MicroStrategy’s preferred shares have lost nearly 7.0% and 13.5% this month as sentiment in the cryptocurrency market deteriorated. As a result, the decline in preferred shares raises questions about the company’s ability to continue financing Bitcoin purchases and covering cash-paid dividend obligations.

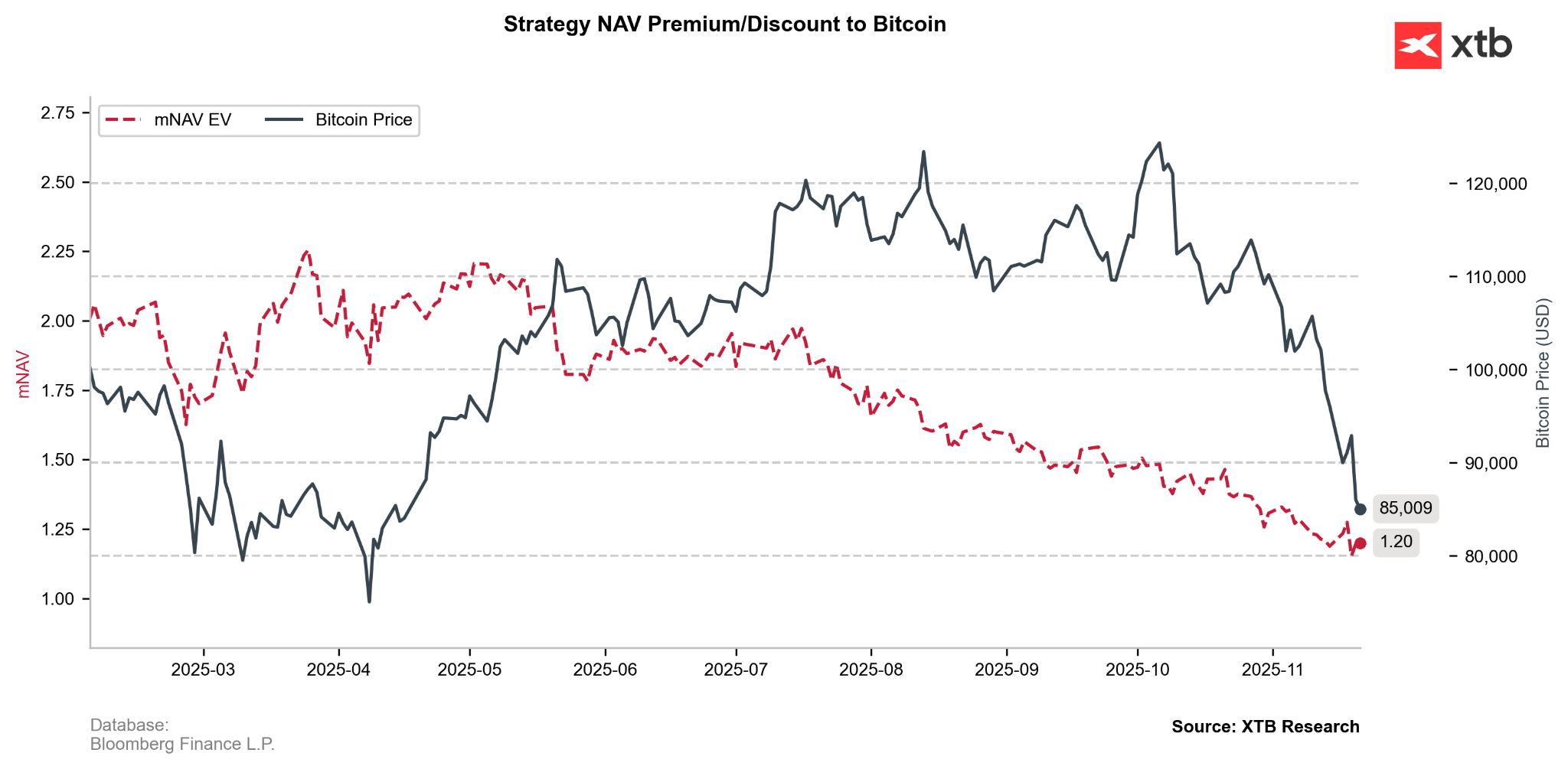

The company’s premium, which historically allowed Strategy (MSTR.US) to raise capital more cheaply than buying Bitcoin directly, has been declining steadily since mid-2025 (mNAV = EV/BTC holding).

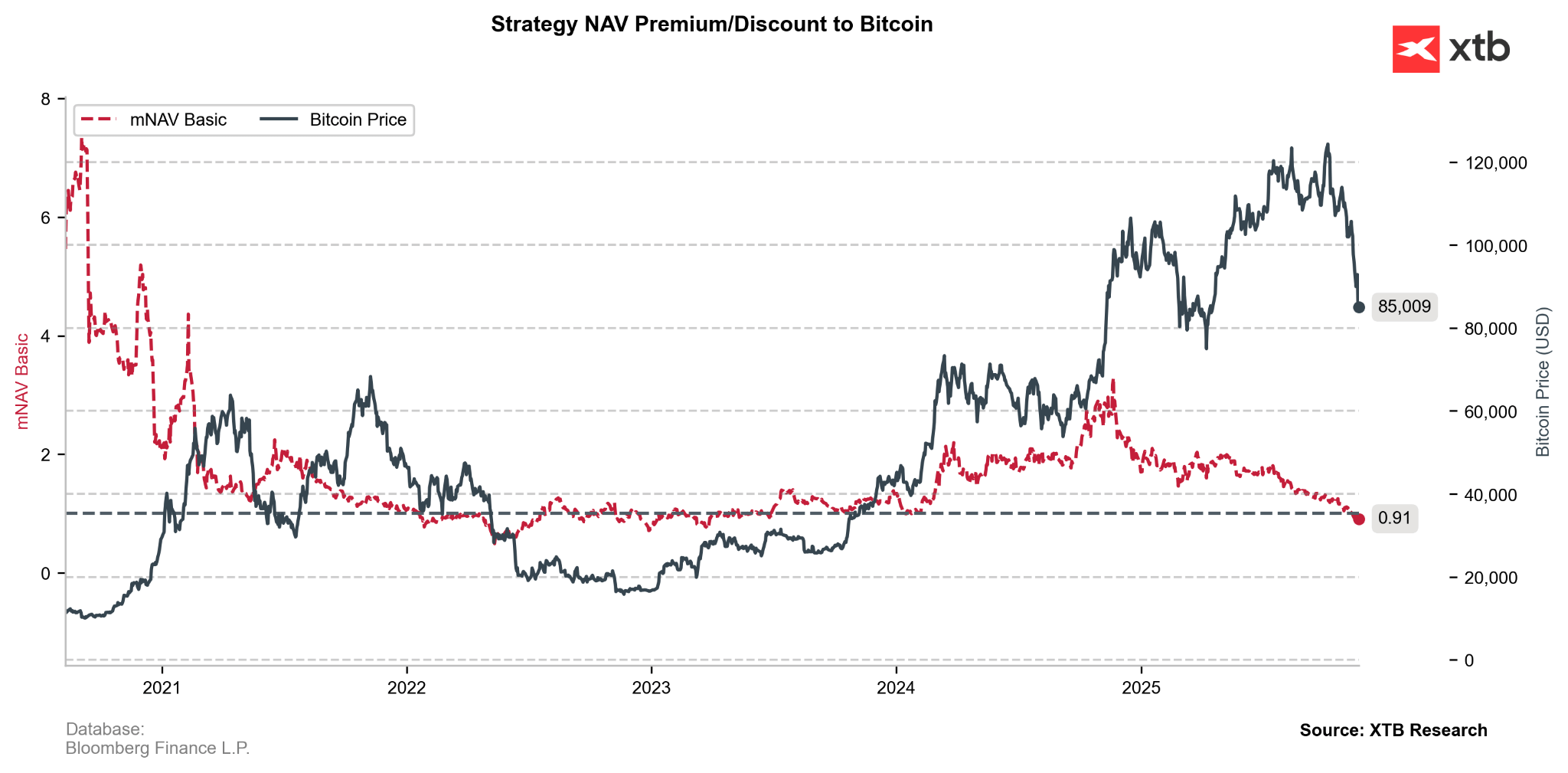

The mNAV Basic ratio (mcap / BTC holding) has fallen below 1, meaning the company’s total market capitalization is now lower than the value of the Bitcoin it holds at current prices. JPMorgan also warned that MicroStrategy could be removed from major MSCI indices, which could trigger outflows of 2.8–8.8 billion USD.

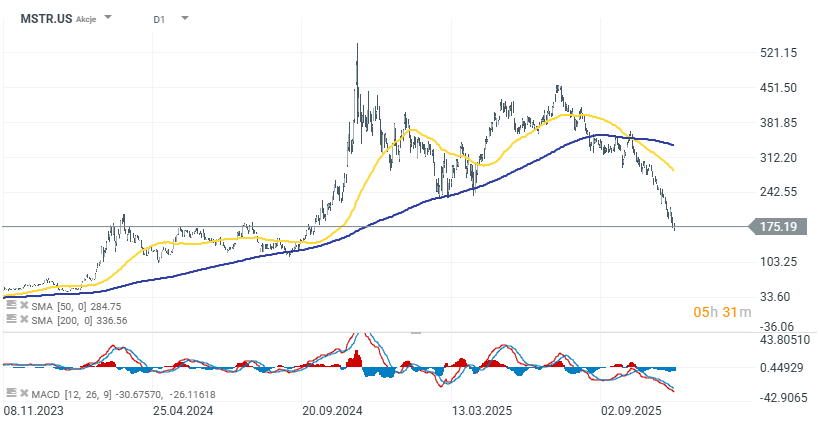

MSTR shares have fallen 10% this week, 55% over the past six months, and 60% year-over-year — much more sharply than Bitcoin itself, which is down 32% from the peak. The stock is trading near 52-week lows amid very high volatility. The company continues to raise capital through new preferred-share issuances, but rising funding costs and the risk of index removal remain key risk factors for investors. In the short term, the most important element appears to be stopping the decline in Bitcoin. Strategy is not facing a liquidity threat, as the nearest debt obligations mature only in 2027 (a small portion) and in the years that follow.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records