Statement from the FOMC January meeting turned out to be hawkish. Markets were hoping that the US central bank would pave the way and set expectations for a rate cut at March or May meetings. While reference to additional policy firming was removed from the statement, it was noted that central bankers do not expect it to be appropriate to reduce the target range until there is a greater confidence that inflation is moving sustainably towards the 2 percent goal. Moreover, there was no adjustment to the pace of quantitative tightening, which was expected by some. Summing up, the statement was hawkish because it did not include any kind of dovish twist markets were hoping for.

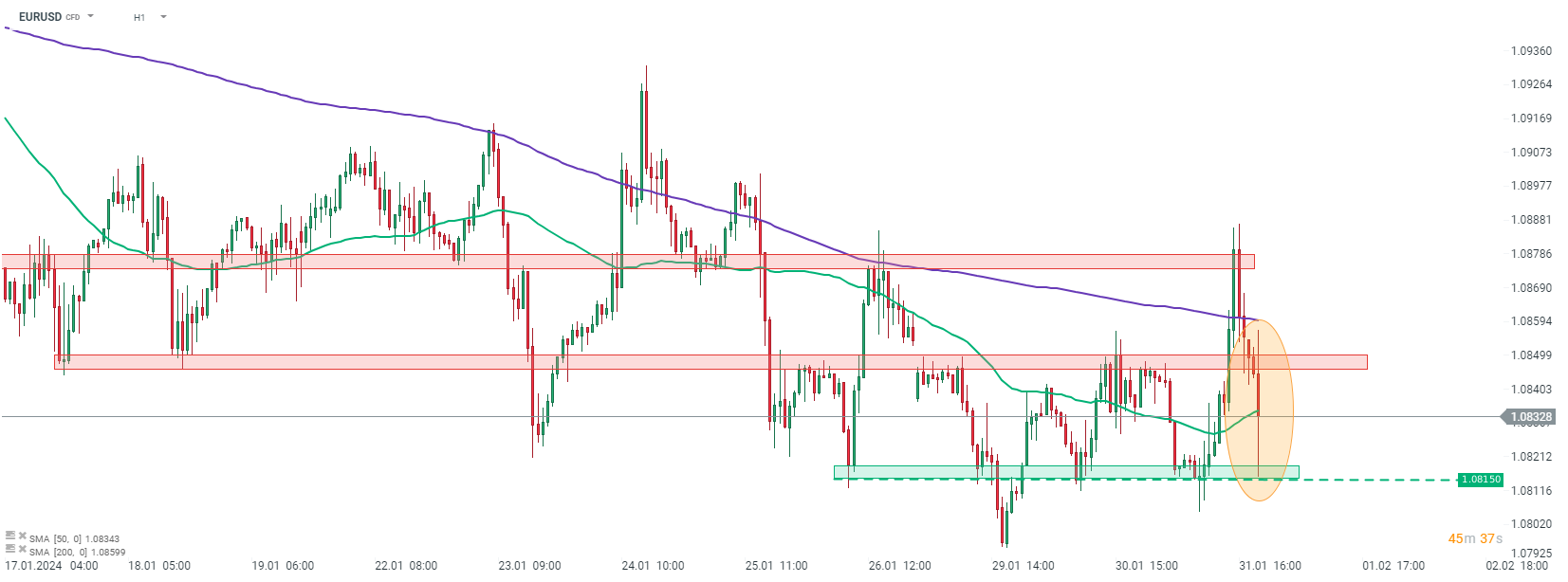

A hawkish reaction can be spotted on the markets, with the US dollar gaining while stocks and gold dropped. Money markets are now almost evenly split over whether the first Fed rate cut will be delivered at March or May meeting. Prior to FOMC decision, odds for a March cut stood at around 70%. EURUSD is trading around 0.2% lower compared to pre-release levels. The 1.0815 support zone was tested in a knee-jerk move but bears failed to push the pair below it.

Source: xStation5

Source: xStation5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙