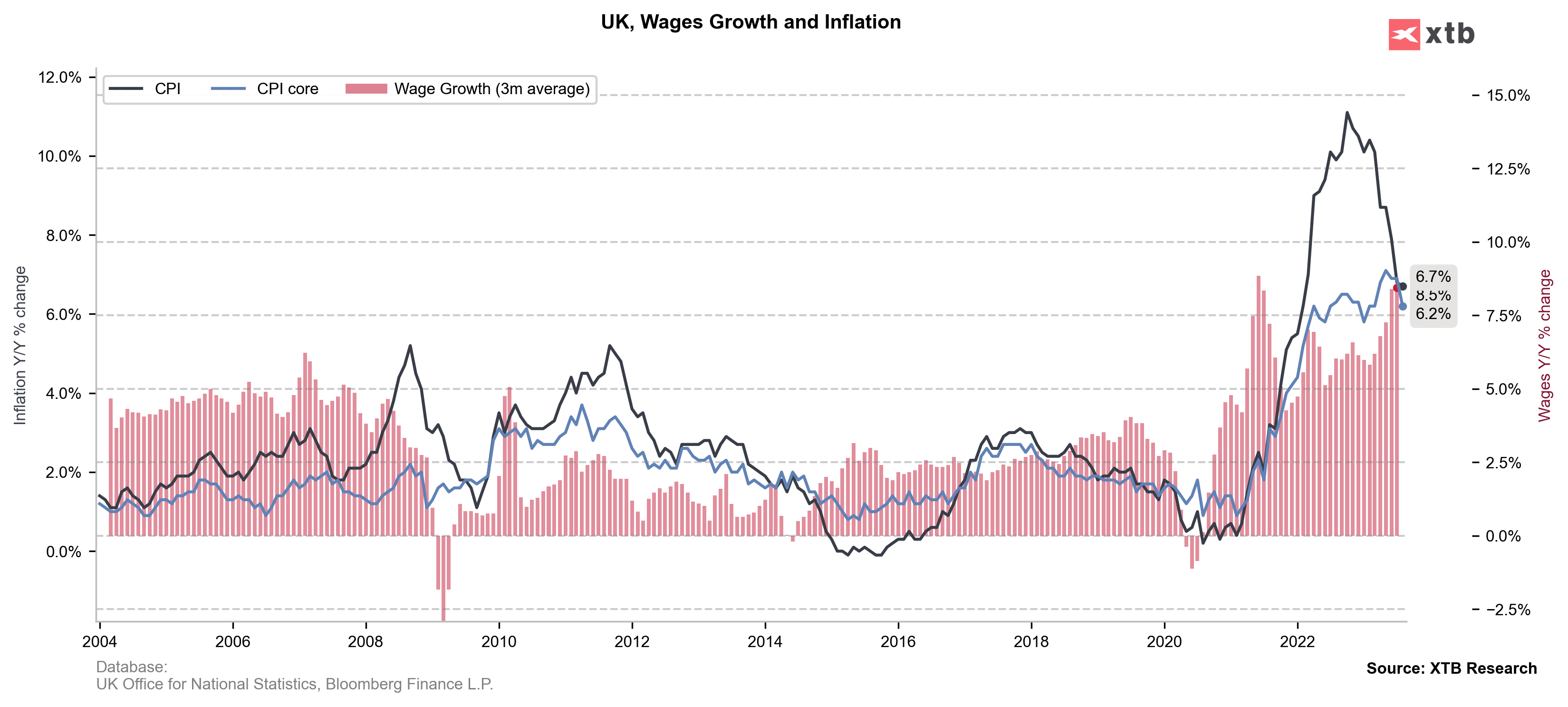

GBP has been under significant pressure this morning after 7:00 am BST. UK CPI report showed headline price growth decelerating from 6.8 to 6.7% YoY in August (exp. 7.0% YoY) while core gauge dropped from 6.9% to 6.2% YoY (exp. 6.8% YoY). A significant drop in core inflation means that the latest pick-up in wage growth did not have much of an impact on inflation in the United Kingdom. This, in turn, has triggered a drop in rate hike bets for the upcoming BoE meeting.

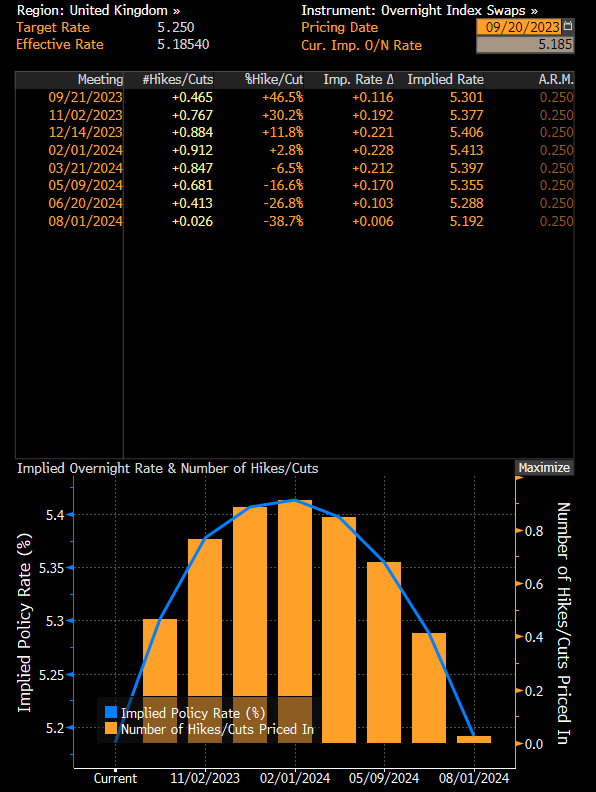

Goldman Sachs says that it looks rather unlikely that the Bank of England will hike rates at a meeting tomorrow. Money market bets for a rate hike have dropped to below 50% following today's data release from around 70% beforehand. Nevertheless, money markets price in one more rate hike before the end of this year.

Money markets expect one more rate hike this year but not tomorrow. Source: Bloomberg Finance LP

UK CPI inflation and wage growth. Source: Bloomberg Finance LP

It should be noted that the market is still almost 100% certain that one more 25 basis point rate hike will be delivered before year's end. Moreover, USD is pulling back ahead of today's FOMC decision, which has helped to almost fully erase GBPUSD drop from earlier today. On the other hand, the pair is trading in a clear downtrend and the 50-hour moving average is being tested at press time.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)