Market sentiment has deteriorated, as illustrated by a slight reduction in gains on indices and a rise in yields. The dollar is also gaining. Interestingly, expectations of a hike from the ECB next week are growing. A hike from the ECB could increase the chances of a move from the Fed.

Gold has gained 0.5% today, which was not a big move, but it was a move above the important $1925 per ounce level. Nevertheless, gold is retreating from around the 100 EMA average (The 50 EMA also runs here). Currently, the key support for gold is 1910 at the Fibo measure of 23.6. Although gold's current declines are not large (around 0.1%), other metals are experiencing greater discounting. Platinum is losing 2%, but it is the pullback in gold that has led to such a move.

Source: xStation5

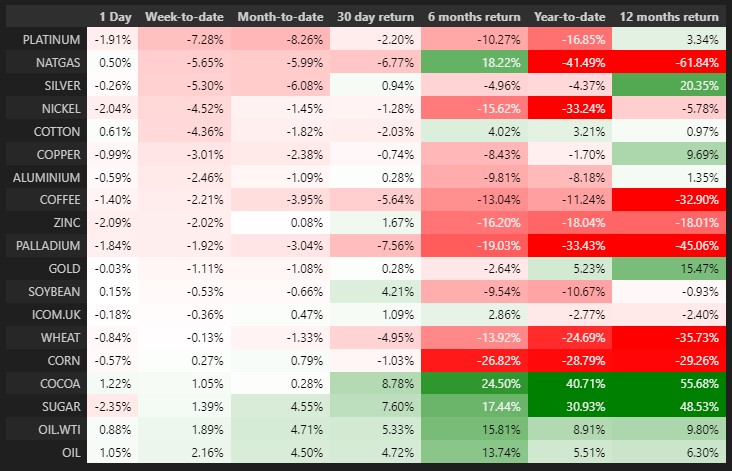

From the perspective of the overall commodities market, gold has been one of the more 'flat' markets, not only recently, but also since the beginning of the year.

Source: XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30