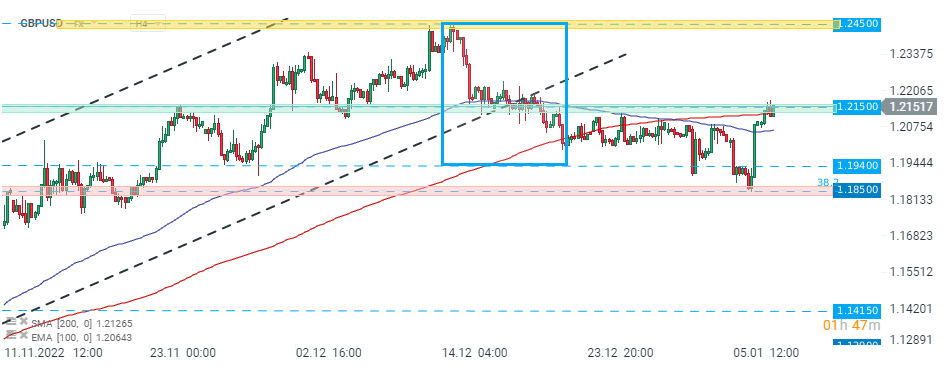

The pound sterling ended 2022 almost 11% lower, which was the worst performance since 2016, when Brits decided to leave the EU. However GBPUSD rose sharply on Friday after a fresh NFP report raised hopes the Fed will deliver smaller rate increases, which weighed on the greenback. On the other hand Fed members persistently reassure that higher interest rates will stay for longer, while the BoE pointed that its tightening process could soon end as inflation may have reached its peak, while the UK economy will most likely face recession in 2023. Further, higher temperatures in Europe pushed UK natural gas contracts to the lowest level since mid-2022, significantly easing inflation expectations. From a technical point of view, GBPUSD pair jumped to major resistance at 1.2150, which is marked with previous price reactions. If buyers manage to uphold recent momentum, upward move may accelerate towards December 2022 highs at 1.2450. On the other hand, if sellers regain control, then another downward impulse towards key support at 1.1850 may be launched. This level is marked with 38.2% Fibonacci retracement of the downward wave started in May 2021.

GBPUSD, H4 interval. Source: xStation5

GBPUSD, H4 interval. Source: xStation5

Prior to the start of the Wall Street session, the US dollar is the worst performing currency among the majors. Source: xStation5

USDIDX - the dollar index pulled back sharply last week and broke below major support at 103.40, which managed to fend off the bears several times in the past. If selling pressure intensifies and break below next support at 102.30 occurs, then declines may deepen further towards the psychological 100.00 mark.. Also medium-term 50-day SMA (green line) attempts to cross under the log-term 200-day SMA (red line). This could form a bearish ‘death cross’ which can at times precede a sharp turn lower. Source: xStation5

USDIDX - the dollar index pulled back sharply last week and broke below major support at 103.40, which managed to fend off the bears several times in the past. If selling pressure intensifies and break below next support at 102.30 occurs, then declines may deepen further towards the psychological 100.00 mark.. Also medium-term 50-day SMA (green line) attempts to cross under the log-term 200-day SMA (red line). This could form a bearish ‘death cross’ which can at times precede a sharp turn lower. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)