Major Wall Street indices erased some of the early losses as investors monitor developments regarding Russian attack on Ukraine, including impact of fresh sanctions and negotiations between both sides. RIA, citing a Ukrainian official, said after four hours Russia and Ukraine have concluded their peace discussions and will return to their respective capitals for further consultations before the second round of talks. Considering the fairly long duration of the talks and the fact that a second round of negotiations will take place, suggests that there is at least a bit of common ground.

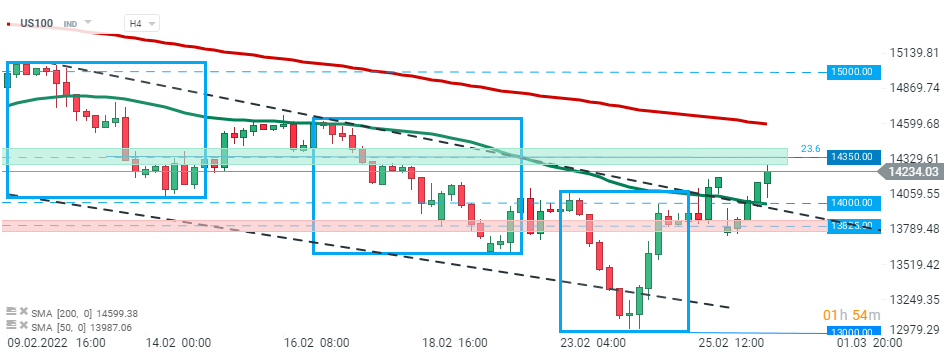

US100 cut early losses and broke above major resistance at 14000 pts. If current sentiment prevails, next resistance at 14350 pts may be at risk. Source: xStation5

US100 cut early losses and broke above major resistance at 14000 pts. If current sentiment prevails, next resistance at 14350 pts may be at risk. Source: xStation5

Besides stocks, major cryptocurrencies also moved higher today. Bitcoin managed to break above psychological resistance at $40,000, which raised concerns that the Russian government and oligarchs may use cryptocurrencies to try and evade sanctions. For this reason Mykhailo Fedorov, Ukraine’s deputy president, called on exchanges to block Russian and Belarusian users’ funds. On the other hand, higher demand may be the result of Russian people using Bitcoin as an alternative method of payment as the local currency has devalued considerably, and several sanctions are making it impossible to use FX alternatives. Also the Ukrainian side is using cryptocurrencies for their cause. On Saturday Ukraine’s government issued an appeal on Twitter for cryptocurrency donations to support the country’s armed forces following Russia’s invasion. So far the community raised more than $20m worth of crypto.

Bitcoin price moved sharply higher and broke above major resistance at $40,000. Next target for bulls is located at $41500 and is marked with previous price reactions and downward trendline. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street