Gold prices are experiencing their third consecutive session of declines, marking what could be the longest losing streak since late April/early May. The precious metal is down almost 1% today, testing a critical support level.

The current downturn in gold is largely attributed to a prevailing risk-on sentiment in the broader market, despite equity indices not currently ascending from historical peaks. This optimism is also fueling a continued recovery in the oil market. Furthermore, weakening demand for gold jewelry in China and India, driven by elevated prices, has been noted as a contributing factor.

The third significant element is a strengthening US dollar. This dollar appreciation follows a reduction in perceived risk surrounding the Federal Reserve chairman's position and robust economic data from the United States. Looking ahead, next week will be pivotal with the release of the Fed's interest rate decision, alongside key macroeconomic indicators such as GDP, ISM indices, and the Non-Farm Payrolls report.

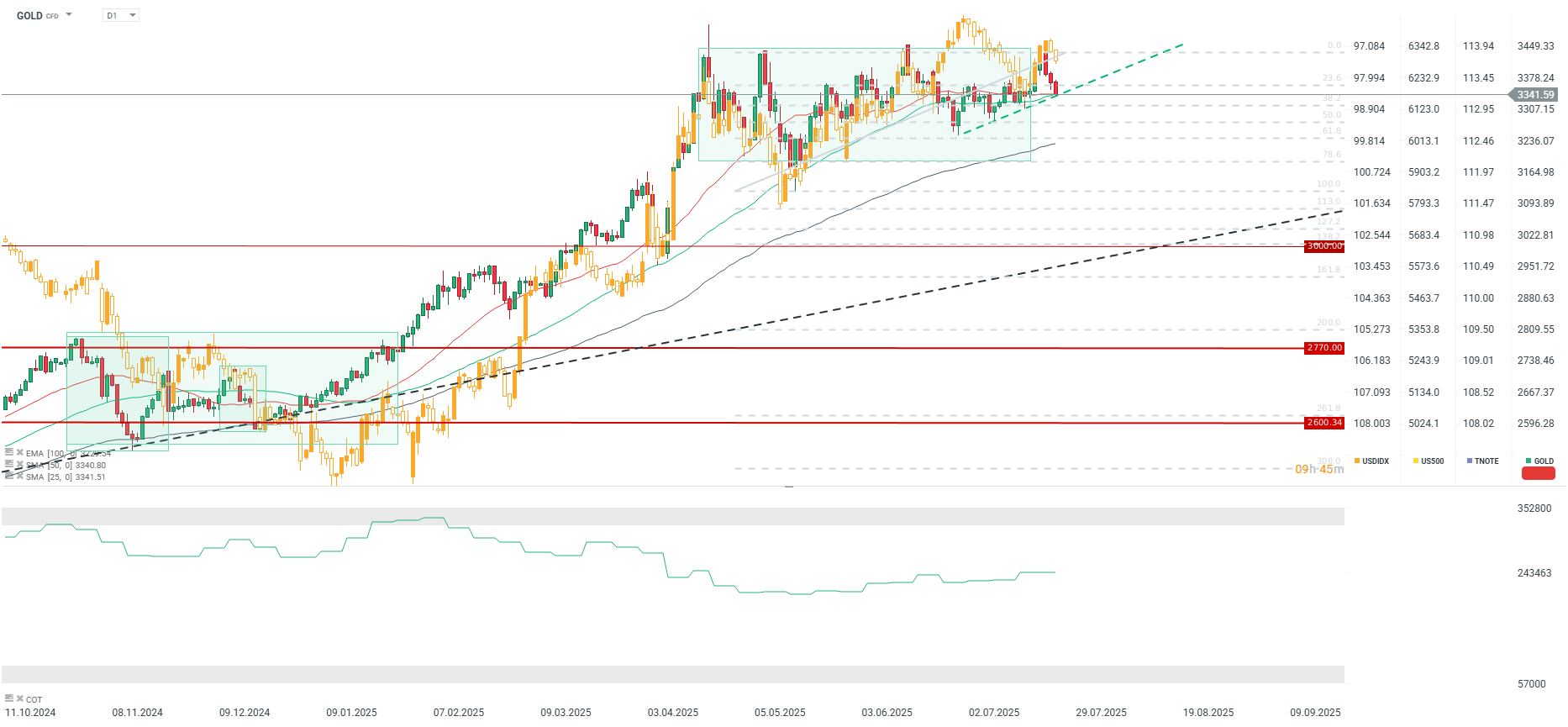

Gold is currently testing support defined by an uptrend line and the 25- and 50-period Simple Moving Averages (SMA). A decisive break below this support could see gold decline to the 3250-3280 range. However, if this support holds today, a return above the 23.6% Fibonacci retracement cannot be ruled out early next week. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡