- The Fed sees weaker demand, low oil prices - factors that will keep inflation low

- Economic activity and employment continue to reboun

Overall, there are no major changes compared to the previous release. The FED is again addressing the risks associated with the coronavirus and its readiness to take further action if needed. We observe slight volatility on the dollar.

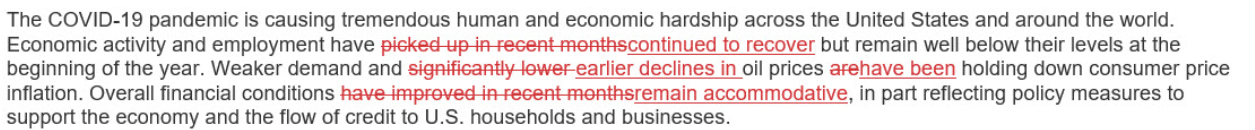

The only changes are seen in the second paragraph of the Fed statement. As one can see the changes are very minor ... Source: Fed, Twitter @zerohedge

The only changes are seen in the second paragraph of the Fed statement. As one can see the changes are very minor ... Source: Fed, Twitter @zerohedge EURUSD fell to the 38.2 retracement for a moment, but it started to rebound quite quickly. Source: xStation5

EURUSD fell to the 38.2 retracement for a moment, but it started to rebound quite quickly. Source: xStation5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙