Gold is an underperformer among precious metals today, dropping around 0.4% at press time. Meanwhile, other precious metals are trading higher on the day, with silver and platinum adding 0.2%, while palladium trades over 2% higher. Gold plunged in the afternoon as the US dollar started to regain ground.

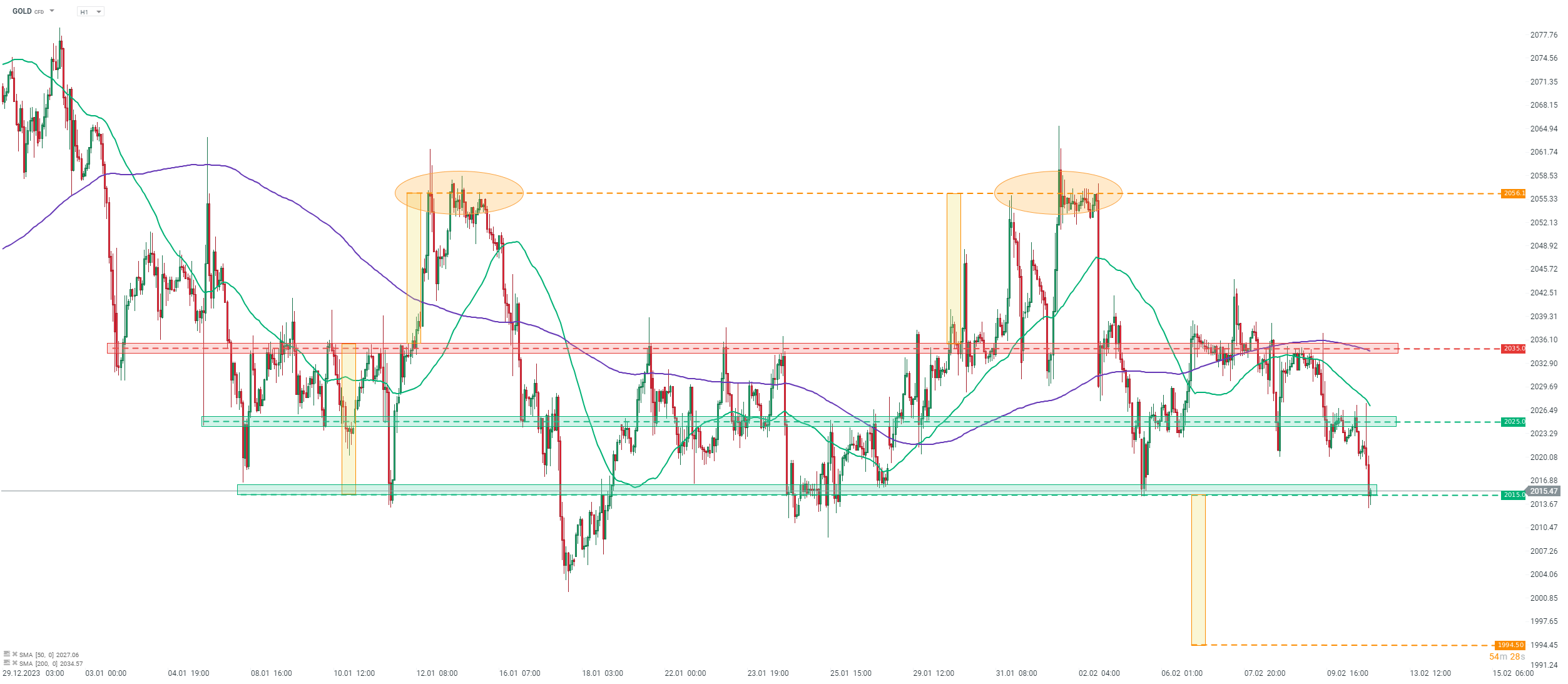

Taking a look at GOLD chart at H1 interval, we can see that gold slumped to the lower limit of the ongoing trading range in the $2,015 area. Bears managed to push the price below this hurdle and to the lowest level in over 2 weeks! Textbook range of the downside breakout from the sideways move suggests a possibility of a drop to as low as $1,994.50 per ounce. However, it should be said that GOLD made a few false breakouts from the range before - both to the upside and to the downside.

Given that the price keeps diverting towards the $2,015-2,035 trading range after each breakout, a strong catalyst may be needed for a more sustained breakout. US CPI data for January, scheduled for release tomorrow at 1:30 pm GMT, could be such a catalyst.

Source: xStation5

Source: xStation5

OIL: prices continue to rise despite the US Navy escort proposal for ships📌

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street