On monday, data by Statistics New Zealand revealed that the country’s retail sales did relatively well in the first quarter, therefore, NZD was the best performing major currencies during the last two days. This morning the RBNZ unsurprisingly kept its policy rate unchanged at 0.25%, but signaled a 25 bps increase to 0.5% by september 2022 and estimated its policy rate would reach 1.5% by the end of 2023. NZD/USD spikes following RBNZ's hawkish tone.

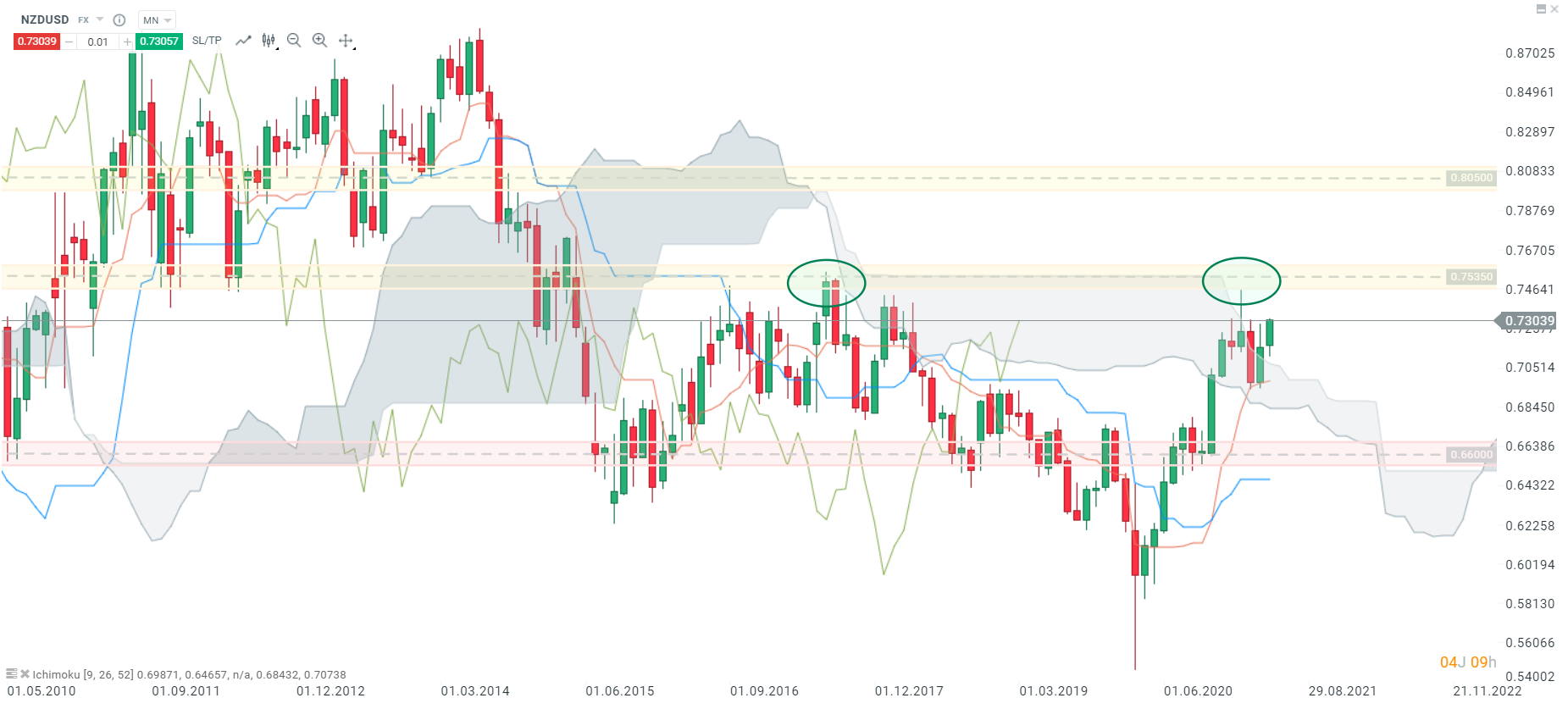

Monthly interval :

Looking at the monthly time frame, we can see that the pair finally managed to break the upper limit of the cloud. However, the Chikou-span is still located inside the Ichimoku cloud and should also break its upper limit (0.75350) to confirm the initial bullish signal. Therefore, it will be a major resistance.

NZDUSD, M1 interval, Source : xStation5

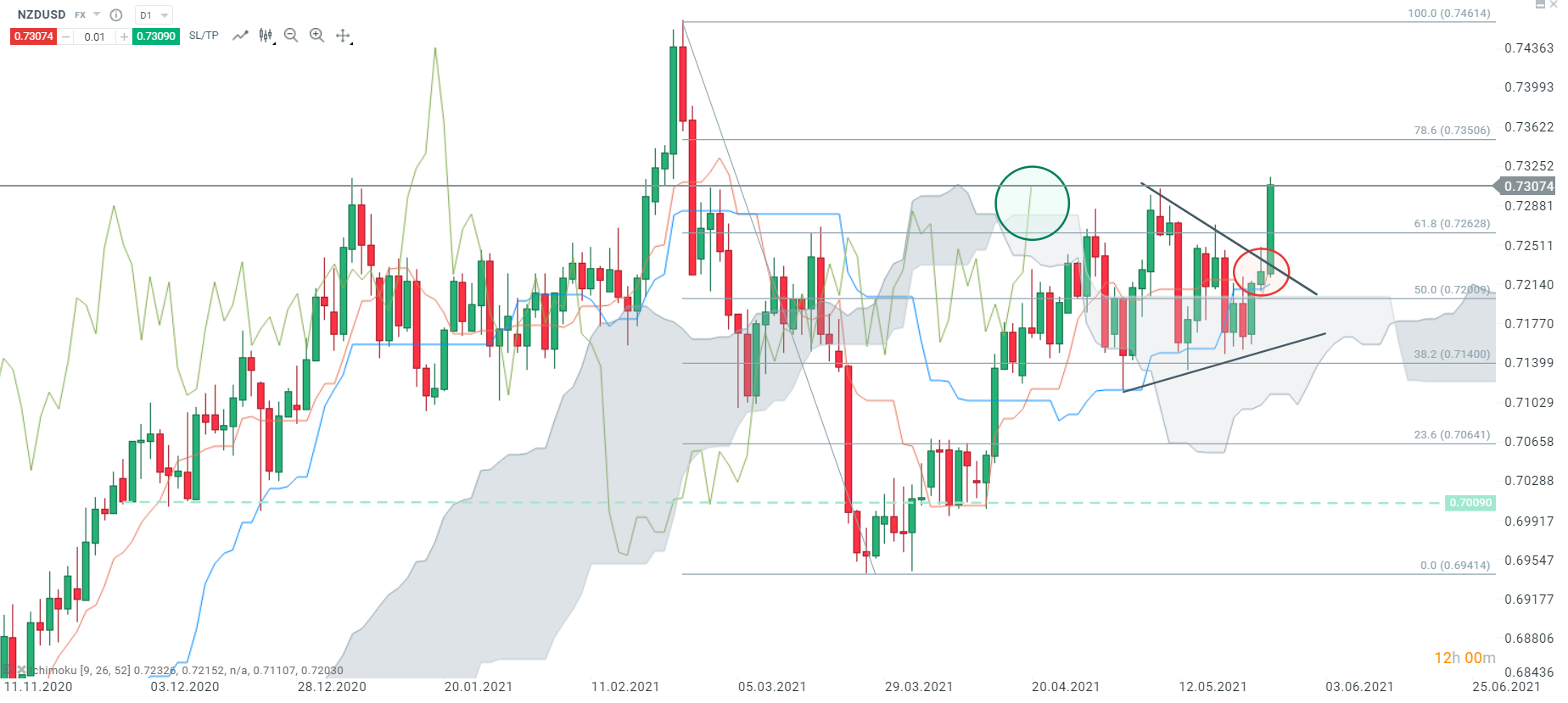

Daily interval :

The daily chart shows that the NZD/USD pair formed a wedge and broke its upper limit this morning which is a bullish signal. The daily bullish signal delivered by prices (red circle) was confirmed by the chikou-span breaking out of the daily cloud (green circle). If bulls manage to push prices higher, the next resistance can be found at the 78,6% retracement (0.7350). On the other hand, if bears take control of the market, the next support can be found at the 61,8% retracement (0.7263), before the major support at 0.7200 (50% retracement coinciding with Senkou-span B).

NZDUSD, D1 interval, Source : xStation5

H4 interval :

On the H4 interval, confirmation (green circle) on the Ichimoku bullish signal (red circle) coincided with the breaking of the downward trendline and led to a spike on NZDUSD. The first short term resistance at 0.7290 has been overtaken and may act as a support. If the current sentiment prevails, an upward move may accelerate towards resistance at 0.7350

NZDUSD, H4 interval, Source : xStation5

Réda Aboutika, XTB France

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)