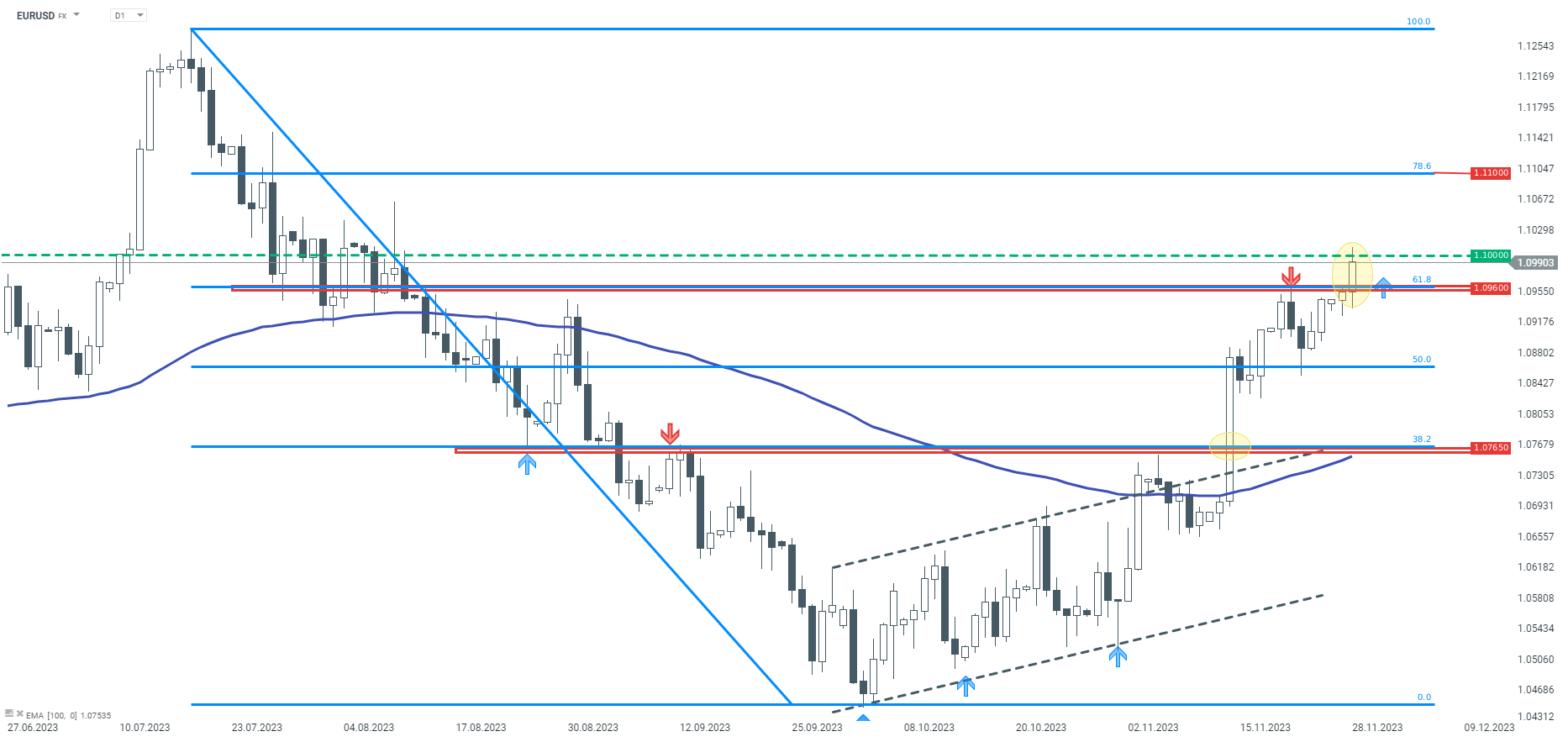

EURUSD quotations have risen above the round level of 1.1000 for the first time since mid-August this year. Looking at the technical situation, bullish sentiment has been prevailing since the beginning of October. The upward movement gained strength on November 14 when CPI inflation data from the USA indicated a faster decline in price growth. The intensity of the upward movement continued, and sellers only appeared at the resistance level of 1.0960, which is derived from measuring 61.8% Fibonacci of the entire last downward wave, counting from the July peak. Breaking through the indicated resistance in today's session may even open the way towards the next Fibonacci retracement - at the level of 1.1100.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)