Mary Daly was interviewed on CNBC today and her statement matched the tone of recent speeches from Fed bankers. At the same time, her statement was slightly less hawkish than that from a few days ago and does not point to two guaranteed rate hikes:

- She said that pointing at 2 hikes was a way to keep optionality open

- Lower inflation is a good news

- Lags in monetary policy are 12-24 months

- The cumulative effects of monetary tightening will work their way through the system

- The Fed will continue to work on rate hikes until inflation is on the path to come back down toward 2%

- There is a risk that we over-tighten and a risk that we under-tighten. That is why we are data dependent

- I have more optionality. Fed should not be declarative

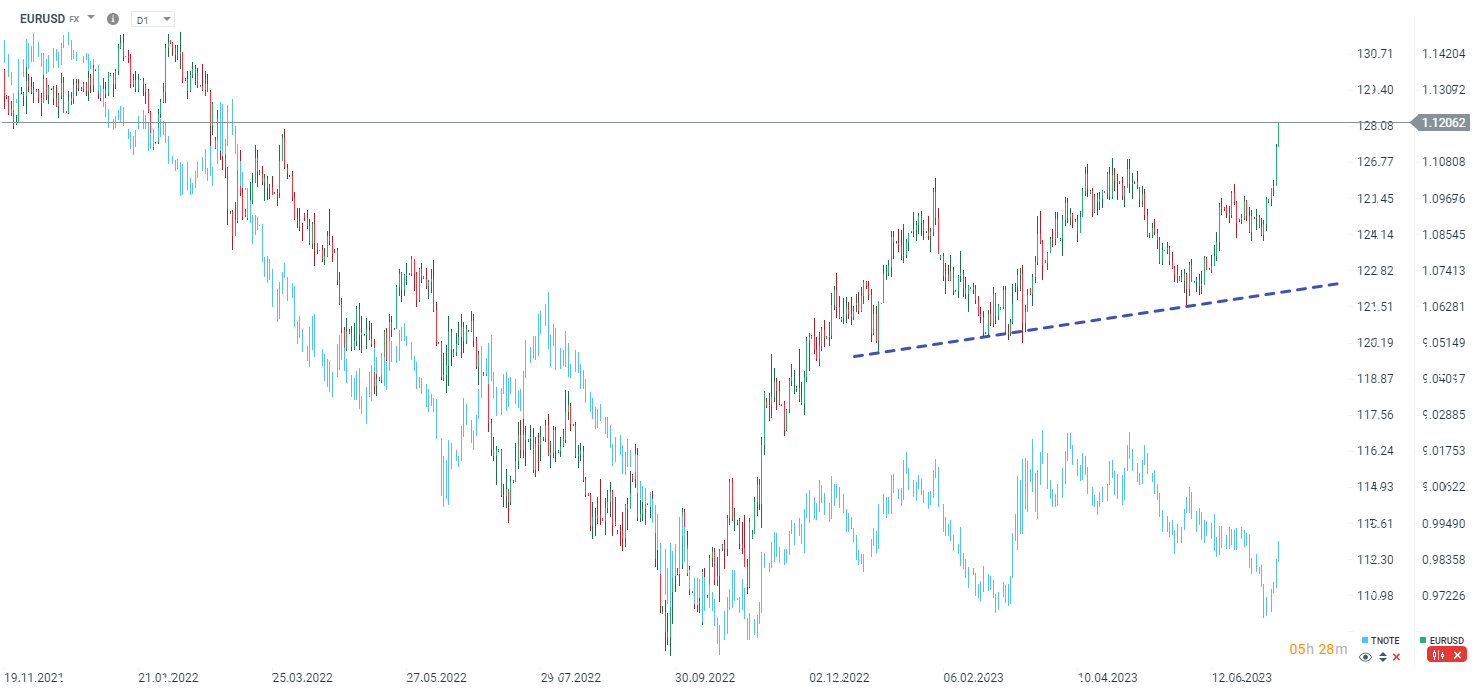

EURUSD is the highest since March 2022. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)