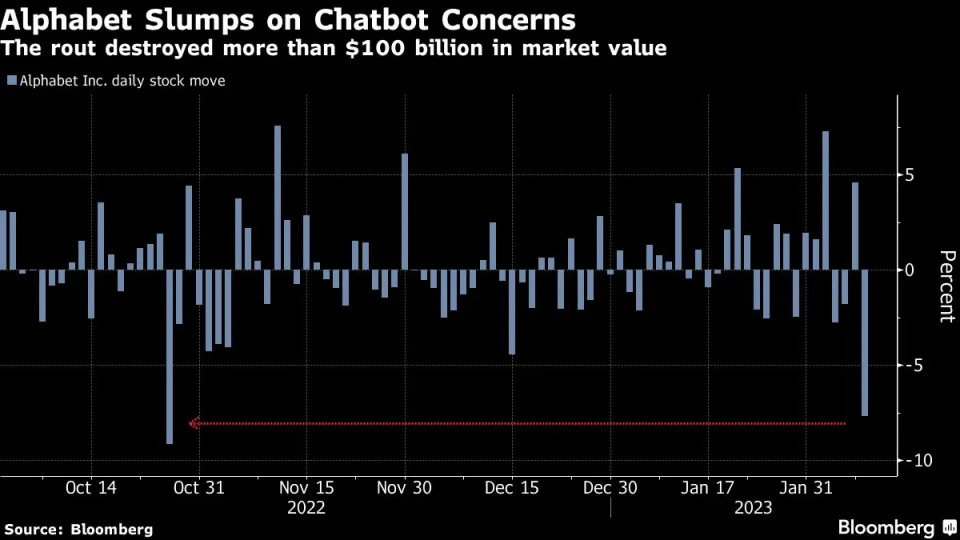

Investors today continued the intense sell-off of Alphabet (GOOGL.US) shares following yesterday's mistake of AI chatbot, Bard (laMDA), a competitor to ChatGPT (GPT-3). This shows how much attention artificial intelligence and everything related to it has attracted in recent times:

- The 'Bard' blunder was more costly to Alphabet than poor quarterly results The market perceives the blunder as if Bard's technology is lagging behind ChatGPT (although there have been blunders for that too), which is backed by Microsoft;

- Morgan Stanley analysts point out that users do not change their search preferences and favorite platforms as quickly (the network effect) and Google's dominance may continue despite the growth of Bing search;

- Millers Tabak analysts described the decline as 'disconnected from the fundamentals';

- Consultancy Glenview Trust sees an opportunity for joint dominance of internet search by Alphabet (Google) and Microsoft (Bing) although it sees a threat to Google's continued dominance;

- Advertising, related to search, accounts for more than half of the company's revenue.

Source: Bloomberg

Alphabet (GOOGL.US) shares, H4 interval. Supply is measuring itself against support provided by the SMA100 and SMA200 averages, running around $94 per share. Source: xStation5

Alphabet (GOOGL.US) shares, H4 interval. Supply is measuring itself against support provided by the SMA100 and SMA200 averages, running around $94 per share. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street