The US dollar is slumping and equity markets rally following today's Fed decision and, more importantly, Powell's press conference. Powell noted that disinflationary process has begun and while he stressed that it is too early to declare victory over inflation, markets quickly jumped to conclusions - less rate hike going forward. Money markets are now pricing in a Fed peak rate below 4.90% and end-2023 rate at 4.4% - indicating rate cuts. US100 gains over 2% while EURUSD is closing in on 1.10 mark.

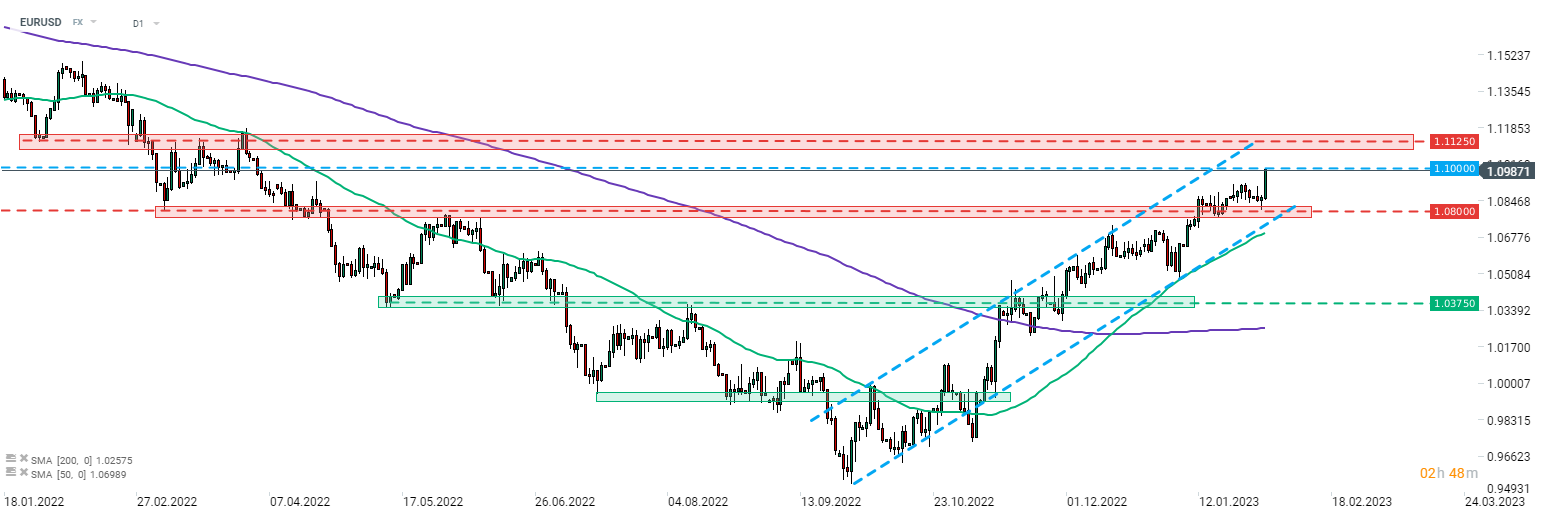

EURUSD climbs to the highest level since April 2022 and is closing in on a 1.10 mark. The pair trades with an upward channel since September 2022. Source: xStation5

US100 trades at the highest level since September and breaks above 12,400 pts mark. Index climbed over 15% off a local low from January 6, 2023. Source: xStation5

US100 trades at the highest level since September and breaks above 12,400 pts mark. Index climbed over 15% off a local low from January 6, 2023. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!