The latest news from Asia Markets indicates that we can expect some kind of aid to Evergrande. However, this is actually a state takeover of the company. Evergrande is to be restructured into 3 different companies, and an agreement with the Chinese Communist Party (CCP) is expected to be announced in the coming days.

The source indicates that the deal aims to protect both Chinese citizens who have purchased apartments from Evergrande and investors who have invested in various types of investment products managed by the company.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe key day for the company is Thursday when the interest payment of USD 83.5 million on 5-year bonds denominated in dollars is to be made. The value of the bonds is estimated at USD 2 billion. According to the current regulations, if the payment or restructuring is not made on time, the company will be considered bankrupt only after 30 days.

This is not the end, however. Tomorrow, a coupon worth USD 35.8 million is also to be paid out on a bond listed in Shenzhen, maturing in September 2025. The subsidiary Hengda Real Estate announced earlier that the coupon would be paid back, but no one commented on the dollar-denominated bonds.

Unfortunately, this is still not the end. The company has yet to pay interest on its 7-year dollar-denominated bonds within a week.

It is expected that the holders of the company's shares and the holders of dollar-denominated bonds will be severely affected by the agreement with the Chinese authorities.

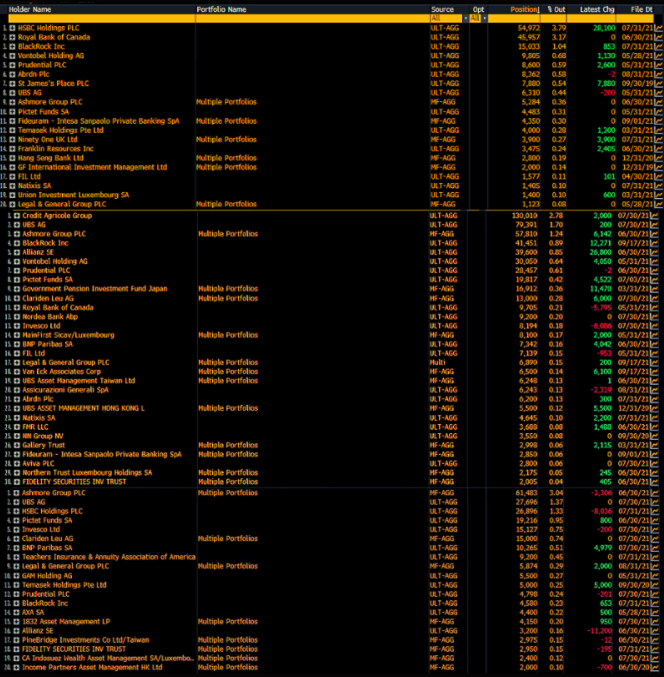

Who is the biggest holder of dollar-denominated debt? Here we see big names such as BlackRock, RBC, HSBC, Prudential, UBS, Credit Agricole and Nordea. Source: Bloomberg, AsiaMarkets