A very busy day lies ahead for the EURUSD pair. At 14:15, the European Central Bank (ECB) will publish its decision on interest rates, followed by the November CPI release at 14:30. EURUSD is down slightly above 0.10%, but volatility remains relatively contained ahead of these key publications. Today’s ECB decision and CPI data may set the tone for EURUSD into the end of the year.

ECB: A “hawkish pause” or incoming disinflation?

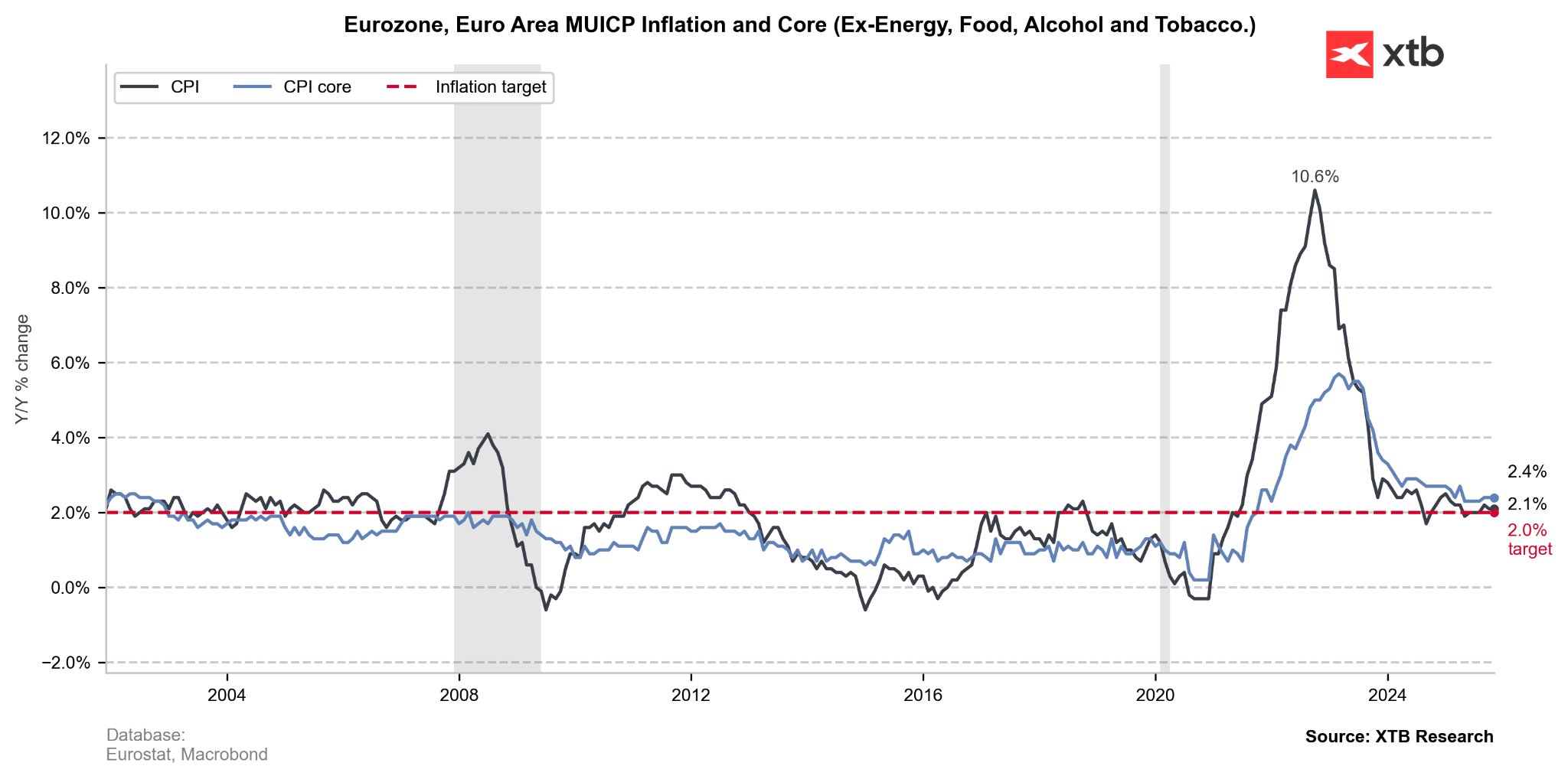

Markets fully price in a pause at today’s ECB meeting. Policy will remain unchanged for the fourth consecutive time. The deposit rate is expected to stay at 2.0%. ECB economists have been signalling for weeks that there is no urgency to adjust policy despite a softer inflation trajectory.

Medium-term projections, which will also be released today, will be crucial. Consensus expects the forecasts to show inflation below the 2% target in 2026–27, which theoretically could justify further easing next year.

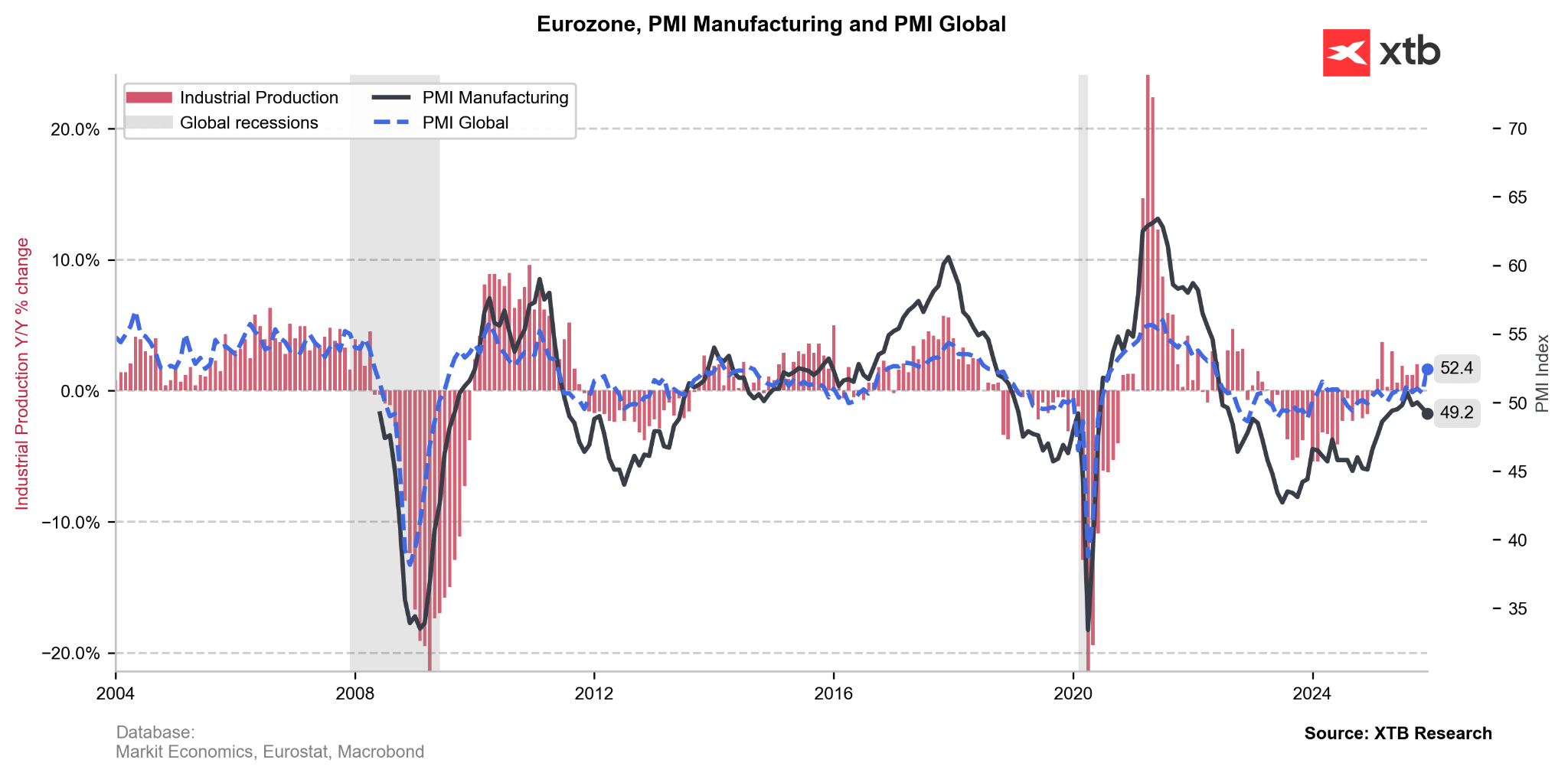

On the other hand, Lagarde will likely emphasize the euro-area economy’s resilience, even though recent PMI data showed a clear weakening of monetary conditions. At the same time, massive fiscal spending planned for 2026 (including Germany’s record bond issuance) may provide a short-term inflationary boost.

The ECB will likely stress that services inflation remains too high to discuss easing in the near term. However, markets will pay close attention to how Lagarde frames the medium-term disinflation embedded in the projections. Any suggestion that the forecast path sits clearly below target could subtly open the door to rate-cut discussions in 2026 — even if Lagarde avoids saying so explicitly.

Overall, the ECB is expected to deliver a neutral message — no cut, no hawkish rhetoric, and no strong forward guidance. But the balance of risks is increasingly tilting toward weaker growth in the eurozone next year. Interestingly, this contrasts with recent comments from Isabel Schnabel, who suggested the ECB’s next move could be a hike.

Has US CPI reached its peak?

While the ECB will set the tone for the European session and the euro, the US CPI release shortly after is likely to determine how global markets — and the dollar — finish the day. The November CPI report will be the first since the government reopened after a record 43-day shutdown, and the lack of October data means the BLS will not publish standard month-on-month changes for November. As a result, investors must rely on year-on-year readings and two-month averages, making this report unusually difficult to interpret.

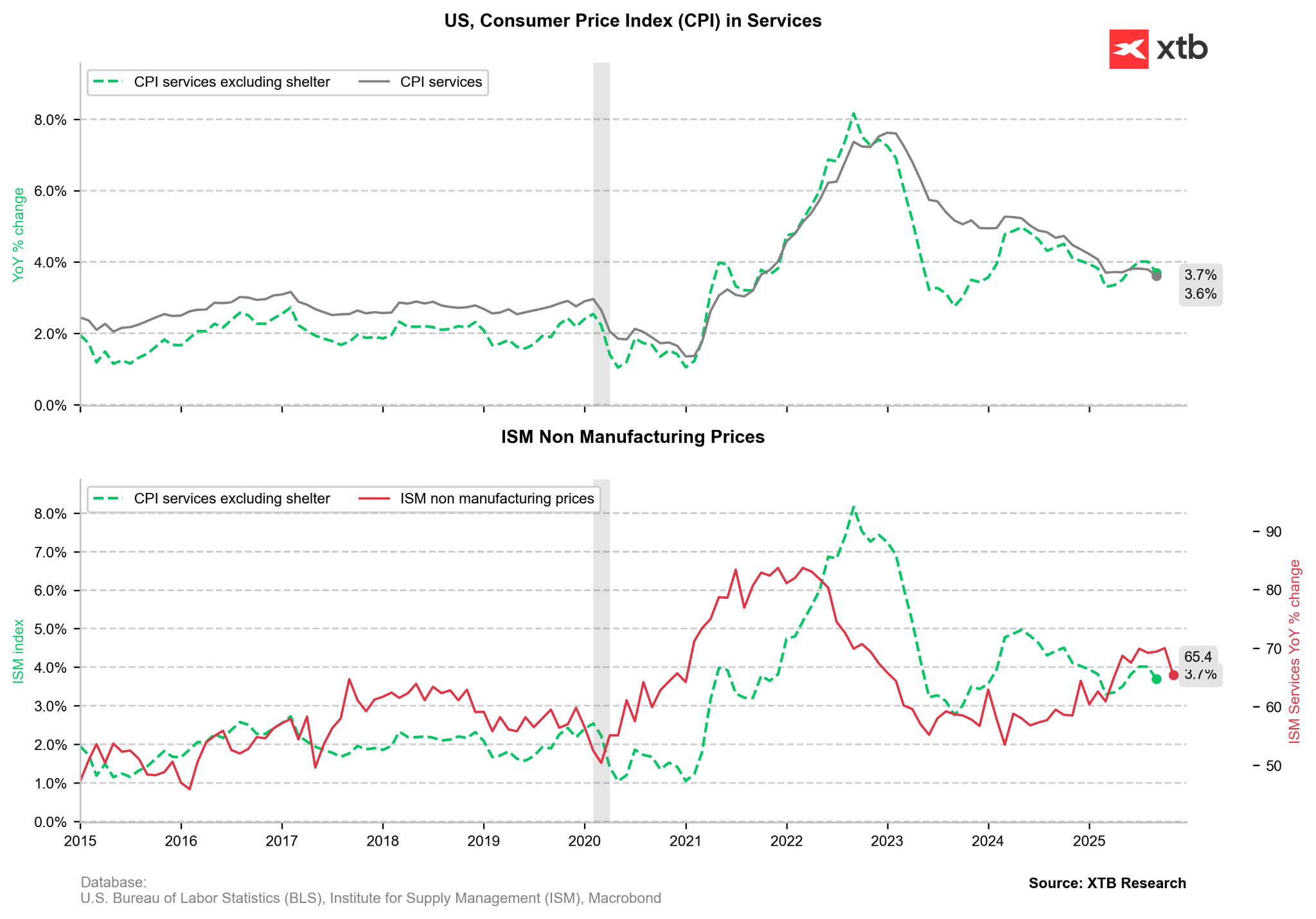

Consensus expects headline inflation to rise to around 3.1% y/y, while core inflation should remain close to 3%. These readings may suggest continued tariff pass-through pressures on goods such as electronics, appliances, and recreational equipment. However, this pressure is partly offset by aggressive holiday discounting, which may make core goods prices look artificially soft in November. Still, Powell recently suggested that tariff-related price impacts are likely fading, paving the way for lower inflation next year.

Services inflation — particularly “supercore” (services excluding shelter) — is expected to continue cooling, consistent with softer labour-market indicators and slowing wage growth.

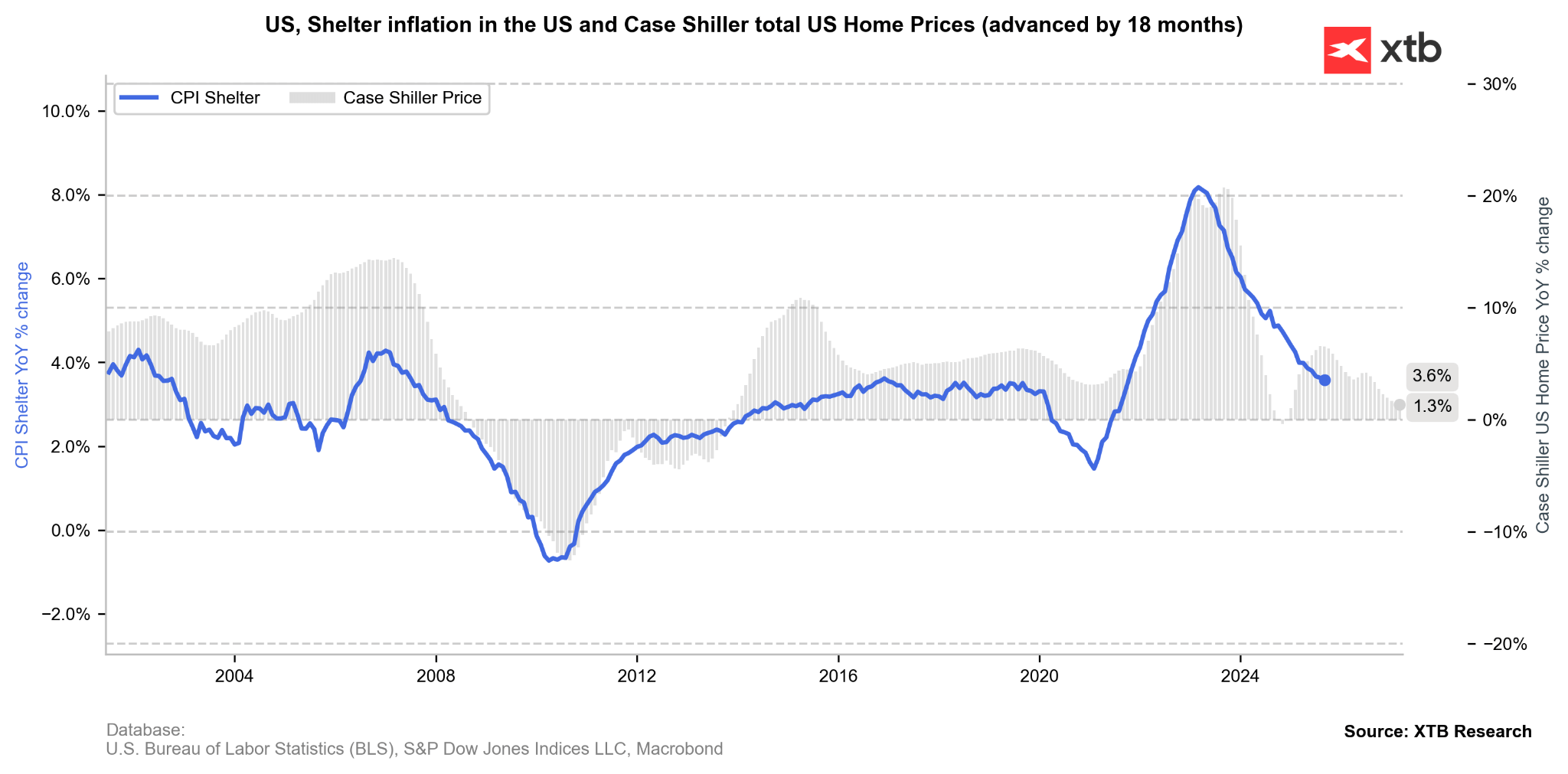

Shelter inflation, although still elevated by historical standards, has been gradually decelerating and remains aligned with the Fed’s disinflation narrative.

A CPI report in line with expectations would strengthen the message that tariff-driven inflation is indeed a temporary phenomenon. In such a scenario, market debate will revolve less around whether the Fed cuts rates again, and more around how aggressively it may ease in 2026. Markets currently price two cuts in 2026, even though the Fed’s own projections indicate one. Bloomberg Economics expects as many as four cuts, mainly due to labour-market weakness.

On the other hand, a higher-than-expected CPI reading — particularly one that clearly pushes core inflation above 3% — would revive doubts about the disinflation trend and could delay expectations for further easing. However, this is not viewed as the base-case scenario.

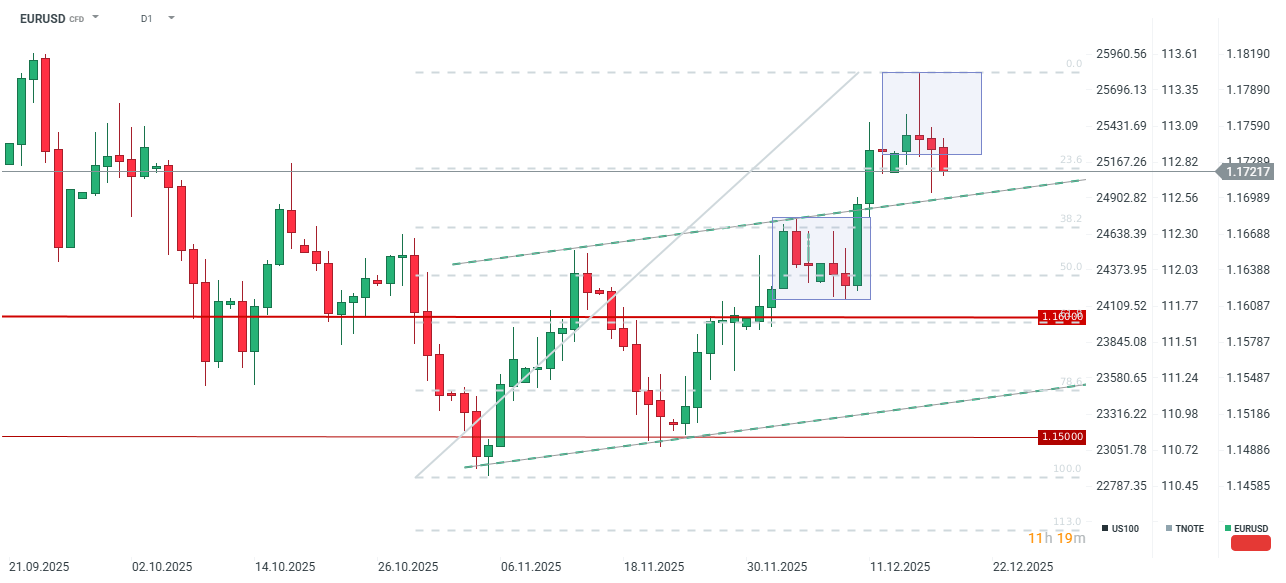

EURUSD (D1 time frame)

EURUSD is falling for the third consecutive day, though the prior two sessions sent mixed signals. The daily candle from December 16 showed strong supply below 1.18, generating a clear bearish signal (shooting star). Conversely, yesterday’s candle indicates demand above 1.17 (hammer formation). A dovish ECB could deepen today’s declines and lead to a test of 1.17. However, the move may prove temporary unless CPI surprises to the upside. Only a very hawkish US inflation print could trigger a sustained decline in EURUSD. A strongly hawkish message from Lagarde appears unlikely, but if it were to occur, EURUSD could move toward 1.1750.

Nonetheless, the base-case scenario currently assumes further downside, followed by a mild rebound and then moderate gains later in December. It is also worth noting that next week brings the US GDP release.

Economic Calendar - All Eyes on NFP (06.03.2026)

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories