The launch of Google’s latest artificial intelligence model, Gemini 3, was met with a very positive market response, reflected in a rise in Alphabet’s stock price on the day of the release. The model stands out for its ability to provide more complex and precise answers with fewer user queries, significantly improving the efficiency of interactions with the AI system. Gemini 3 is highly scalable and integrates directly with Google services, including Search, potentially reaching hundreds of millions of users per month. Such broad distribution gives Alphabet a real advantage in data collection and AI model optimization, while rapid deployment of new features across the company’s ecosystem strengthens its competitiveness in the artificial intelligence sector.

Experts note that Gemini 3 may be trained exclusively on Google’s own TPU processors, representing a significant departure from the industry’s common practice of using Nvidia GPUs. Training models on proprietary processors provides Alphabet with a strategic advantage, allowing for greater control over costs, hardware availability, and independence from external suppliers. This approach enables more efficient use of infrastructure, reduces training and inference costs, and increases predictability in AI model development timelines. Full integration of hardware, software, and training processes demonstrates that the company is building a self-sufficient computing ecosystem that could reshape competitive dynamics in the industry.

According to analysts, Alphabet’s comprehensive ecosystem, which includes proprietary hardware, cloud infrastructure, and integration with consumer and enterprise products, gives the company a significant technological edge and allows for effective commercialization of AI technologies. Gemini 3 is a strategic component that may strengthen Alphabet’s position in the artificial intelligence market and narrow the gap with competitors. At the same time, challenges remain, including rising AI investment costs, potential speculative bubbles in the sector, and regulatory pressures, all of which may affect the pace of further development. Competition in large language models and multimodal AI continues to be a critical factor shaping the market.

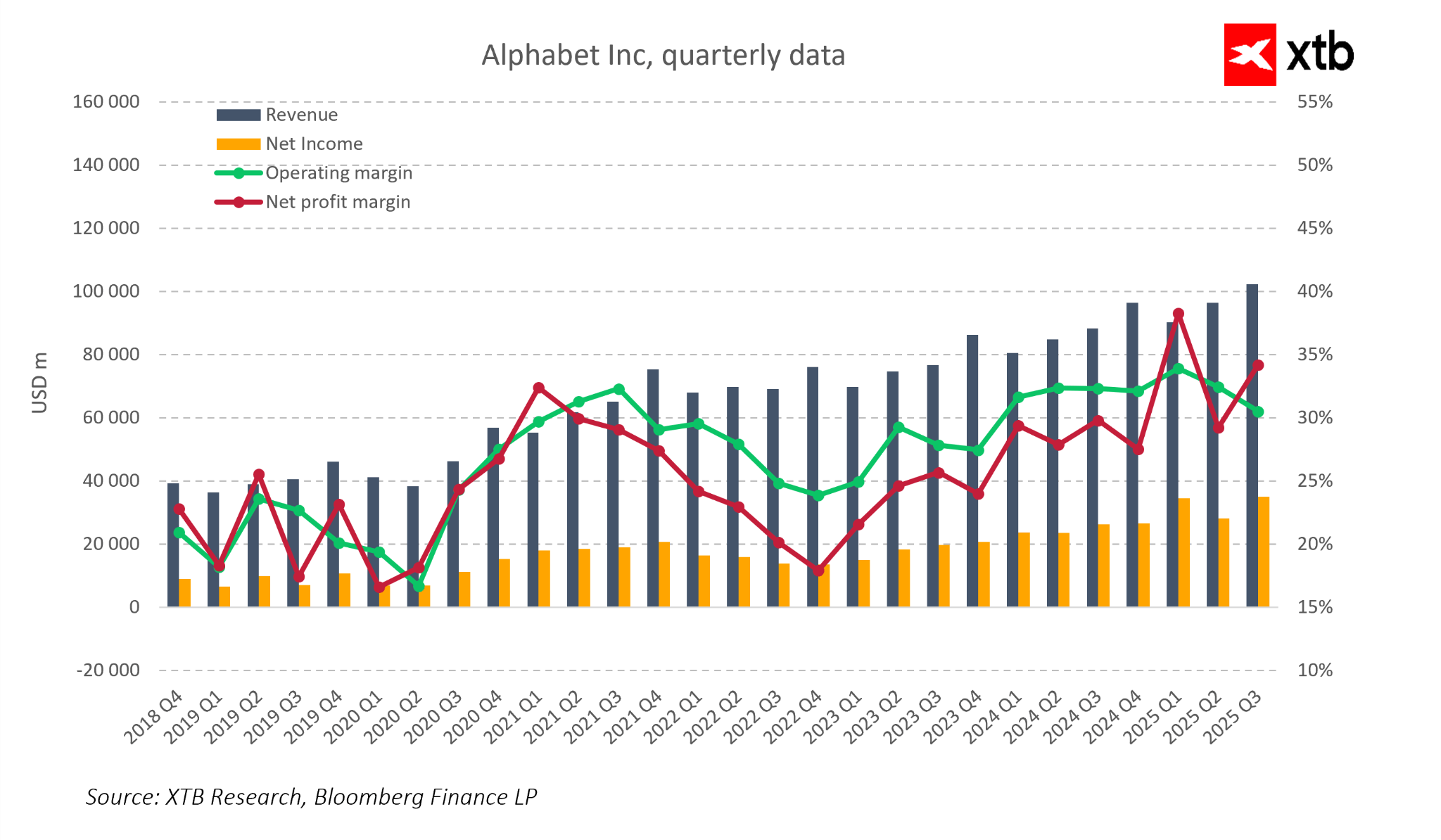

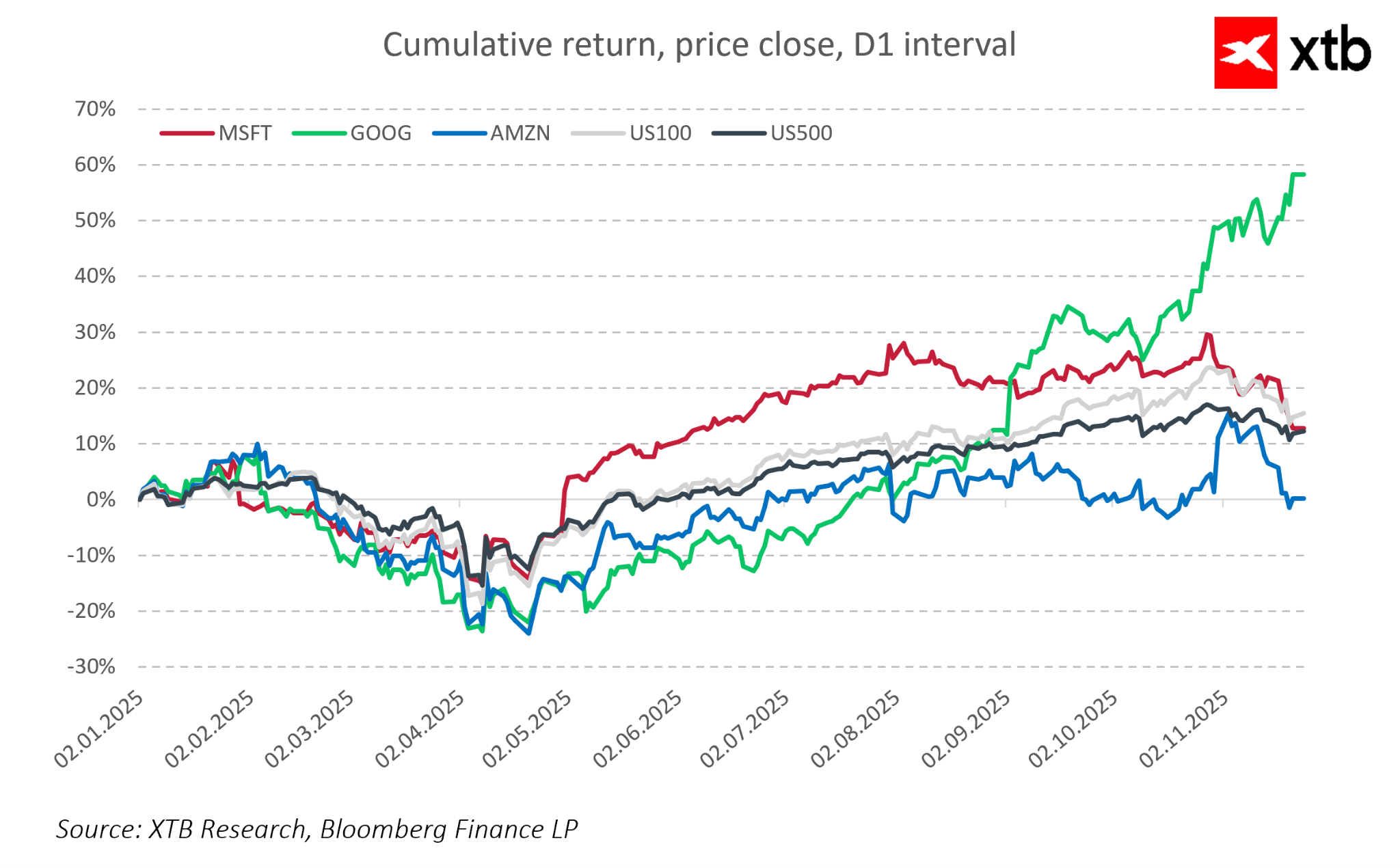

In summary, Gemini 3 significantly strengthens Alphabet’s position as a key player in artificial intelligence, and the ability to train the model on proprietary TPU processors provides the company with a strategic cost, technology, and operational advantage. However, it is still difficult to say definitively that Alphabet has achieved full dominance in the AI race. The technological and market success is evident and provides a solid foundation for further growth, but the future still carries risks and variable challenges that will determine the company’s ultimate position in the market. Additionally, it is worth noting that Alphabet’s stock return year-to-date significantly outperforms competitors such as Microsoft and Amazon, as well as major market benchmarks including the S&P 500 and Nasdaq 100, reflecting growing investor confidence in the company’s strategic position in the field of artificial intelligence.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%