French inflation slowed more than expected to its lowest level in a year, which is good news for the European Central Bank, which may have less ground for further tightening given the incoming macro data. The next indication in this regard will be the CPI reading from Germany, which will be released at 01:00 pm BST.

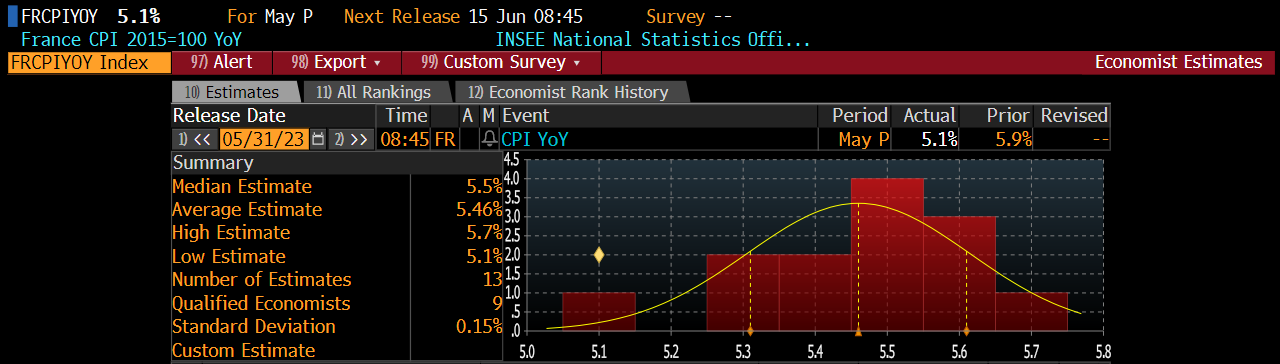

The annual rate of change in consumer prices in the eurozone's second largest economy eased to 5.1% y/y in May from 5.9% in April. Analysts had expected a reading of 5.5%. Source: Bloomberg

The annual rate of change in consumer prices in the eurozone's second largest economy eased to 5.1% y/y in May from 5.9% in April. Analysts had expected a reading of 5.5%. Source: Bloomberg

In the wake of the strong fall in inflation, the EURUSD pair is trading with sizable declines this morning, which, by their extent, broke through important support at the level of yesterday's lows and the EMA 200. D1 interval. Source: xStation5

In the wake of the strong fall in inflation, the EURUSD pair is trading with sizable declines this morning, which, by their extent, broke through important support at the level of yesterday's lows and the EMA 200. D1 interval. Source: xStation5

Economic Calendar: U.S. PCE Reading in the Spotlight!

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)