Summary:

- Economic releases from the US have been gloomy

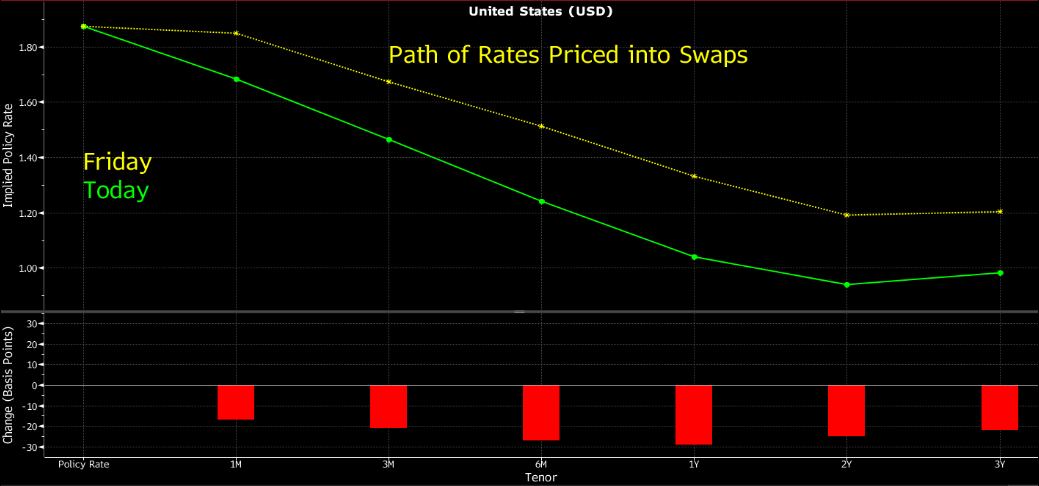

- Market participants have doubled down on deeper rate cuts this year

- “Bad data is good data” has come back

A set of economic releases we have been offered thus far this week has been particularly soft to say the least. Chicago PMI, manufacturing ISM, non-manufacturing ISM, all of them came in well below expectations strengthening the case the US economy could be heading for a recession sooner rather than later. Even an apparent good result regarding employment reported by the ADP was not so good given the fact that a lot of jobs came from temporary jobs. Although US indices have been heading lower so far this week, we got a sudden shift in this pattern on Thursday when a big U-turn took place in the wake of rising rate cut expectations following another grim report from the Institute for Supply Management. That has reminded us of the old adage present in markets already few years ago that a bad release is actually a good one. Thus, one may conclude that financial markets are getting yet again addicted to monetary policy. All in all, it appears that the yield curve inversion has been again a valuable predictor of a future slowdown.

Markets have doubled down on lower rates in the wake of dismal economic releases. Source: xStation5

Markets have doubled down on lower rates in the wake of dismal economic releases. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀