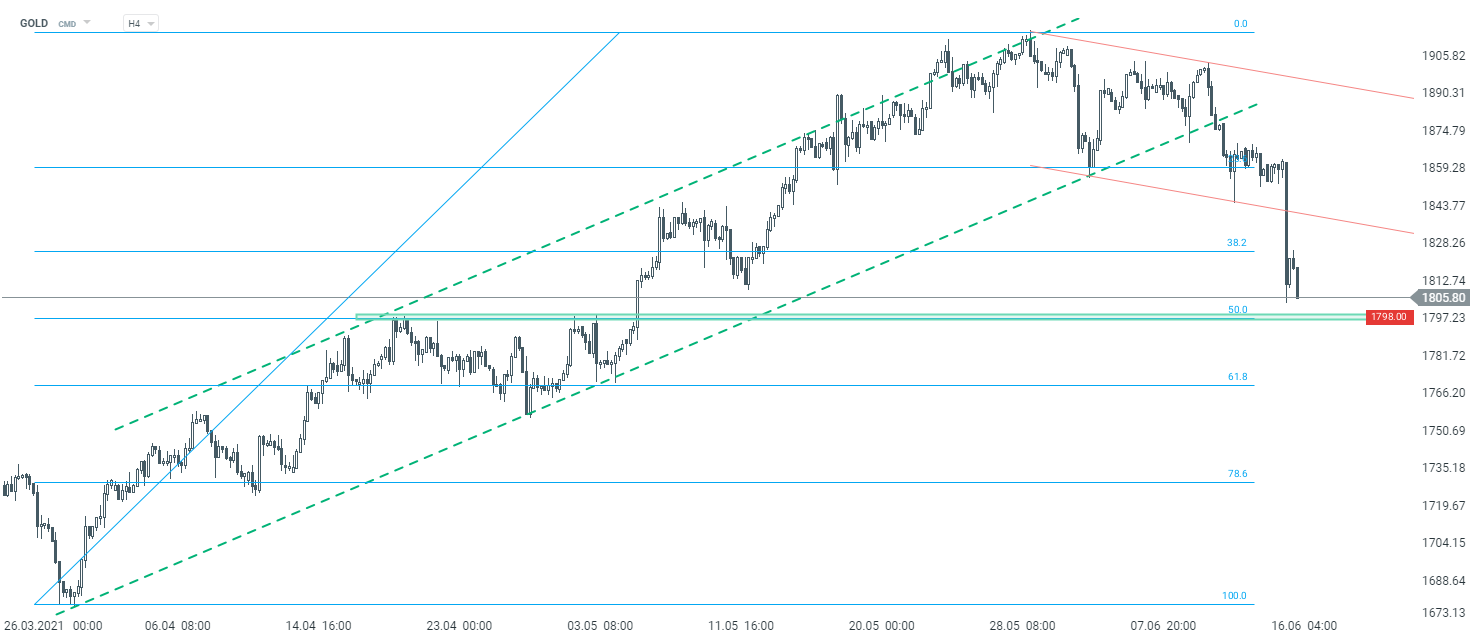

Yesterday's policy announcement from the FOMC hinted at a faster than previously assumed beginning of monetary tightening in the United States. Famous dot chart pointed to 2 rate hikes in 2023. While this is still a distant future, assets benefiting from the low interest rate environment took a hit. Gold was one of the most heavily impacted assets, dropping around 2% yesterday. While the beginning of today's trading seemed like bulls may be attempting to regain control over the market, precious metal erased gains and resumed decline. Gold reached the lowest level since the beginning of May and is trading just a touch above the $1,800 support area, marked with the 50% retracement of the upward move launched at the beginning of Q2 2021.

Gold erased morning gains and moved towards yesterday's lows at around $1,805. Source: xStation5

Gold erased morning gains and moved towards yesterday's lows at around $1,805. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)