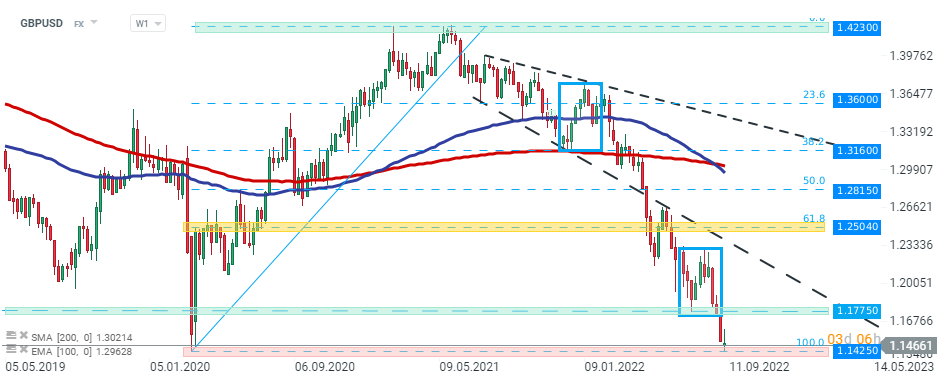

GBPUSD fell during today's session to the lowest level since March 2020 amid worsening UK macroeconomic outlook, surging inflation and soaring energy prices. Also hawkish remarks from several Fed members support the US dollar. Today Fed Mester said it is far too soon to conclude that inflation has peaked while wage pressures show little sign of abating. Therefore, in her opinion, the US central bank needs to raise rates to 'somewhat above 4%' by early next year, then hold it there. On the flip side, political uncertainty in the UK eased a bit, after new prime minister Liz Truss took over the office. Tomorrow the new government is expected to unveil an energy rescue plan, with measures worth £200 billion which aims to freeze energy bills in the UK. From a technical point of view, GBPUSD bounced off the key support at 1.1425, where pandemic lows are located. As long as the pair sits above, upward correction may be launched towards local resistance at 1.1775.

GBPUSD, W1 interval. Source: xStation5

Three markets to watch next week (27.02.2026)

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨

Chart of the Day: EURUSD in Consolidation Ahead of Macro Data from Europe and the US

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)