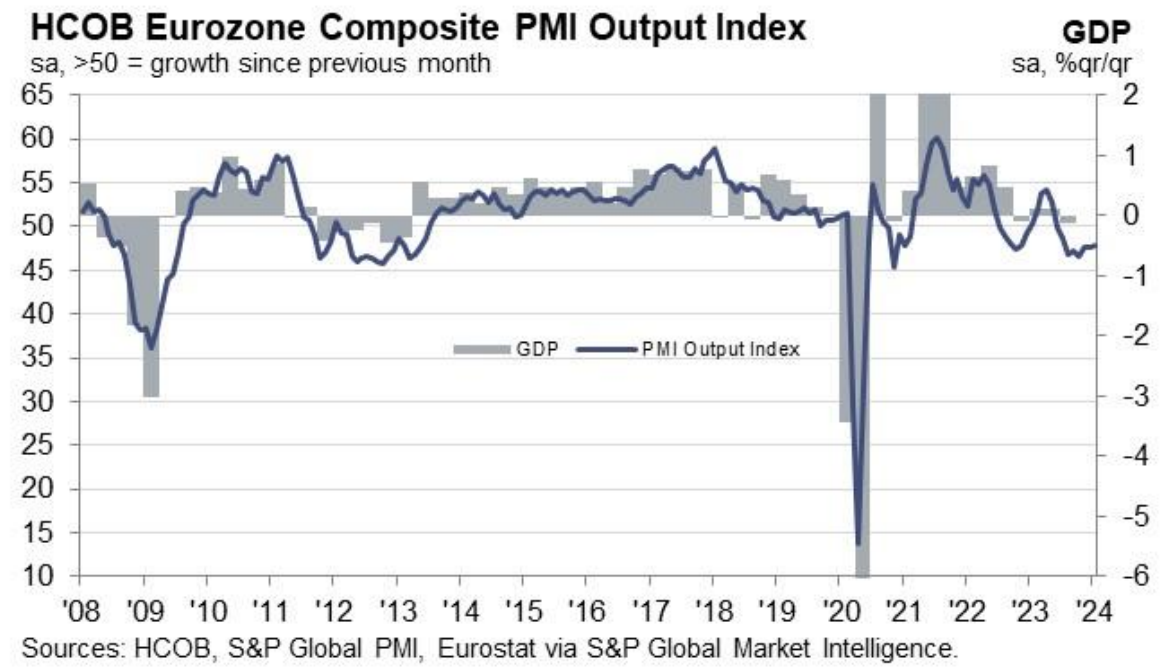

Flash PMIs readings surprised, with values higher for industry and worse for the services sector. The commentary on the reports indicates that France is likely to stagnate in the first quarter of 2024, but the risks of this scenario are directed downwards. On the other hand, the data for Germany point to continued recession. The ECB is currently in a very challenging position, as on the one hand it is struggling with weakening economic momentum and on the other hand the spectrum of possible interest rate cuts is reduced by rising wages.

Eurozone Flash PMIs (Jan):

Manufacturing: 46.6 vs. Exp. 44.7(Prev 44.4)

Services: 48.4 vs. Exp. 49.0 (Prev 48.8)

Composite: 47.9 vs. Exp. 48.0 (Prev 47.6)

German Flash PMIs (Jan)

Manufacturing: 45.4 vs. Exp. 43.7 (Prev. 43.3)

Services: 47.6 vs. Exp. 49.5 (Prev. 49.3)

Composite: 47.1 vs. Exp. 47.8 (Prev. 47.4)

French Flash PMIs (Jan):

Manufacturing: 43.2 vs. Exp. 42.5 (Prev. 42.1)

Services: 45.0 vs. Exp. 46.0 (Prev. 45.7)

Composite: 44.2 vs. Exp. 45.2 (Prev. 44.8)

Source: S&P Global

Source: S&P Global

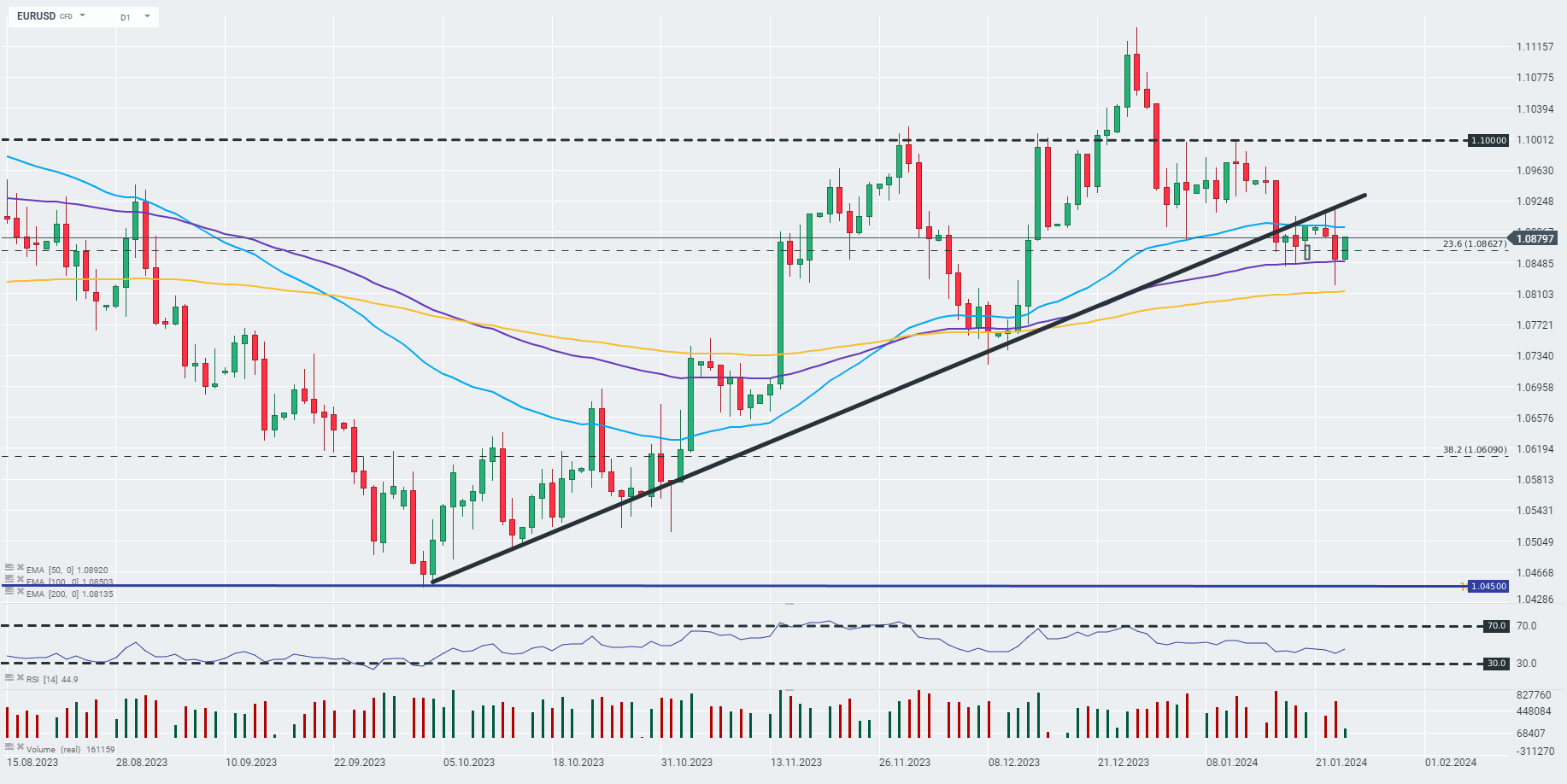

The EURUSD pair recorded declines after the German data readings, but this movement has now been negated after the Eurozone data and the pair is now trading higher. Source: xStation

The EURUSD pair recorded declines after the German data readings, but this movement has now been negated after the Eurozone data and the pair is now trading higher. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉