EURUSD is up slightly ahead of the first ECB decision of the year. Of course, it is almost 100% certain that the bank will decide to keep interest rates unchanged, so attention will be focused primarily on the press conference. Although the market has been pointing all along to April as the first possible date for cuts, opinions are sharply divided on the ECB. Lagarde hinted at a summer deadline during the Davos conference, and many ECB members could opt for a cut in June at the earliest, if inflation starts to fall again.

According to the Bloomberg consensus, June will be the first interest rate cut, of which there will likely be 4 this year. The market, on the other hand, is assessing more aggressive cuts, although the ECB's chief economist indicated that by June the ECB will know all the necessary data to decide whether cuts are needed and how much there will be. The ECB points to several risk factors, such as an overly dovish market attitude, which could limit dis-inflationary processes, rising oil prices and the recent crisis over transportation through the Red Sea.

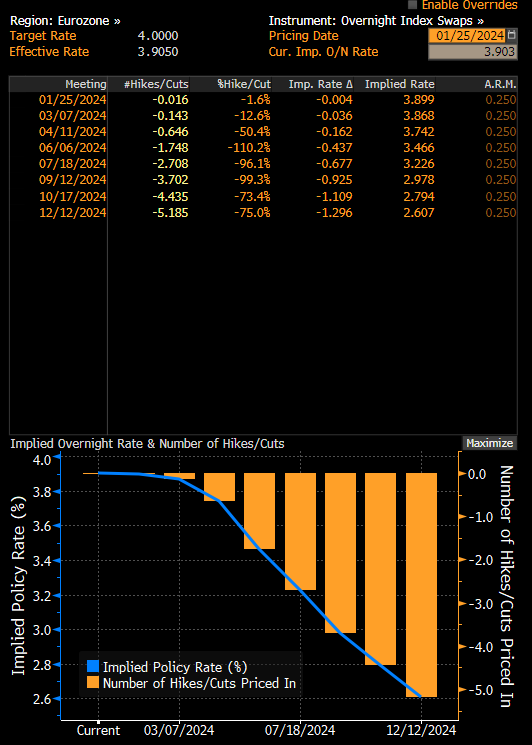

The market is already pricing in only a 50% chance of a rate cut in April. Source: Bloomberg Finance LP

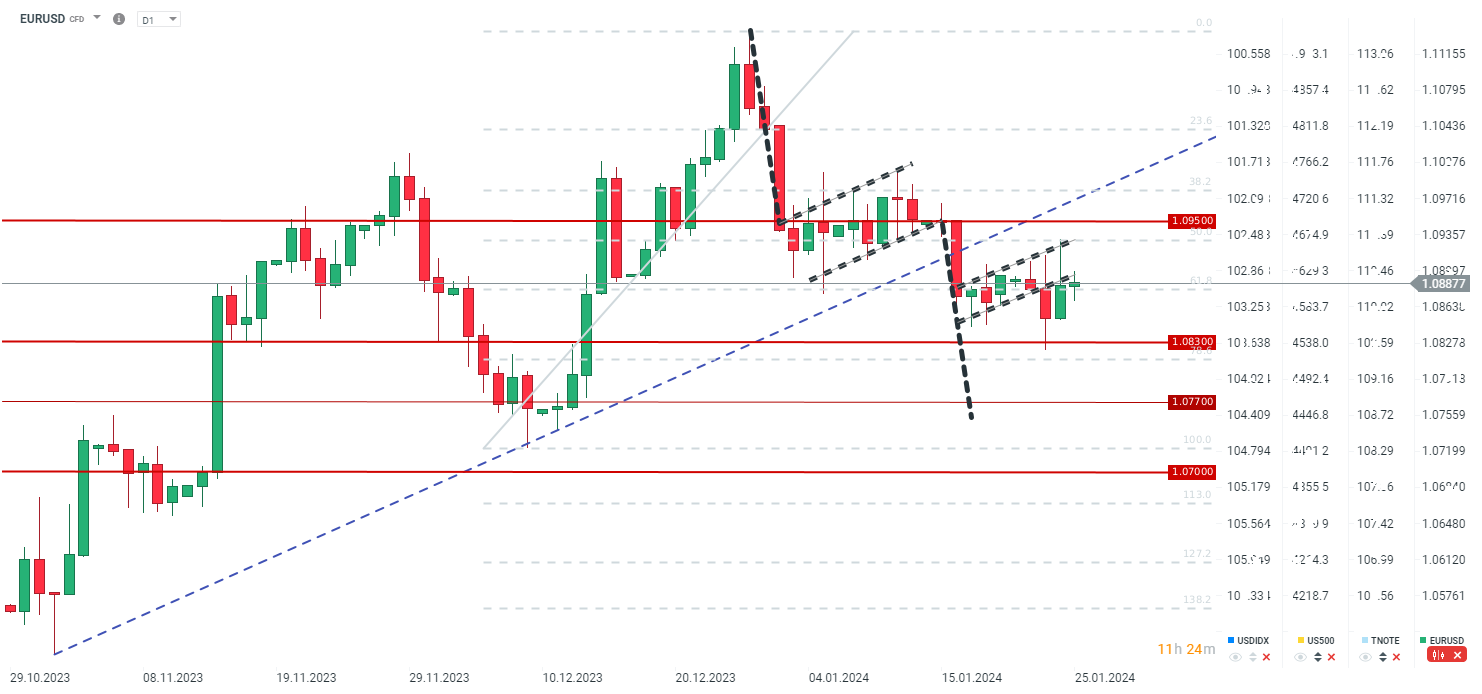

EURUSD is gaining minimally, having halved its rise yesterday. If the EURUSD ends today's session below the 61.8 retracement, downward pressure could follow ahead of next week's Fed decision. However, if the pair rises after the decision due to possible hawkish comments, then there will be renewed pressure to test the area around 1.0920 with possibility of breaking out above 1,10 in the medium term. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)