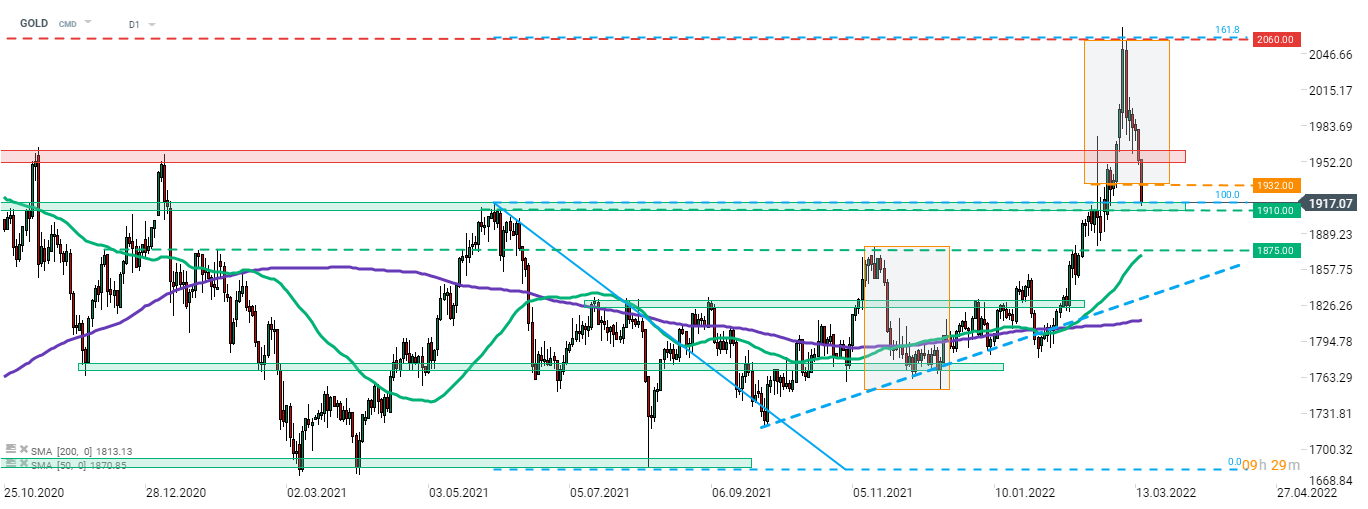

Gold dropped below a key short-term support level in the $1,932 area, following the release of the US PPI report for February. Data showed headline producers' price growth staying unchanged at 10.0% YoY in February, in-line with market expectations. Core PPI decelerated from 8.5 to 8.4% YoY while the market expected acceleration to 8.7% YoY. Release of the data had little impact on the USD market and equities. However, much bigger reactions could have been spotted on the gold market. Precious metal has been trading lower throughout the day but the downward move accelerated following release of US PPI data. As a result, gold price dropped below an important short-term support at $1,932 per ounce - the lower limit of a local market geometry. Such a break hints that the short-term trend may have reversed and a bigger sell-off is looming. Price is currently testing support in the $1,910 area that was limiting upward moves before gold price popped in late-February 2022. Breaking below this hurdle would pave the way for a test of the $1,875 area, where the short-term upward trendline as well as previous price reactions can be found.

Traders should keep in mind that there are 2 major macro events scheduled for tomorrow that are likely to impact gold. The US retail sales report for February will be released at 12:30 pm GMT, followed by FOMC rate decision at 6:00 pm GMT. Weak retail sales reading could hint that the situation of the US consumer is deteriorating, what could be a serious counterargument against quick and big rate hikes.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉