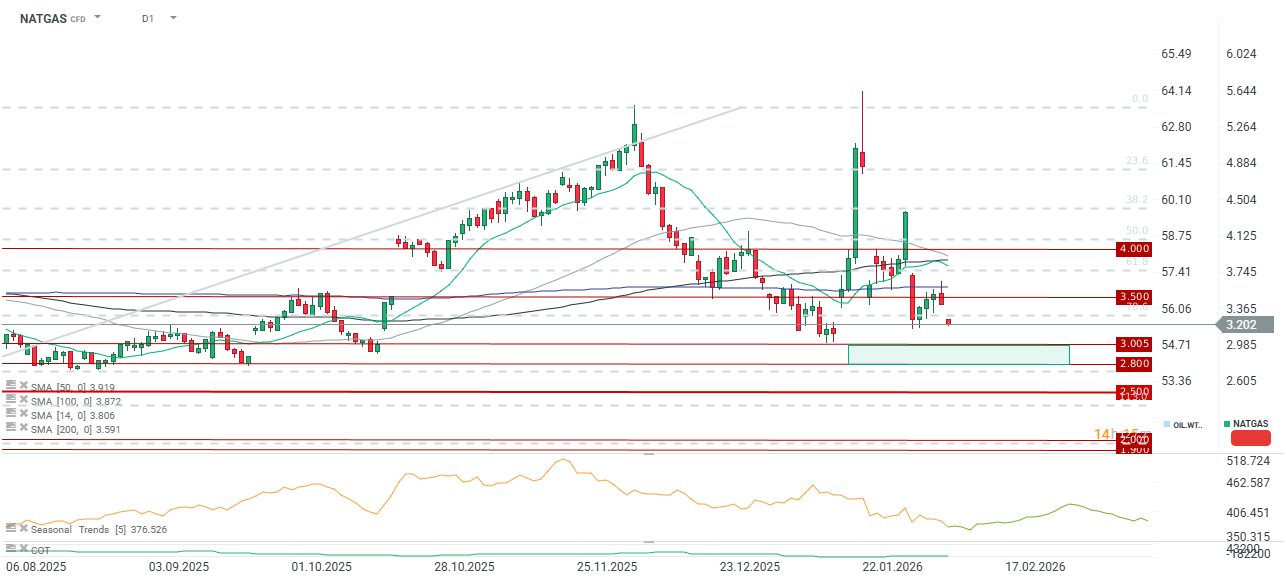

Natural gas prices have retreated by more than 6% at the start of the new week. Looking back to last Friday's peak, the price is now down as much as 12%. Markets are currently testing the $3.2 USD/MMBtu level, representing the local lows from early last week. Should this support be breached, prices would hit their lowest level since mid-January, with the potential to decline toward a significant demand zone around $2.8–$3.0 USD/MMBtu.

Primary drivers of the decline:

-

Shifting weather forecasts: Following January’s Arctic blast, meteorological models now indicate a warming trend across key US regions (such as the Midwest and Northeast), curtailing gas consumption for space heating.

-

Inventory dynamics: The latest storage report revealed a massive draw of 360 bcf (for the week ending January 30). However, upcoming temperature forecasts point to a significant reduction in heating requirements for February.

-

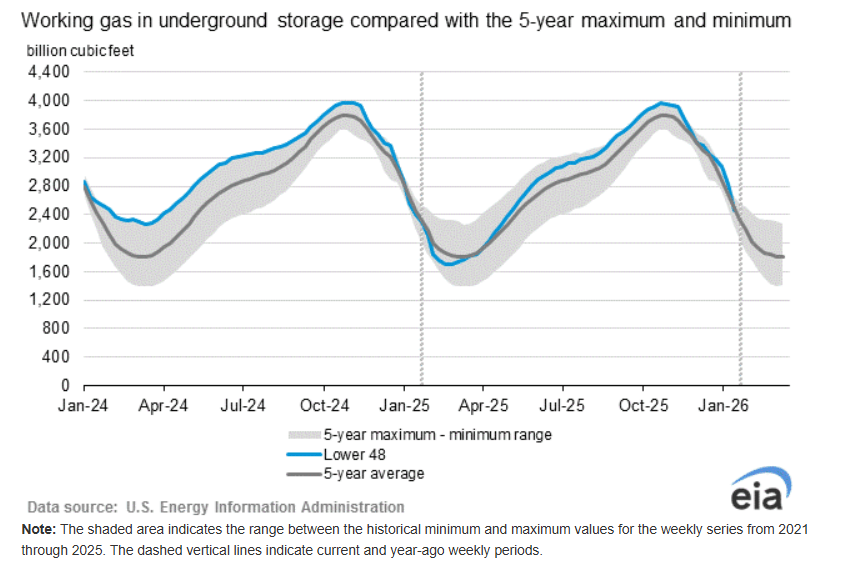

Stockpiles: Inventories remain above year-ago levels, while sitting marginally below the five-year average.

-

Softer industrial demand: Seasonal reductions in activity within the chemical and energy sectors, coupled with high storage efficiency, are weighing on prices.

Inventory and Seasonality Inventories remain relatively close to the five-year average. Forecasts suggest that gas consumption from the start of February will be significantly lower, which should result in smaller weekly drawdowns moving forward. Source: EIA

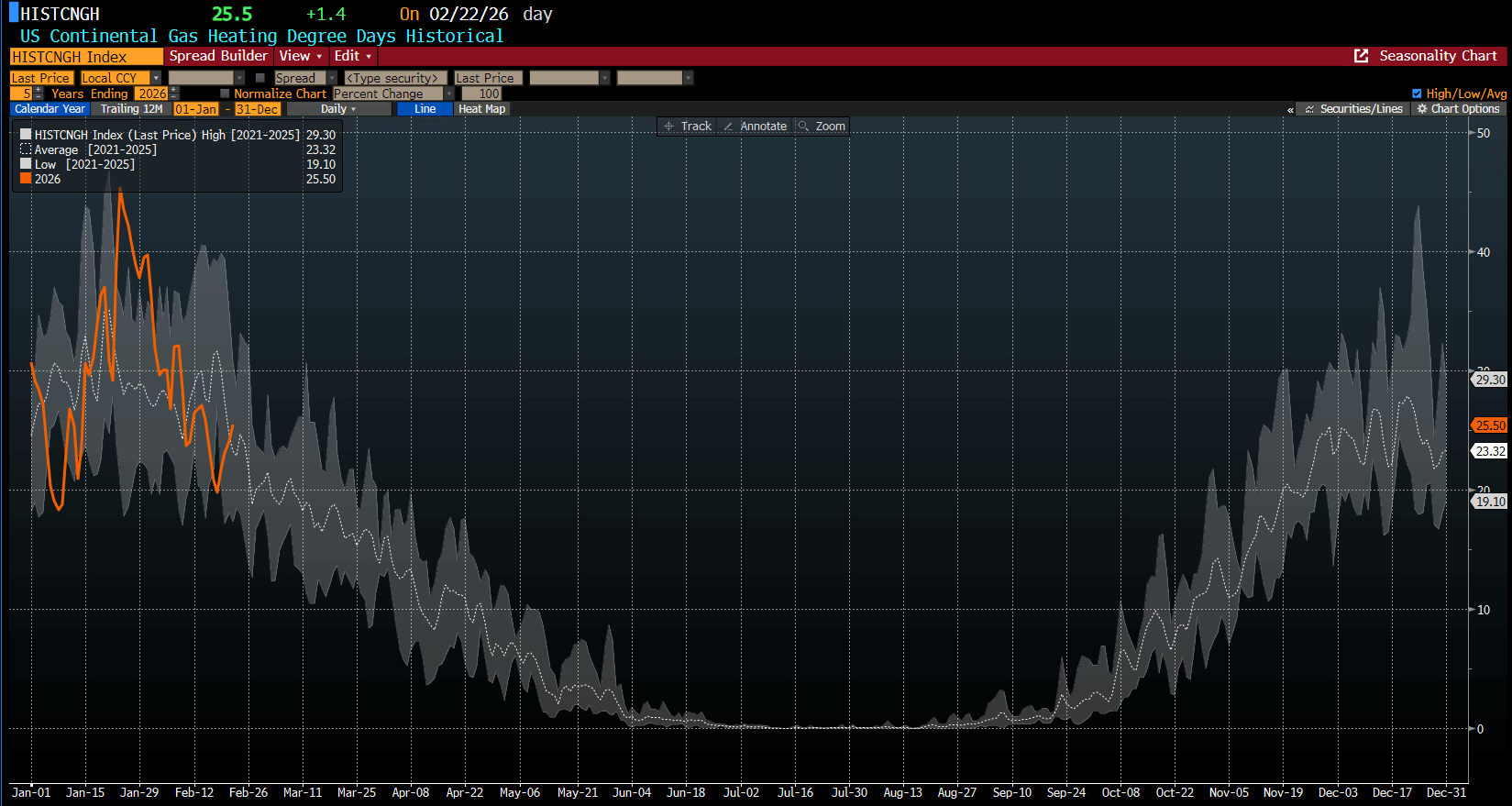

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Technical Outlook Prices fell sharply at the start of the week. If the support near $3.2 USD is broken, the price may head toward the next demand zone situated between $2.8 and $3.0 USD/MMBtu. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment