In recent days GBPUSD moved further away from six-month high of $1.2355 reached earlier this month as recession fears sparked demand for safe haven assets including US dollar. Also the outlook for the sterling remains clouded by fears of a domestic recession. BOE Governor Andrew Bailey has been warning markets that tightening expectations is overdone with the UK toppling into a two-year recession. Nevertheless today we can observe some dollar weakness which enables the GBPUSD pair to bounce off the local support at 1.2150. Nevertheless, the main sentiment remains bearish, therefore a move towards 1.20 level or even key support 1.1865 cannot be ruled out.

GBPUSD, H4 interval. Source: xStation5

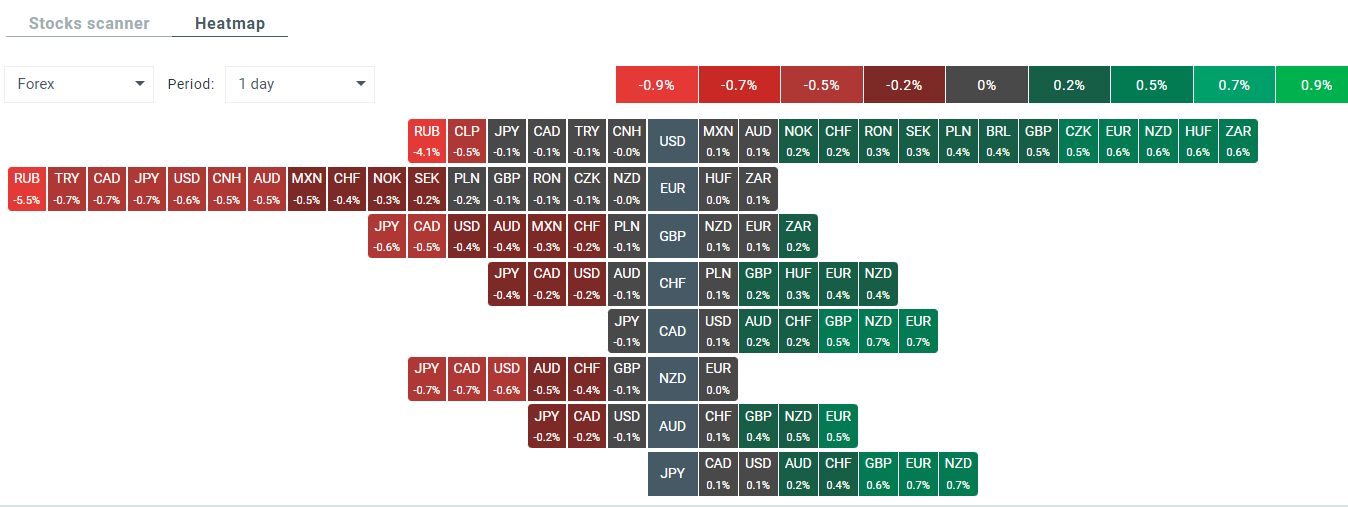

USD weakened slightly on Wednesday. Source: xStation5

USDIDX struggles to break above key resistance at 105.30 which is marked with previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the upward wave launched in May 2021. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals