FedEx (FDX.US) stock rose over 4.0% on Wednesday despite mixed quarterly figures. Company which is considered as one of the economy bellwethers plans to improve profitability and greatly reduce costs.

-

Company earned $3.18 per share, which topped market expectations of $2.81 per share.

-

Revenue plunged by 4% year-over-year to $22.8 billion, below analysts’ projections of $23.74 billion.

FedEx key quarterly figures. Source: Alpha Street

-

Investors welcomed another round of “aggressive” cost-cutting measures which includes parking planes, closing offices, stopping rural Sunday delivery, and layoffs in freight division. Company raised package-delivery rates and expects to cut another $1 billion beyond what it forecast in September.

-

“Our teams have an unwavering focus on rapidly implementing cost savings to improve profitability,” CFO Mike Lenz said in an earnings release. “As we look to the second half of our fiscal year, we are accelerating our progress on cost actions, helping to offset continued global volume softness.”

-

The company also said it sees financial year 2023 earnings of $13.00 to $14.00 per share, slightly below analysts’ estimates of $14.08 per share.

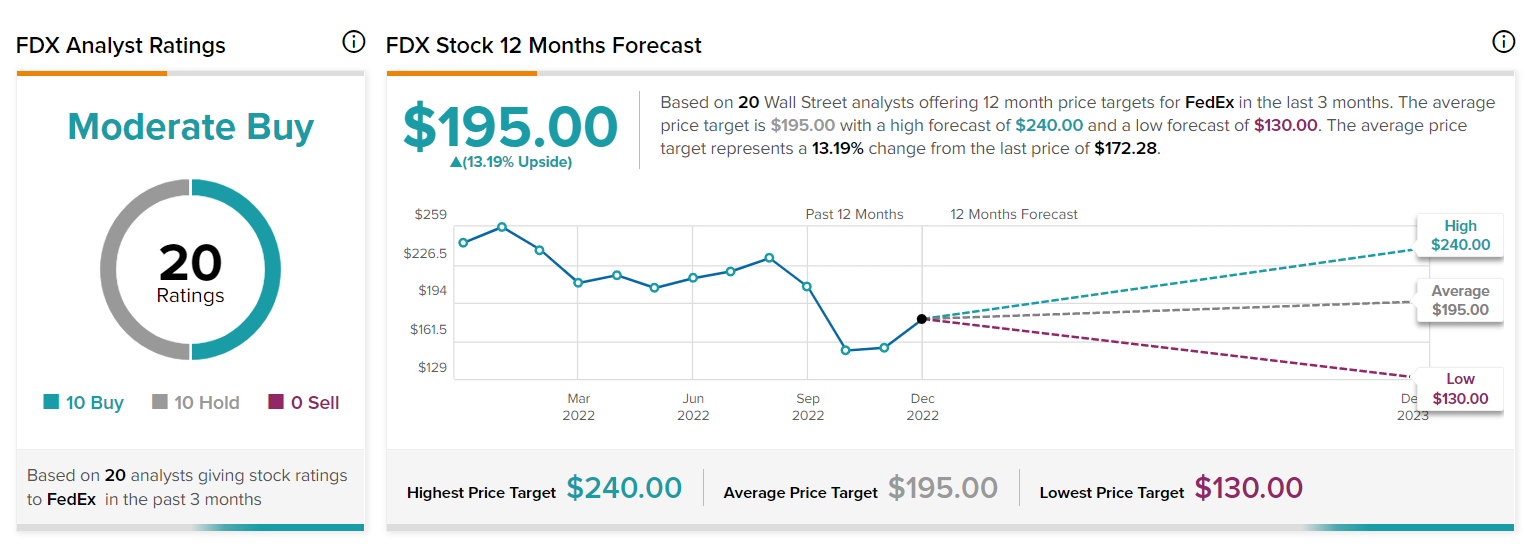

FedEx has a price target of $195.00 based on 20 analysts ratings, which implies over 13.00% upside potential. Source: Tipranks

FedEx has a price target of $195.00 based on 20 analysts ratings, which implies over 13.00% upside potential. Source: Tipranks

FedEx (FDX.US) stock launched today's session with a bullish price gap, however buyers are unable to reach major resistance at $176.20, which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. If sellers manage to regain control, the lower limit of the local ascending channel may act as nearest support. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street